- BNB is forming a bullish cup-and-handle pattern with a potential breakout target near $1,135.

- Token burns and rising DEX + stablecoin activity are adding strong fundamental support.

- BNB Smart Chain now rivals Solana and Ethereum in volume and ranks 4th in blockchain profitability.

Binance Coin (BNB) has kinda been drifting sideways all year. Not exciting, not dramatic… just floating. But that might not be a bad thing. In fact, if the charts are right, this boring stretch could be the calm before a $655-to-$1,000 breakout wave before 2025 closes.

The Calm Looks Like a Cup—With a Handle

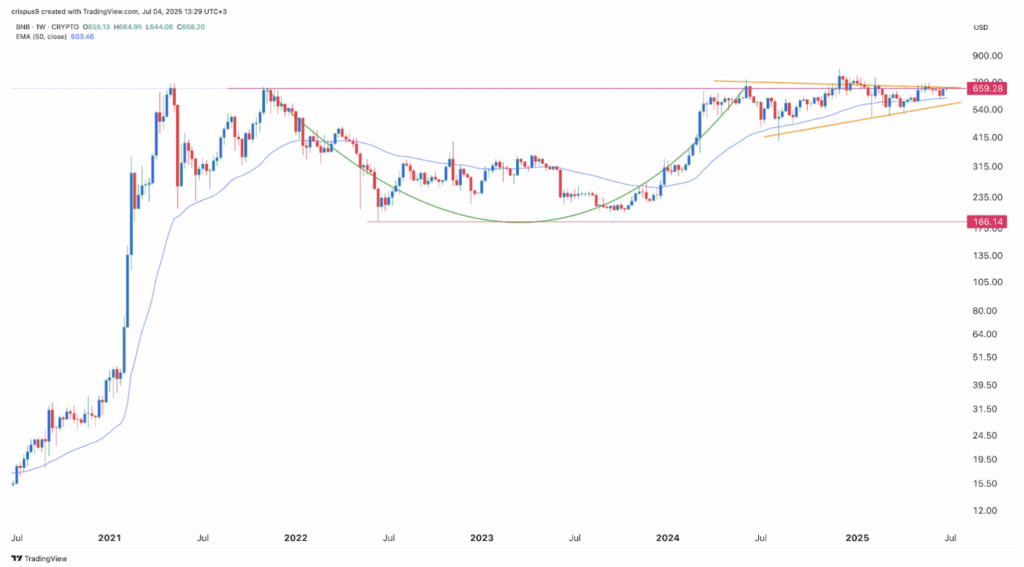

So let’s talk patterns. According to technical nerds, BNB’s current price action might be part of a good ol’ “cup-and-handle” setup. Sounds like kitchenware, but traders love it. The shape includes a big U-curve (the cup) followed by a tighter consolidation phase (that’s the handle).

Right now, BNB’s upper resistance sits at around $660, and the rounded bottom dropped all the way to $185—giving that cup some serious depth at $475. Now we’re in the handle part, which is forming a triangle shape. If this plays out like typical setups do, the lines of that triangle will soon meet—and that’s when breakouts usually happen.

If the breakout comes and pushes past the $1,000 mark, the full move could aim for $1,135. That’s based on just adding the cup depth to the breakout point. Simple math. Wild results.

Billion-Dollar Burn Incoming?

Here’s where it gets spicier. BNB has a deflationary angle. Yep, it burns its own tokens, which is crypto-speak for “makes them disappear forever.” There’s a real-time fee-based burn and a quarterly one based on how many blocks the chain spits out.

So far, over $174 million worth of BNB has been burned. But coming up? A burn worth more than $1 billion. That’s a huge dent in circulating supply—and supply drops tend to boost prices, especially in bullish conditions.

Also, long term, the goal is to shrink the circulating supply from 140 million to just 100 million tokens. That’s tight.

BSC Is Quietly Crushing the DEX Game

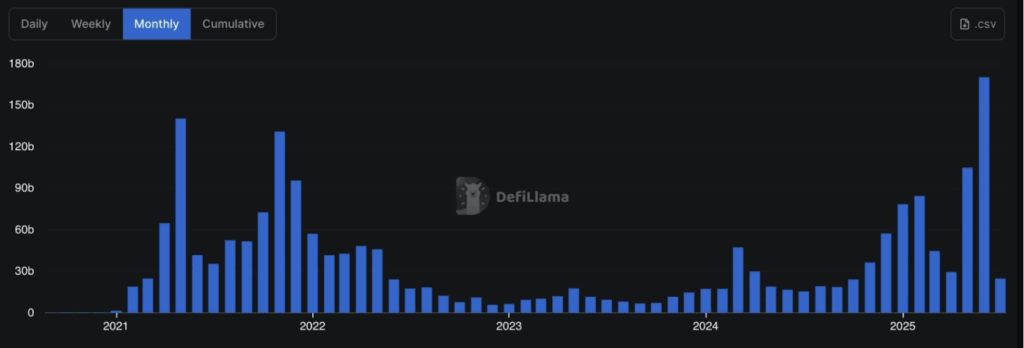

BNB Smart Chain (BSC) isn’t just vibing—it’s dominating. In terms of decentralized exchange (DEX) volume, it’s beating some big names. On a single Friday, BSC saw $6 billion in DEX volume. Solana? $2 billion. Ethereum? $1.79 billion. Base? Not even close.

Over the last 30 days, BSC hit $179 billion in volume. That’s miles ahead of Solana ($61B) and Ethereum ($56B). PancakeSwap’s still the big dog here, by the way.

Stablecoins, Too? Yep

There’s more. The stablecoin action on BNB Chain is picking up fast. Artemis data shows stablecoin supply on BNB Chain just passed $10 billion. And in just 30 days, stablecoin address count spiked 75% to hit 12.6 million.

Adjusted transaction volume hit a massive $334 billion. That’s not small. BNB Chain is now the fourth most profitableblockchain out there—raking in $20 million in fees over the past year.

So yeah, BNB might be snoozing right now, but this consolidation? It’s part of the bigger cup-and-handle game. Add in rising token burns, insane DEX dominance, and a booming stablecoin ecosystem—and you’ve got a coin that might be quietly prepping for a major breakout.