- BNB trades around $933 after rejecting resistance near $975 and holding $930 support.

- On-chain data shows 82M active addresses and $120B DEX volume in October.

- Liquidity pressures from U.S. fiscal tightening weigh on risk assets, including BNB.

BNB, the native token of the BNB Chain, has managed to stay above a critical $930 support level even as broader crypto markets show strain from tightening global liquidity. The token slipped 0.33% to $933 after briefly touching $974, consolidating within a narrow $46 trading range while exchange volume surged 71% above its 24-hour average, according to CoinDesk Research data.

Technical Picture: Consolidation Amid Volatility

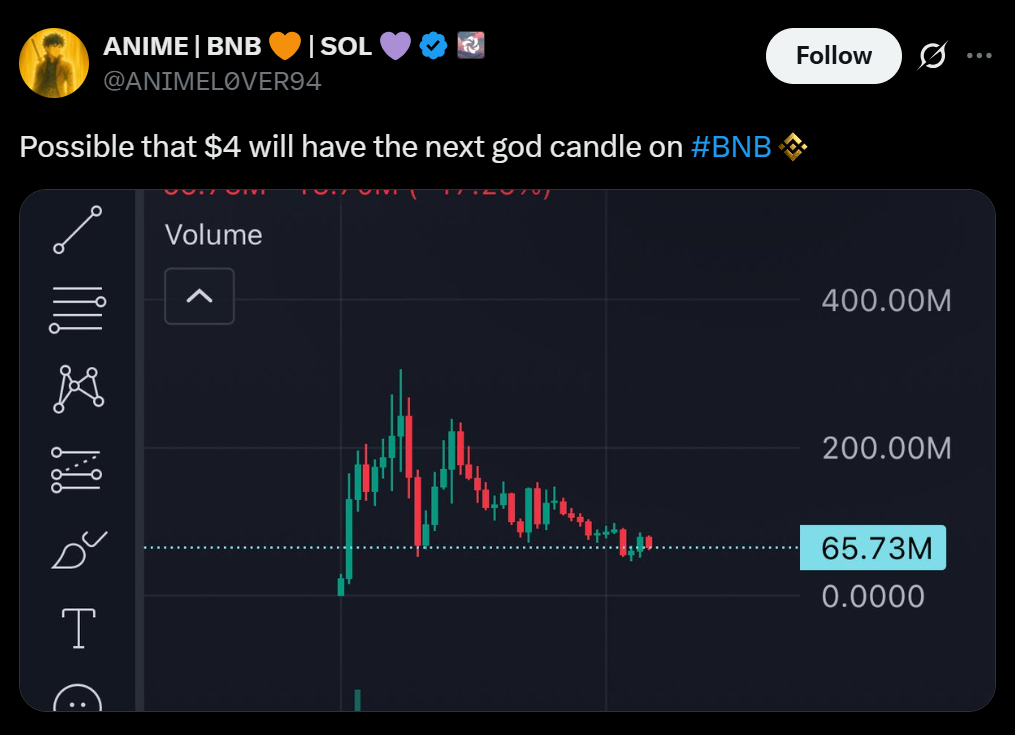

BNB’s price action remains range-bound between $930 and $975, with the latter acting as a short-term ceiling. The rejection at $975 signaled seller strength, but buyers have repeatedly defended the $930 level — an area that has now become a critical support floor. Analysts note that a decisive breakout above $975 could reopen the path toward October’s local highs, while a breakdown below $930 might expose the token to deeper retracements.

Despite the subdued price performance, on-chain metrics remain robust. “BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” said Johnny B., founder of BNBPad.ai. “The BNB Chain saw 82 million active addresses in October, marking a new all-time high, and DEX volumes neared $120 billion based on DeFiLlama data.”

Macro Liquidity Pressures Shape Market Sentiment

BNB’s resilience comes against a challenging macro backdrop. A U.S. Treasury cash rebuild and a $500 billion decline in bank reserves since July have squeezed market liquidity, prompting investors to rotate away from risk assets. The CoinDesk 20 index fell 0.9% in the past 24 hours, while Bitcoin struggled to hold the $100,000 level.

Traditional markets mirrored the crypto downturn: the Nasdaq 100 dropped 4.7% this week, and the S&P 500 slid 2.7%, as tightening financial conditions drained momentum across speculative sectors.

Adoption Offsets Market Weakness

Even amid these headwinds, the BNB ecosystem’s fundamentals remain strong. The continued growth in user activity and decentralized exchange volume suggests that BNB’s network adoption may be cushioning its price from a steeper correction. New decentralized applications like Asper have also contributed to user retention and ecosystem expansion.

A sustained defense of the $930 zone could reinforce confidence among traders, but momentum remains fragile. A push above $975 is now the key trigger to confirm renewed upside momentum, while prolonged macro stress could test buyers’ resolve in the weeks ahead.