- ADA defended the $0.2205 level, a key historical support that previously preceded recovery.

- Price remains over 25% above its February low, fueling speculation that a durable bottom may be forming.

- Analysts suggest upside could be significant in a new bull cycle, though broader market conditions remain the deciding factor.

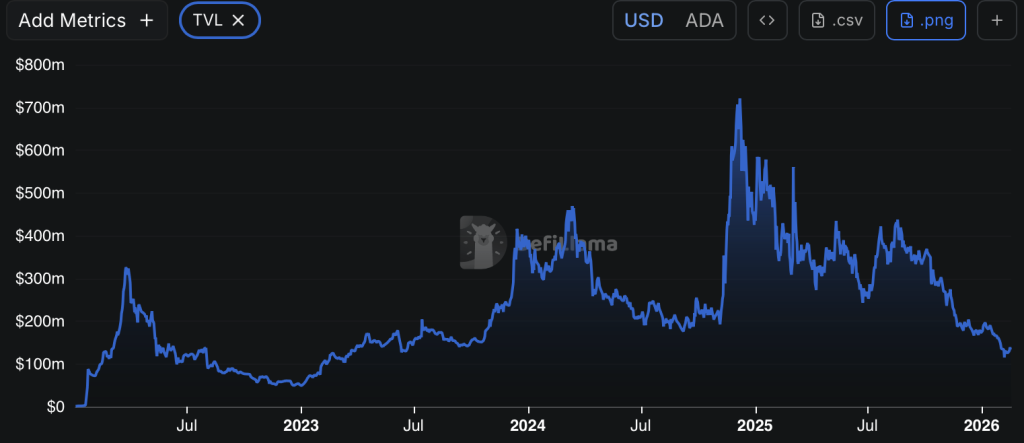

Cardano is back in the middle of one of those familiar debates. Did ADA just print a real bottom… or is this just another pause before more downside? After sliding during the broader market weakness, ADA briefly touched levels not seen since earlier bearish phases, and that’s what got people talking.

When price revisits old pain zones, traders pay attention. Especially when it doesn’t immediately collapse through them.

The $0.2205 Level That Changed the Tone

On February 6, ADA dipped to roughly $0.2205 during a wider crypto pullback. That number wasn’t random. It closely matched a prior low from mid-2023, a level that had previously sparked a meaningful recovery. Markets have long memories, and so do traders.

This time, the reaction looked similar. Once ADA tapped that zone, selling pressure started to slow. Buyers stepped in, not aggressively at first, but enough to stall the slide. Since then, price has held above that level, suggesting that sellers may have, at least temporarily, run out of fuel.

Context matters here too. Around that same period, the Fear and Greed Index collapsed to an extreme reading of 5. That’s deep in “panic” territory. Historically, those kinds of readings tend to show up when most participants are already positioned defensively. Ironically, that’s often when longer-term buyers begin accumulating.

A Modest Bounce, But a Meaningful One

After stabilizing, ADA climbed to a local high near $0.3050 before retracing part of the move. Even with the pullback, the token remains more than 25% above its February low. That might not sound dramatic in crypto terms, but it’s not insignificant either.

Early reversals don’t usually explode immediately. They tend to grind first. Consolidate. Test patience.

Some analysts see this structure as early confirmation that the February low could hold, assuming the broader market doesn’t unravel again. Among them is Sssebi, a Cardano stake pool operator and technical analyst, who suggested that the dip may have been an unusually attractive accumulation zone.

He argues that if the market transitions into a new bullish cycle from here, ADA’s upside relative to current valuation could be substantial. It’s a big “if,” sure. But crypto cycles have a habit of flipping sentiment faster than most expect.

The Bigger Picture: ADA Is Still Far From Its Peak

Cardano’s previous all-time high sits around $3.10, recorded back in 2021. From current levels, that’s a multiple-fold move away. Sssebi even floated the possibility of ADA eventually trading above $5 under highly optimistic conditions, which would represent roughly a twentyfold increase from recent lows.

That projection is speculative, obviously. But it’s rooted in historical behavior. ADA has shown the ability to rally sharply after extended consolidation phases before.

In early 2020, the token bottomed deeply and then delivered major returns in the following bull cycle. It also posted a multi-fold gain from its 2023 bottom before peaking again in late 2024. Past performance doesn’t guarantee anything, but it does provide context. ADA has moved aggressively when conditions align.

Risk Still Exists, Even If Downside Feels Limited

Other analysts, including Crypto Jebbb, share a cautiously optimistic tone. The argument isn’t that risk has vanished, but that downside from current levels may be more limited compared to the potential upside, especially if sentiment shifts.

Still, macroeconomic pressures, regulatory shifts, or another broad crypto selloff could quickly change the picture. Crypto markets don’t move in straight lines, and bottoms are often messy before they’re obvious in hindsight.

For now, ADA’s ability to defend $0.2205 has become the anchor point of the bullish argument. If that level continues to hold and broader conditions stabilize, the case for a durable bottom strengthens. If it fails, the debate resets.

Right now, Cardano isn’t screaming breakout. But it’s no longer screaming breakdown either. And sometimes, that transition phase is where the real opportunity quietly forms.