• LINK breaks below $14.50 as volume spikes 118% amid heavy technical selling.

• Three-wave liquidation cascade confirms bearish momentum and flips $15 into resistance.

• Chainlink Reserve now holds 800K+ LINK but sits 27% underwater on its average entry.

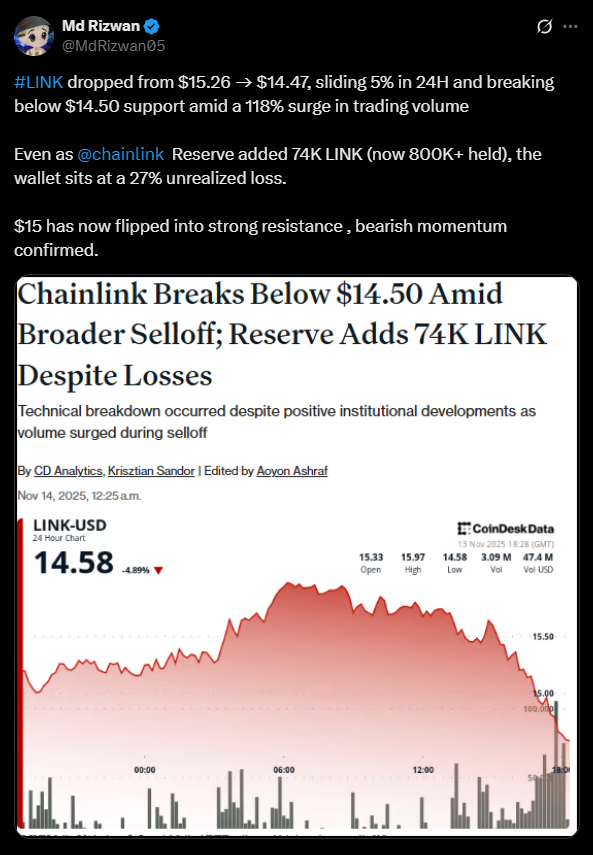

Chainlink fell sharply on Thursday, sliding from $15.26 to below $14.50 and confirming a breakdown of its ascending support trend. The drop came with a 118% spike in trading volume, signaling heavy sell-side pressure as buyers failed to hold the $15 zone. LINK touched its weakest level since late October and underperformed the broader CoinDesk 5 Index, which also saw notable weakness.

Liquidation Cascade Confirms Bearish Momentum

CoinDesk Research’s technical analysis model pointed to a rapid three-wave liquidation cascade between 17:05 and 17:41 UTC, with over 360,000 tokens trading within minutes. This flushed LINK through support levels and turned $15 into firm resistance. Bears quickly seized control, dragging the token toward the $14.40 area as momentum tilted decisively downward.

Chainlink Reserve Adds Tokens Despite Price Decline

Despite the sell-off, Chainlink’s on-chain treasury continued accumulating. The Chainlink Reserve added 74,049 LINK on Thursday, pushing total holdings past 800,000 tokens. However, with an average entry near $20, the reserve remains down roughly 27% on its position. The steady accumulation may provide long-term support, but it hasn’t stopped short-term technical weakness.