- Cardano [ADA] is trading inside a falling wedge pattern, with analysts eyeing a breakout target near $0.94 if resistance levels give way.

- Binance data shows 75% of traders are long on ADA, signaling strong bullish conviction that could fuel an upside push.

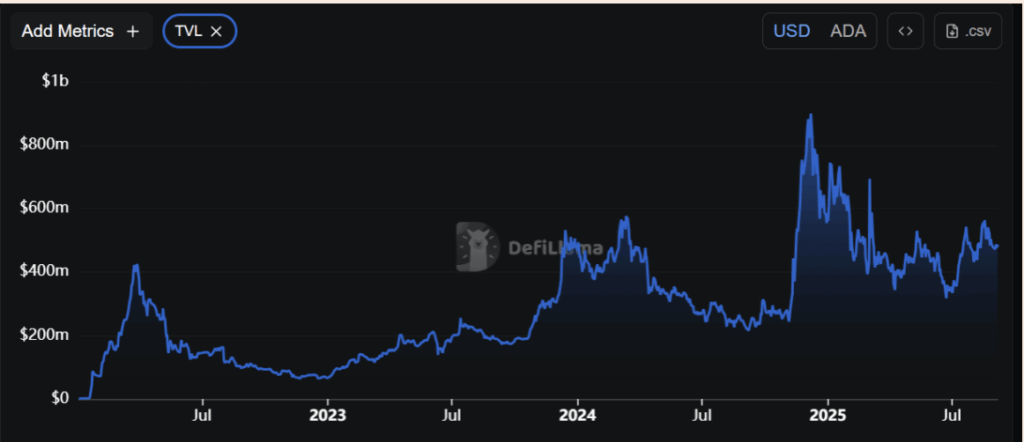

- On-chain growth continues, with TVL climbing to $487M and DEX volumes surging nearly 20% in a week, reinforcing ADA’s bullish setup.

Cardano [ADA] has been drifting inside a narrowing falling wedge since early September, a setup that traders usually read as a hint for bullish reversals. Market analyst Ali Martinez even sketched out a possible breakout target around $0.94—assuming ADA can muscle through its nearby resistance. For now, the coin sits near $0.83 after weeks of sideways chop, leaving everyone wondering if this is just more noise… or the calm before a surge.

Traders Lean Heavy on the Long Side

Fresh Binance data paints a clear picture of optimism. Nearly 75% of accounts are long on ADA, with shorts making up only about a quarter of positions. That’s roughly a 3:1 ratio leaning bullish, which shows traders aren’t exactly shy about betting on a breakout. If resistance gives way, those leveraged longs could end up fueling the very rally they’re hoping for, turning cautious optimism into a full-blown rush.

Exchange Outflows Point to Accumulation

Even as ADA’s price cooled off, money wasn’t exactly flooding back to exchanges. Instead, September 6th saw net outflows of nearly $840K, a move that usually signals investors prefer tucking their tokens away in private wallets. It’s not the type of flow you see when holders are itching to sell. If anything, it looks like quiet accumulation, trimming the supply available on centralized platforms and setting up for a squeeze if demand kicks in.

DeFi and DEX Numbers Back the Case

Cardano’s DeFi ecosystem has kept steady despite the market’s wider hesitation. TVL has climbed to $487.18 million, up just over 2% in the last 24 hours, hinting at stronger user participation in the network’s decentralized protocols. At the same time, decentralized exchange activity is ticking up too—daily volume hit $4.68 million, while weekly totals jumped nearly 20% to $25.56 million. That kind of steady on-chain activity often precedes stronger price recoveries, and in ADA’s case, it stacks nicely with the wedge breakout narrative.

Final Takeaway

All told, ADA’s falling wedge, strong long positioning, steady exchange outflows, and growing DeFi footprint point to a market that’s quietly building energy. The $0.94 target might sound ambitious, but if momentum builds the way these indicators suggest, Cardano could finally be setting up for a move that snaps it out of months of consolidation.