- Chibi Finance rug pulls $1 million of community funds.

- The development team disappeared and shut down all social media accounts before mixing the stolen funds through Tornado Cash.

In a startling event, Chibi Finance, a DeFi project on Arbitrum’s Layer 2 blockchain, has allegedly executed a rug pull, leaving users dismayed as the development team vanished and over $1 million in user deposits disappeared.

Exploiting their social media presence and the hype surrounding the project, the Chibi Finance developers raised a substantial amount of funds. However, it quickly became evident that the team had deployed a malicious contract that facilitated the theft of user funds from Chibi’s smart contracts.

This rug-pull maneuver involved draining the project’s liquidity pool and swiftly laundering the stolen tokens to other networks, making tracing the illicitly obtained funds challenging.

Rugpulls Explained

A rug pull refers to a deceptive tactic commonly observed in cryptocurrency, where developers or individuals behind a project abruptly and intentionally drain the invested funds or liquidity provided by users, resulting in significant financial losses for the victims.

This scheme involves the creators of a project gaining trust and credibility within the community through various means, such as marketing efforts and active engagement on social media platforms.

They attract investors and users who contribute their funds or liquidity with the expectation of returns or benefits. However, once a substantial amount of capital has been amassed, the rug pull occurs, with the developers swiftly withdrawing the funds or removing the liquidity, leaving investors with little to no value in their investments.

The term “rug pull” symbolizes unexpectedly removing support or value, akin to pulling a rug out from under someone, causing them to stumble or fall. In cryptocurrency, it signifies the sudden and deliberate elimination of financial backing, leading to severe economic consequences for those involved.

The Trail of Stolen Funds

PeckShield, a security firm, revealed that the stolen tokens, valued at $1 million, were converted into 555 ETH and transferred from Arbitrum to Ethereum. The funds were routed through the crypto mixer Tornado Cash to obscure the transactional activity further.

Following the rug pull, the Chibi Finance development team promptly disappeared, deactivating their Twitter and Telegram accounts. The project’s website also went offline.

How Tornado Cash Masks Transactions

Tornado Cash employs innovative techniques to enhance transaction privacy by disrupting the connection between user wallet addresses and using zero-knowledge proofs to store transaction records. The platform effectively conceals the location from which transactions originate, significantly bolstering user anonymity.

Tornado Cash supports mixing any ERC-20 token, enabling users to send funds through the platform, where the token and its specific amount are securely stored on a ZK roll-up smart contract hosted on the Ethereum network.

When funds are mixed, the smart contract returns an equivalent token amount to a new address unlinked to the original sender, a process known as withdrawing. This process can be repeated multiple times using different addresses, further obscuring the correlation between the original address and the transaction.

Implications for Chibi Finance and the Industry

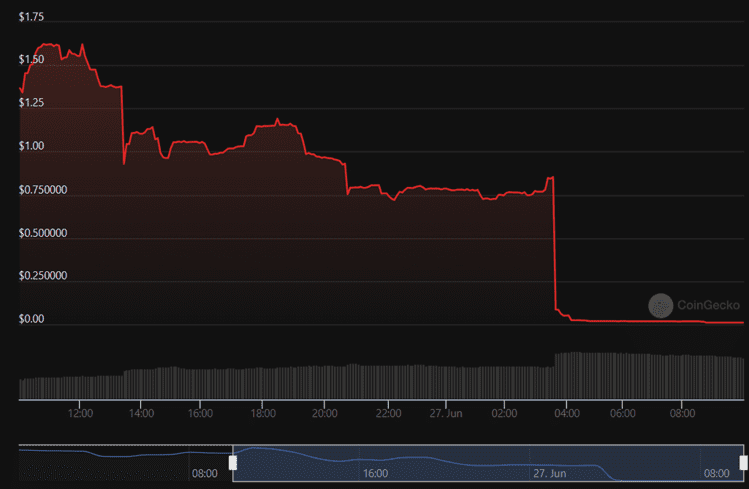

Within 24 hours after the rug pull, the CHIBI token’s value plummeted by a staggering 98.7%, nearly reaching zero. This incident undermines investor trust and raises significant concerns regarding the security and reliability of projects built on the Arbitrum and Ethereum networks.

The rug pull executed by Chibi Finance serves as a grim reminder of the risks and challenges faced by the DeFi industry. With the increasing number of fraudulent actors exploiting vulnerabilities, users, and investors must exercise caution and conduct thorough research.

Furthermore, developers and platform operators must prioritize implementing stringent security measures and transparent practices to protect the trust of their communities. As the industry evolves, collaborative efforts among stakeholders and adopting robust security protocols will be pivotal in constructing a more resilient and trustworthy DeFi ecosystem.