- BONK remains stuck in a bearish structure, with lower highs and weak recovery attempts.

- Key resistance near $0.000001025 continues to cap upside and favor short setups.

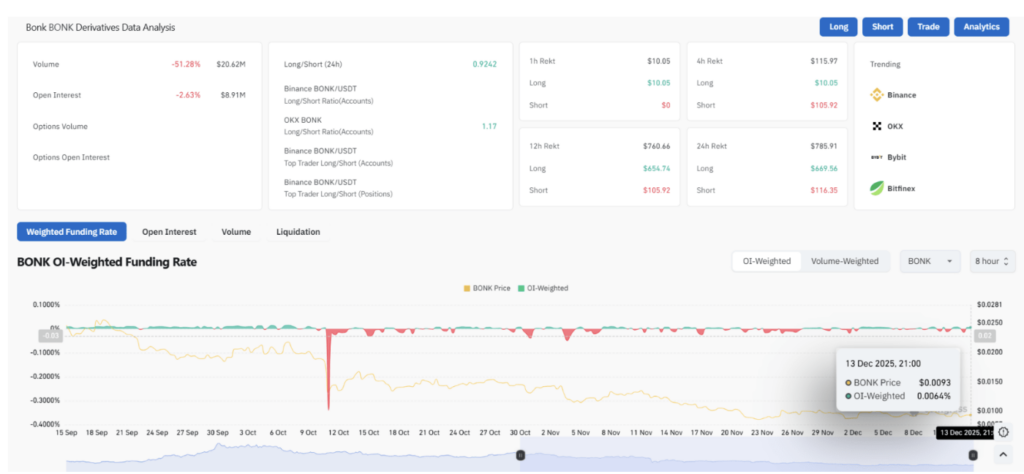

- Falling volume and open interest suggest traders are reducing risk, not building conviction.

BONK continues to trade under pressure, and so far, sellers aren’t letting go. After the recent decline, price action hasn’t shown the kind of follow-through that would signal a real recovery. Instead, BONK is stuck drifting sideways, with sentiment still cautious and traders waiting for clarity before committing either way.

Bearish Structure Remains Intact on Higher Timeframes

Crypto analyst CryptoPulse highlighted that the higher-timeframe trend remains firmly bearish. On the daily chart, BONK keeps printing lower highs and lower lows, with a noticeable string of large red candles reflecting persistent sell pressure. Price is now consolidating inside what looks like a bearish flag, a pattern that often favors continuation rather than reversal, even if things look quiet on the surface.

Key Resistance Levels Limit Upside Attempts

One level drawing attention is the $0.000001025 zone, which analysts see as a major resistance area. A move back into that range could attract sellers looking for short setups rather than fresh longs. There’s also the risk of a sharp breakdown below current support, which would confirm the bearish flag and potentially accelerate downside pressure.

Technical Indicators Continue to Signal Weakness

From a technical standpoint, BONK remains well below its major exponential moving averages. The 20-day EMA sits just overhead as immediate resistance, while the 50-day, 100-day, and 200-day EMAs are stacked much higher, reinforcing the bearish structure. The MACD is still below the zero line, and although the histogram has turned slightly positive, there’s no bullish crossover yet. Momentum may be slowing, but it hasn’t flipped.

Volume and Open Interest Point to Trader Caution

Derivatives data adds another layer of caution. Trading volume has dropped sharply, and open interest has also declined, signaling position unwinding rather than new accumulation. Funding rates remain slightly positive, but leverage on the long side is limited. For now, traders appear to be stepping back instead of leaning aggressively into either direction.