- Ethereum must boost network activity and developer engagement to sustain growth.

- Daily Active Addresses need to rebound to signal renewed investor confidence.

- Revived Open Interest will support stronger, more durable price rallies.

Ethereum’s long-term dream of hitting $20,000 isn’t just about hype or ETF headlines—it’s about proving real, lasting growth. Sure, institutional money is flowing in, but that alone won’t take ETH to new heights. To reach those numbers, the network needs stronger fundamentals: more user activity, higher developer engagement, and a revival in speculative participation. Without those, enthusiasm fades fast.

Network Growth Must Catch Up

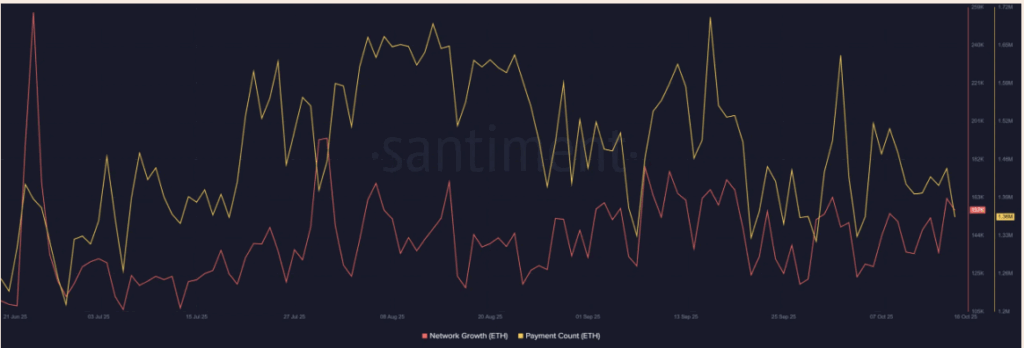

Ethereum’s network expansion has been… well, a bit uneven. Current data shows around 157,000 new addresses, with daily payment counts near 1.36 million. Those numbers aren’t bad, but they’re not exactly explosive either. It suggests users are holding back, waiting for the next big moment.

For Ethereum to move toward $20K, retail participation needs to kick back in, along with deeper dApp adoption. The ecosystem must show genuine utility—transactions, innovation, and builder activity—not just price speculation. When retail and institutional energy align, that’s when real strength shows up.

Address Activity Holds the Key

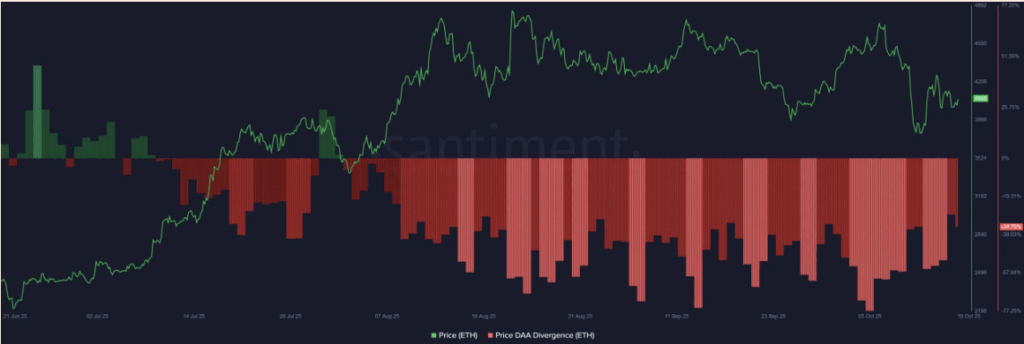

Right now, Ethereum’s Daily Active Addresses (DAA) show a divergence of about -34%, hinting that smaller investors are less active even as prices stabilize. That kind of drop in engagement usually signals a period of hesitation.

Historically though, when DAA flips positive—when users start moving ETH again—it tends to spark major uptrends. So, the comeback of address activity might be the missing spark. If more users start interacting, staking, or swapping again, it could create the perfect storm of conviction and liquidity needed for a true run.

Open Interest Needs a Revival

Speculative energy matters, even if no one likes to admit it. Open Interest (OI) has dropped 6.41%, sitting around $43.87 billion. That’s a sign traders are cooling off after the summer volatility. While that can lower risk short-term, it also limits the potential for big breakouts.

To change that, ETH needs steady increases in both leverage and spot buying. Not reckless leverage—but the kind that signals confidence. Once OI and liquidity grow together, rallies tend to last longer and hit harder.

Is $20K Really on the Table?

In short—yes, but not without work. Institutional demand gives Ethereum structure and legitimacy, but the real fuel will come from network usage and investor engagement. ETH can’t just rely on Wall Street’s appetite; it has to match it with on-chain energy.

If Ethereum finds that balance—between speculation, adoption, and innovation—the climb to $20,000 won’t just be a dream. It’ll be the next logical step in its evolution.