- Binance will now accept BlackRock’s BUIDL tokenized Treasury fund as collateral for institutional trading.

- Securitize is expanding BUIDL to the BNB Chain, increasing its interoperability and DeFi utility.

- RWAs like BUIDL continue gaining traction as yield-bearing collateral across on-chain and institutional finance.

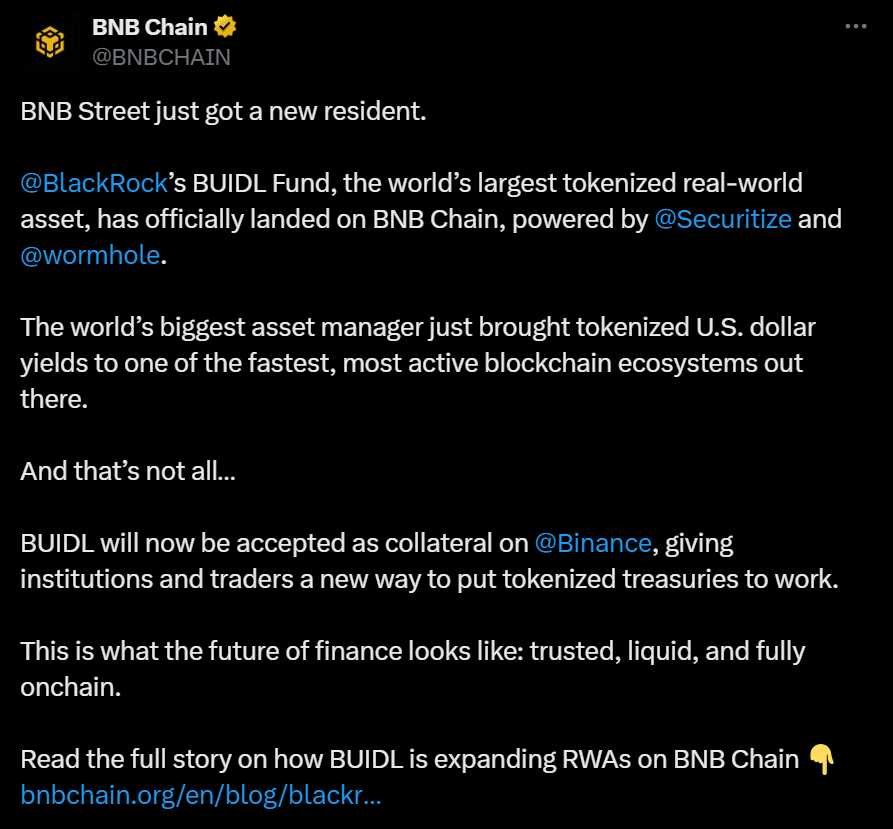

BlackRock’s tokenized U.S. Treasury fund, BUIDL, is taking another major leap into mainstream crypto infrastructure. The fund — issued by Securitize — will now be accepted as collateral for institutional trading on Binance, the world’s largest exchange by volume. The announcement marks a significant expansion of how real-world assets (RWAs) are used within digital markets, blending traditional finance stability with on-chain accessibility.

BUIDL Can Now Serve as Off-Exchange Collateral

With this move, institutional traders can post BUIDL tokens with a custody partner instead of depositing funds directly onto Binance. This structure gives them far more flexibility: they can actively trade while their collateral remains in a secure, yield-generating asset rather than sitting idle on an exchange. Binance said the shift directly responds to client demand for “more interest-bearing stable assets” that can serve operational roles in day-to-day trading.

Securitize Expands BUIDL to BNB Chain

Securitize is also rolling the fund out to the BNB Chain, meaning the token can now interact with DeFi applications within the BNB ecosystem. This upgrade increases interoperability and opens new use cases for institutional and DeFi participants, including lending, borrowing, and treasury management across multiple chains.

RWAs Continue Gaining Ground

The rise of tokenized real-world assets — including funds, bonds, and credit — has become one of the fastest-growing segments of crypto in 2024 and 2025. Tokenized Treasuries like BUIDL allow investors to park cash on-chain while earning yield, making them popular as collateral for DeFi protocols and institutional trading desks. BlackRock’s digital assets head, Robbie Mitchnick, said the integration helps bring core financial instruments from TradFi “into the onchain finance arena.”