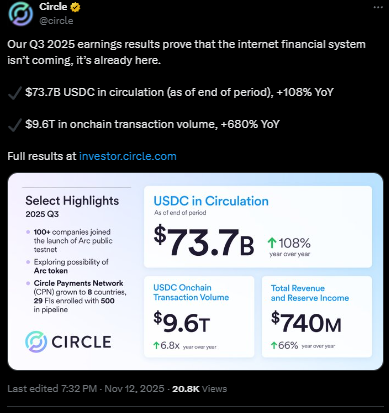

- Circle’s USDC supply surged 108% year-over-year to $73.7 billion, with $214 million in Q3 net income.

- Over 100 major firms, including BlackRock and AWS, joined Circle’s Arc Network public testnet.

- USDC now holds a 29% market share, remaining the second-largest stablecoin behind Tether’s $183 billion USDT.

Circle’s USDC had a massive run this year, hitting $73.7 billion in circulation by the end of Q3 2025. That’s a stunning 108% jump compared to last year, driven by growing institutional adoption and a steady rise in yield returns. The company also pulled in a net income of $214 million this quarter, making it one of its strongest performances yet. At the same time, Circle’s Arc Network quietly gained serious traction with over 100 top firms — including BlackRock, Goldman Sachs, and AWS — joining its new public testnet.

A Look at the Numbers

Circle’s total revenue soared to $740 million, up 66% year-over-year, while adjusted EBITDA came in at $166 million — a 78% increase from last year. The average amount of USDC circulating through Q3 sat at $67.8 billion, and reserve returns hit 4.2%. Currently, USDC holds a 29% market share among all USD-backed stablecoins with more than $100 million in circulation. It trails only Tether’s USDT, which still dominates the market with around $183 billion in tokens floating around.

Arc Network Gains Momentum

The Arc Network might just be Circle’s next big leap. Launched on October 28, its public testnet drew in over 100 companies — a pretty remarkable turnout. The network is designed to power institutional-level digital asset systems, bridging the gap between traditional finance and blockchain infrastructure. Circle also hinted that it’s exploring a native token for Arc, but hasn’t yet shared what it would actually do or when it might drop. Still, with names like BlackRock and Goldman Sachs already circling around (pun slightly intended), it’s clear there’s real interest brewing.

The Bigger Stablecoin Picture

Even with all this growth, USDC remains in second place behind Tether. USDT holds about 60% of the global stablecoin market, reporting more than $10 billion in profit this year and expecting $15 billion by year-end. The total stablecoin market is now worth roughly $316 billion — and growing fast. Tether’s massive user base, now hitting 500 million verified users, shows just how mainstream stablecoins have become. Meanwhile, Circle continues to strengthen its regulatory position in the U.S., operating as a licensed money transmitter while pushing for clearer federal guidance.