- BTCS posted a massive $65.59M Q3 net income, fueled by $73.72M in unrealized Ethereum gains and record revenue from its aggressive ETH-first strategy.

- The company’s Ethereum dividend, loyalty program, and $50M buyback slashed short interest from 5.56M shares to under 1M, while total ETH holdings climbed to 70,322 tokens.

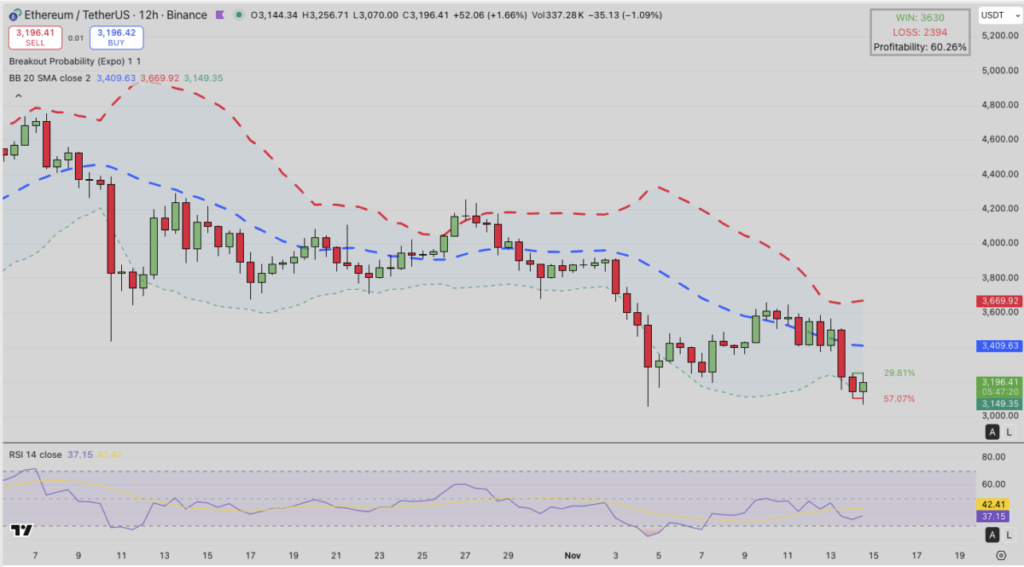

- Ethereum trades near $3,183 with bearish momentum, and a breakdown below $3,146 could send ETH toward $3,000–$2,900 unless bulls reclaim the key $3,409 resistance.

BTCS just delivered the kind of quarter most crypto-exposed companies dream about. The firm posted $4.94 million in Q3 revenue and a staggering $65.59 million in net income, all powered by its aggressive Ethereum-first approach — a strategy that suddenly looks a lot smarter than critics once claimed.

Ethereum-Focused Strategy Turns BTCS Into a Heavyweight

According to the company’s filing, the massive earnings surge was largely fueled by $73.72 million in unrealized gains as Ethereum climbed sharply throughout the quarter. BTCS now holds 70,322 ETH, worth roughly $291.58M at the end of September—making it one of the most Ethereum-exposed public companies in the U.S.

CEO Charles Allen called the quarter a “defining moment,” pointing to a combination of major moves: raising over $200 million, launching a share-repurchase program, and boosting ETH-per-share for investors. Allen said the results prove their “capital-efficient model” is working exactly as intended.

Interestingly, BTCS’s revenue for the first nine months of the year has already hit $9.40M, more than 2.3x its entire 2024 performance. Their pivot toward Ethereum isn’t just working — it’s rewriting the company’s trajectory altogether.

Dividends, Buybacks, and Shrinking Short Interest

One of the most talked-about catalysts was BTCS issuing the first-ever Ethereum dividend and launching a loyalty reward. The strategy didn’t just attract attention — it crushed short positions. Short interest dropped from 5.56 million shares to under 1 million in just two months, forcing bearish traders to unwind quickly.

The company also pushed through a $50 million buyback program, scooping up shares at prices around 15% below the average issuance, which further solidified shareholder value.

Ethereum Price Outlook: Can Bulls Regain Control?

While BTCS celebrates, Ethereum itself is wobbling. ETH is currently trading near $3,183, heading for its third straight losing session. On the 12-hour chart, candles are pressing against the lower Bollinger Band around $3,146, hinting that downside pressure hasn’t fully cooled off yet.

The first major resistance sits at the middle Bollinger Band around $3,409. ETH needs a clean breakout above that zone to reset its bullish structure — otherwise, the trend remains corrective and heavy.

The RSI at 36.51 is deep in bearish territory and still sliding, but not oversold yet. Sellers remain in control for now. If RSI cracks below 30, a sharper reaction bounce could show up, though ETH hasn’t confirmed any reversal signals just yet.

A decisive candle close below $3,146 would expose a deeper slide into the $3,000 region — the same zone ETH briefly bounced from in early November. If bulls can reclaim the $3,409 middle band, momentum may flip, but until then, the chart leans cautiously downward, even risking a retest of $2,900 if pressure builds.

Ethereum is searching for direction, and BTCS’s gigantic ETH stash means they’ll be riding every wave right alongside the rest of the market — but with far more to gain, or lose, than most.