- BlackRock deposited roughly $600M worth of BTC and ETH to Coinbase Prime.

- The move followed sizable outflows from BlackRock’s Bitcoin and Ethereum ETFs.

- ETF flow data often lags real market activity and doesn’t always signal immediate selling.

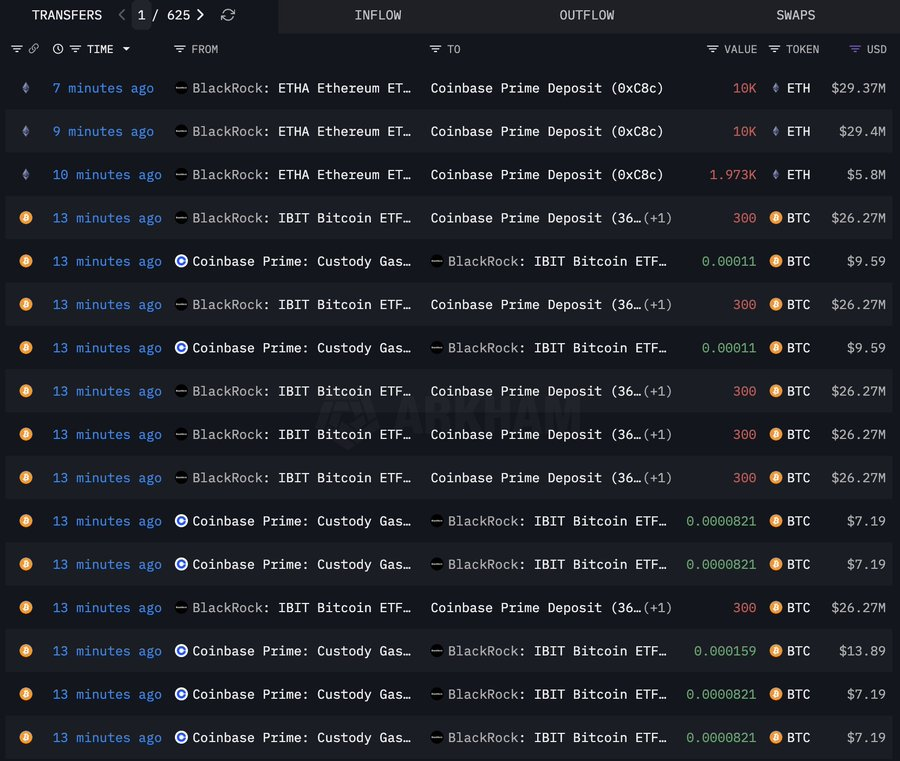

BlackRock transferred a sizable batch of digital assets to Coinbase Prime today, depositing 74,973 Ethereum worth roughly $220 million alongside 4,356 Bitcoin valued near $382 million, according to Arkham Intelligence. The timing of the move immediately drew attention, especially as crypto markets continue to wrestle with uneven institutional flows. While large transfers often spark speculation, the context around BlackRock’s ETF activity adds a few extra layers to unpack.

ETF Outflows Paint a Mixed Picture

The deposits follow a day of notable outflows across BlackRock’s crypto ETFs. On Tuesday, the firm’s Bitcoin ETF saw more than $210 million in net redemptions, while its Ethereum ETF recorded outflows exceeding $220 million. On the surface, those numbers suggest cooling demand, but ETF flows don’t always reflect real-time trading pressure in the underlying assets. They track share creation and redemption, not necessarily immediate buying or selling in spot markets.

How Authorized Participants Shape the Data

Authorized participants play a critical role in how ETF flows translate to on-chain activity. These intermediaries can hold ETF shares in inventory, wait for liquidity to improve, or redeem shares for Bitcoin or Ethereum at a later stage. Because of that flexibility, inflows and outflows often lag actual market behavior. A large redemption today doesn’t automatically mean aggressive selling happened today, even if it looks that way at first glance.

Why the Transfers Matter Anyway

Even with those nuances, BlackRock’s decision to move hundreds of millions in BTC and ETH to Coinbase Prime is still worth noting. Prime accounts are typically used for custody, execution, or settlement, meaning the assets are positioned for potential activity. Whether that activity turns into selling, rebalancing, or internal fund management remains unclear. For now, the transfers highlight how institutional positioning can shift quietly behind the scenes, well before price reacts.