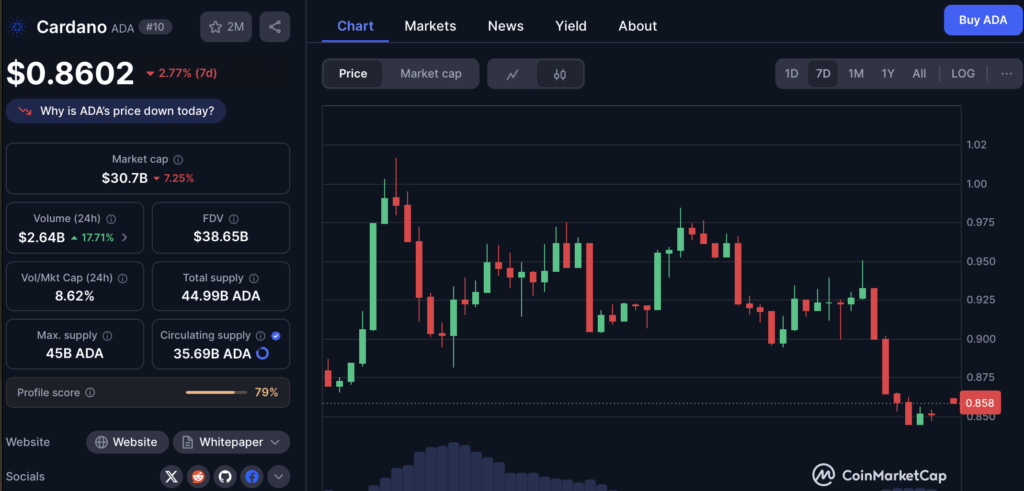

- ADA trades at $0.85, far below its all-time high.

- Bank adoption could push ADA to $2–$10+, depending on scale.

- While speculative, even one major bank move could flip Cardano’s narrative overnight.

Cardano’s ADA is trading around $0.85 right now, still dragging after the latest market dip. The coin’s been weak for months, and a lot of traders are starting to run out of patience. But let’s flip the script for a second—what if something huge actually happened? Like, say, major U.S. banks adopting Cardano. Sounds far-fetched maybe, but if it did happen, the effect on ADA’s demand (and price) could be massive.

Cardano has always marketed itself as the research-heavy, academically grounded blockchain, with an emphasis on scalability and real-world utility. The issue, though, is that despite all those years of development and a passionate community, ADA still hasn’t caught up with Ethereum or Solana in terms of adoption. If U.S. banks were to integrate ADA into payment systems, settlements, or tokenization platforms, it would instantly change that picture. Instead of being seen as just another altcoin, ADA would turn into part of financial infrastructure itself—a token with credibility, actual demand, and new reasons for people to hold and use it.

What Bank Adoption Could Mean for ADA’s Price

If banks ever pulled the trigger, ADA’s price could play out in a few ways:

- Conservative case ($2–$3): ADA reclaims its 2021 highs. Even modest adoption could restore confidence and push the token back to familiar levels.

- Moderate case ($5–$7): With steady inflows and usage by banks, ADA breaks new highs and pushes into a $175B–$250B market cap, putting it in the same league as other top Layer-1s.

- Aggressive case ($10+): If ADA became central to tokenization or settlement rails, a 10x from here wouldn’t be crazy. That would mean a $350B+ market cap, brushing closer to Ethereum’s current standing.

Reality Check

Of course, this is speculation. ADA is still sitting more than 70% below its all-time high, while Ethereum is only around 15% under its peak. Adoption has also been slower for Cardano, with weaker on-chain activity compared to rivals. Those are real issues that can’t be ignored.

Still, crypto loves to flip the narrative fast. All it takes is one headline—say, a U.S. bank announcing integration—and ADA’s story could change overnight. From a community-driven project with big ideas, it could suddenly become a blockchain woven into the financial system itself. And in that scenario, patience might just pay off.