- BNB Chain has shown strong resilience during the 2023–2026 cycle, reaching a new all-time high and maintaining a relatively small drawdown compared to other major altcoins, backed by strong fundamentals and low dilution risk.

- BNB Chain leads in blockchain activity metrics, including over 4 million daily transactions and the highest number of supported DApps, while ranking third in DeFi total value locked (TVL) behind Ethereum and Solana.

- Despite lower blockchain revenue compared to competitors like Ethereum and Tron, BNB Chain’s massive DApp ecosystem and steady user growth position it as a serious contender for long-term Web3 dominance.

Altcoin performance has been pretty disappointing throughout the 2023–2026 cycle, pushing many traders to put most of their attention back on Bitcoin. But despite the overall sluggishness, a closer look shows that not all altcoins are struggling. In fact, the total altcoin market cap remains comfortably above $1 trillion — $1.17 trillion, to be exact — and a 9% surge over the past week is starting to restore some optimism.

Among the bigger names, BNB Chain has stood out for its relative strength and stability. Currently ranked as the fifth-largest cryptocurrency by market cap, just behind BTC, ETH, USDT, and XRP, BNB sits around an $89 billion valuation. Some analysts are even calling it one of the most resilient altcoins of this cycle.

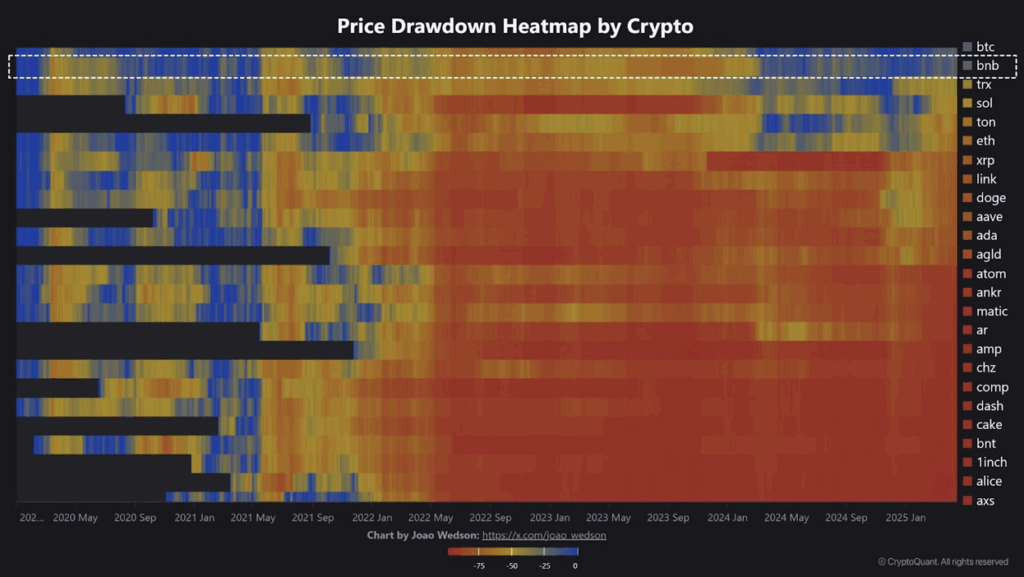

João Wedson, founder of Alphractal, recently pointed out using a cryptocurrency drawdown heatmap that while most altcoins have suffered catastrophic drops of up to -98.5% from their all-time highs, BNB has managed to avoid that fate. Even more impressively, it’s one of the very few altcoins that has actually hit a new all-time high during this cycle. For Wedson, this resilience goes way beyond just price action — he highlights BNB Chain’s solid foundations, growing DeFi footprint, and real-world utility. In his words, BNB is “one of the rare altcoins with real utility, strong fundamentals, and growing adoption, making it the strongest-performing altcoin alongside BTC.”

Is BNB Really the Most Resilient Altcoin?

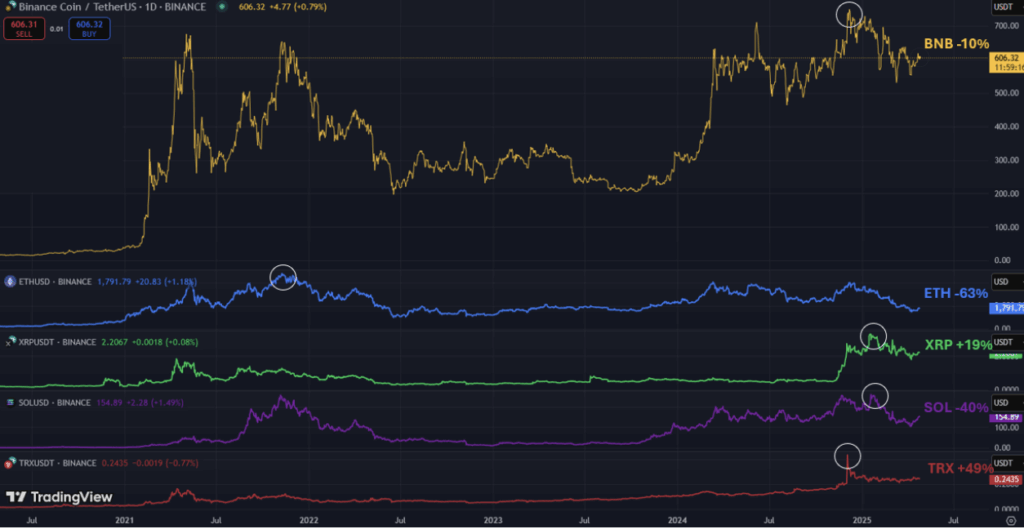

When you dig into the numbers, the story gets a little more nuanced. Sure, BNB has hit a new all-time high this cycle — but so have XRP, TRX, and Solana. (Though to be fair, Solana’s new peak barely edged past its 2021 high.) Comparing current prices to previous cycle highs, BNB is down about 10%, which is miles better than Ethereum, down 63%, and Solana, down 40%. However, XRP and TRX have outperformed BNB percentage-wise, with gains of 19% and 49%, respectively.

One big advantage BNB enjoys is its low dilution risk. According to Messari’s FDV ratio, 96.51% of BNB’s total supply is already in circulation, similar to Ethereum and TRX, while Solana (86.33%) and especially XRP (58.33%) have a lot more future supply set to hit the market. Less dilution usually translates to more price stability, giving BNB an edge over some of its rivals.

Still, as strong as BNB’s price action has been, its true staying power comes from fundamentals — not just market hype.

BNB Chain’s Ecosystem Is Booming

BNB’s value is tied closely to its blockchain, BNB Chain — a combo term that now includes both BNB Smart Chain and the Beacon Chain. It’s a serious player across gaming, DeFi, launchpads, and even the memecoin sector. Plus, being the centerpiece of the world’s biggest centralized crypto exchange doesn’t hurt.

BNB Chain processes about 4 million daily transactions — way ahead of Ethereum (around 1 million) and XRP Ledger (1.8 million), but behind Tron’s 5.5 million and way behind Solana’s massive 54 million non-vote transactions daily.

In terms of daily active users, BNB Chain also performs pretty well, boasting around 1.1 million daily active addresses. It beats Ethereum (about 384,800) and XRP Ledger (roughly 55,600) but again trails Tron (2.4 million) and Solana (3.7 million).

Where BNB Chain really flexes its muscles is in the DApp ecosystem. According to DappRadar, BNB Chain supports 5,686 DApps, edging out Ethereum’s 4,987 and dwarfing Polygon’s 2,402. This supports Wedson’s view that BNB Chain has built a “massive” and deeply rooted ecosystem — one that could help it dominate once Web3 adoption truly takes off.

BNB Chain also ranks third in total value locked (TVL) in DeFi, with around $5.8 billion, behind Ethereum’s $50.5 billion and Solana’s $8 billion, according to DefiLlama. It even managed to briefly outperform all other blockchains in DEX trading volume back in March 2025, hitting a weekly total of $14.3 billion.

BNB Chain’s Revenue Lags Behind — For Now

One area where BNB Chain still lags is revenue generation — the total transaction fees collected by the network. In 2024, Ethereum was the clear leader with $2.5 billion in fees, followed by Tron ($2.1 billion), Bitcoin ($923 million), and Solana ($751 million). BNB Chain was a distant fifth, with just $194 million.

The trend has continued into 2025. Over the past 30 days, Tron leads with $272 million, Solana with $34.7 million, Ethereum with $20.8 million, and BNB Chain trailing at $17.1 million. Compared to its size and user activity, BNB’s fee generation is relatively modest — something it will need to address as competition in Web3 heats up.

Final Thoughts: Is BNB Chain Built for the Long Run?

BNB Chain might not top every single metric, but it consistently ranks among the top smart contract platforms across user activity, DApp development, and DeFi TVL. Its resilience during one of the toughest altcoin cycles in recent memory speaks volumes. While low blockchain revenue remains a weak spot for now, the growing strength of BNB Chain’s ecosystem positions it to thrive if Web3 adoption really explodes.

In a market full of flashy projects and short-term hype, BNB’s slow-and-steady approach — backed by real-world use cases — might just be its biggest superpower.