- BONK surged over 52% this week amid rumors of a 2x leveraged ETF and a looming 1 trillion token burn.

- Solana ETF buzz and nearing 1 million holders have added to bullish sentiment.

- A market correction is possible as speculation cools and investors eye profit-taking.

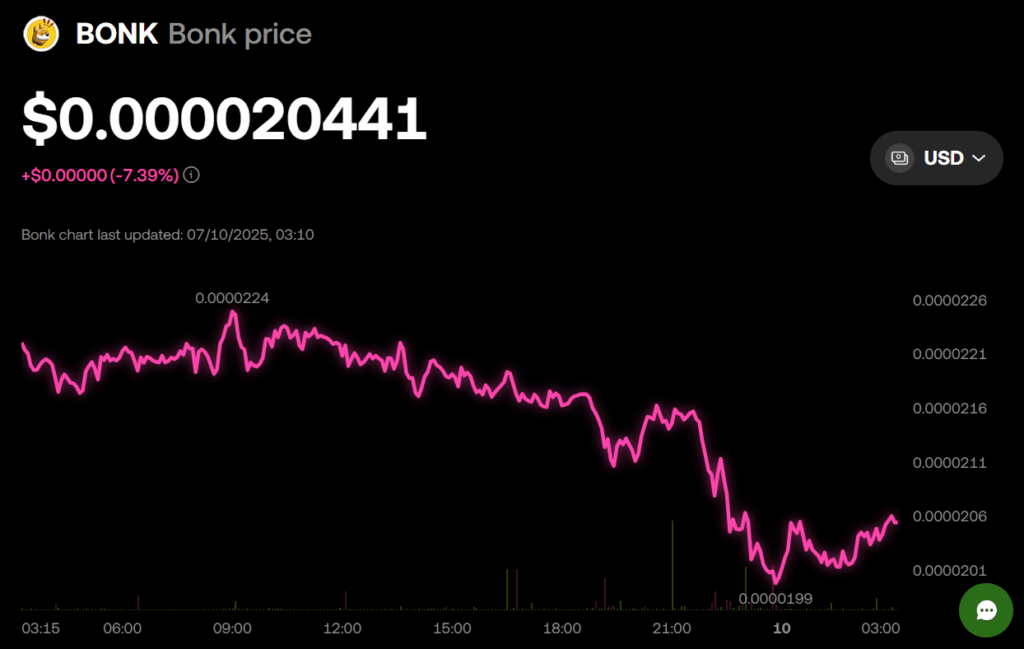

Solana-based memecoin Bonk (BONK) is having a standout week, topping performance charts with a 52.1% gain in the weekly window among the top 100 cryptocurrencies by market cap. It’s also up 52.5% over the past two weeks and 38.4% over the last month. Despite this bullish streak, the daily chart shows a slight 4.9% pullback, with the token still down 17.5% since July began, pointing to some underlying volatility.

Why BONK Is Pumping Right Now

The recent BONK rally appears to be driven by a mix of speculation and strategic updates. Rumors suggest that Tuttle Capital may file for a 2x leveraged ETF tracking BONK — a move that could open the door to significant institutional capital inflows. Although no official filing has been made, anticipation alone is drawing investor attention. Simultaneously, the project is approaching the 1 million holder milestone, which would trigger a 1 trillion token burn, reducing supply and further stoking bullish expectations.

Additionally, BONK is likely benefitting from spillover optimism around a potential Solana ETF, which is still under SEC review. This broader excitement surrounding SOL may be lifting associated projects like BONK in its wake.

Caution: A Market Cool-Off May Be Looming

While momentum is clearly in BONK’s favor right now, a correction seems likely once current speculative catalysts subside. The broader crypto rally appears to be driven by institutional ETF inflows, with retail participation still lukewarm. If enthusiasm around BONK’s burn or ETF rumors fades, or if larger holders begin to take profits, we could see a sharp retracement in price.

ETF inflows into Bitcoin and Ethereum have continued despite geopolitical tensions like the Israel-Iran conflict. However, BONK remains a high-risk asset, and its future trajectory will likely be influenced by macroeconomic decisions, such as interest rate policies from the U.S. Federal Reserve — which, for now, remain on hold.