• BONK slipped 2.4% to $0.00001488 but saw trading volume surge 38% above average.

• Support near $0.00001475 could fuel a short-term rebound toward $0.00001520.

• Analysts view the move as consolidation, not capitulation — here is why traders remain cautiously bullish.

BONK dropped 2.4% in the past 24 hours to $0.00001488, slipping beneath its key $0.000015 support level. The selloff came with a surge in volume — nearly 38% above average, according to CoinDesk Research — indicating strong market participation even amid the dip. While the breakdown briefly shook sentiment, traders see signs of steady accumulation forming near support, hinting that BONK’s pullback may be short-lived.

Volume Spike Signals Active Market

Despite forming lower highs around $0.00001524, BONK’s latest decline coincided with 749.86 billion tokens traded, showing that liquidity remains strong. Analysts are watching the $0.00001475 level as a potential inflection point. If the coin holds above it and selling pressure eases, a rebound toward the $0.00001500–$0.00001520 range could follow. The active trading environment also points to dip buyers gradually positioning for the next move higher.

Technicals Point to Consolidation

Analysts describe the current setup as consolidation, not capitulation. BONK’s volatility widened to about 5.2%, with leveraged trades clearing out near the session low at $0.00001487. Holding above $0.00001475 could lay the groundwork for a short-term bounce, especially if trading volume normalizes and relative strength indicators begin to recover.

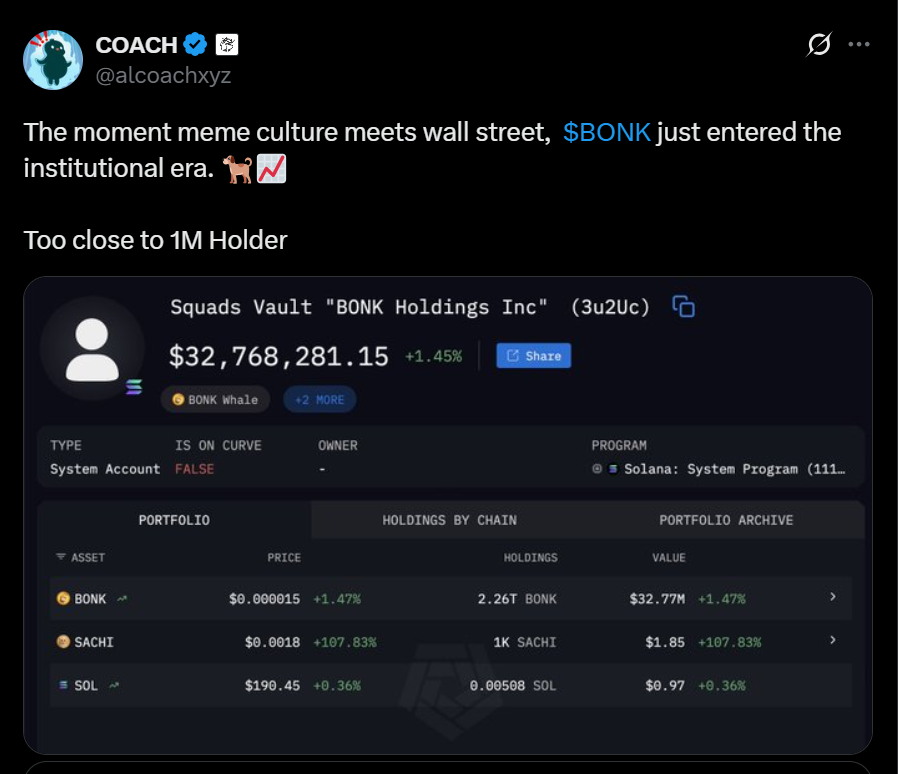

Meme Coin Sentiment Still Strong

Even with the minor setback, BONK’s overall uptrend remains intact. Speculative enthusiasm across meme coins continues to provide underlying support, and a clean recovery above $0.000015 could quickly trigger renewed buying. As long as market liquidity stays elevated, traders see potential for BONK to stabilize — and possibly rally — heading into November.https://politics.georgetown.edu/profile/kevin-hassett/