- Ethereum ETFs already attract billions, but flows remain cyclical and currently lack staking features.

- Solana’s market infrastructure is maturing fast, with CME futures live and options set for October.

- A US Solana ETF could boost mainstream access and liquidity, but sustained on-chain growth will decide if SOL truly outperforms ETH.

Ethereum ETFs went live in the US in July 2024, with first-day volumes crossing $1 billion and net inflows of $107 million. Since then, flows have been cyclical, with periods of strong creation followed by outflows. While ETFs opened mainstream access via brokers and retirement accounts, they haven’t smoothed out ETH’s market cycles. Institutions and treasuries continue to accumulate ETH, reinforcing its role as the benchmark Layer-1, though the lack of staking features in US products limits yield potential compared to direct holdings.

Solana’s Growing Market Infrastructure

Solana is catching up fast. CME listed Solana futures in March 2025 and plans to launch options on October 13, giving ETF market makers tools to hedge effectively. Outside the US, Solana already trades in regulated investment wrappers through Europe’s 21Shares and Canada’s 3iQ. On-chain, Solana has shown impressive growth: $271M in Q2 revenue, stablecoin transfers above $59B in January, and more than $9B USDC supply. Sub-cent fees, fast block times, and high throughput make it a hub for DEXs, perpetuals, and even memecoins—though outages and regulatory risks remain concerns.

What a US Solana ETF Could Change

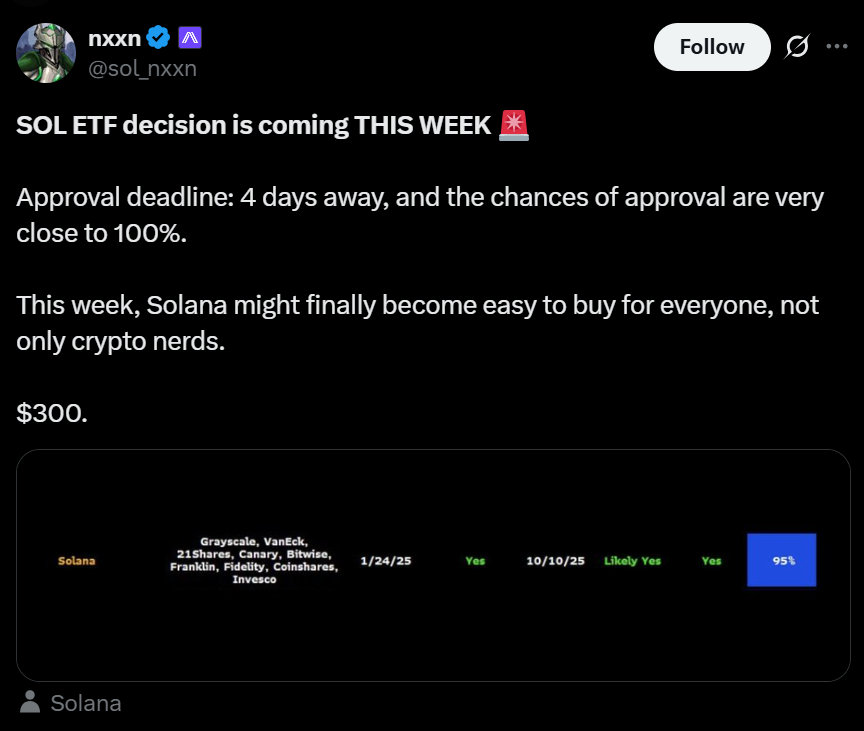

ETF approval would give Solana mainstream exposure in brokerage and retirement accounts, a channel that ETH has already benefited from. Market makers would gain tighter hedging tools through CME futures and options, improving liquidity and narrowing spreads. With the SEC’s new “generic listing standards” for spot-commodity ETPs, the runway for assets beyond BTC and ETH looks wider than ever. Early success in Canada and Europe shows appetite for Solana products is real, but US approval could unlock much larger flows.

The Outperformance Question

In a bull case, strong ETF inflows combined with deepened derivatives markets and sustained on-chain demand could see Solana outpace ETH in total returns within six to twelve months post-approval. The base case is more balanced: flows may track broader risk appetite, leaving Ether’s institutional familiarity and entrenched ecosystem as advantages. In a bear case, delays or shallow liquidity could stall momentum, leaving ETH to maintain dominance. Ultimately, the signals to watch are ETF creations and redemptions, CME open interest, stablecoin settlement volumes, and active developer activity. If these align, Solana has a shot at narrowing the gap—but ETH remains the benchmark.