- BlackRock transferred over $192M in Bitcoin and $22M in Ethereum to Coinbase Prime

- IBIT recorded $435M in net outflows last week, while ETHA saw $69M withdrawn

- Bitcoin and Ethereum both pulled back after weekend rallies amid ongoing volatility

BlackRock has transferred a large batch of crypto assets to Coinbase Prime, adding to signs of pressure across its spot crypto ETF products. The move comes as both Bitcoin and Ethereum ETFs continue to see uneven investor flows amid ongoing market volatility.

BlackRock Sends Bitcoin and Ethereum to Coinbase Prime

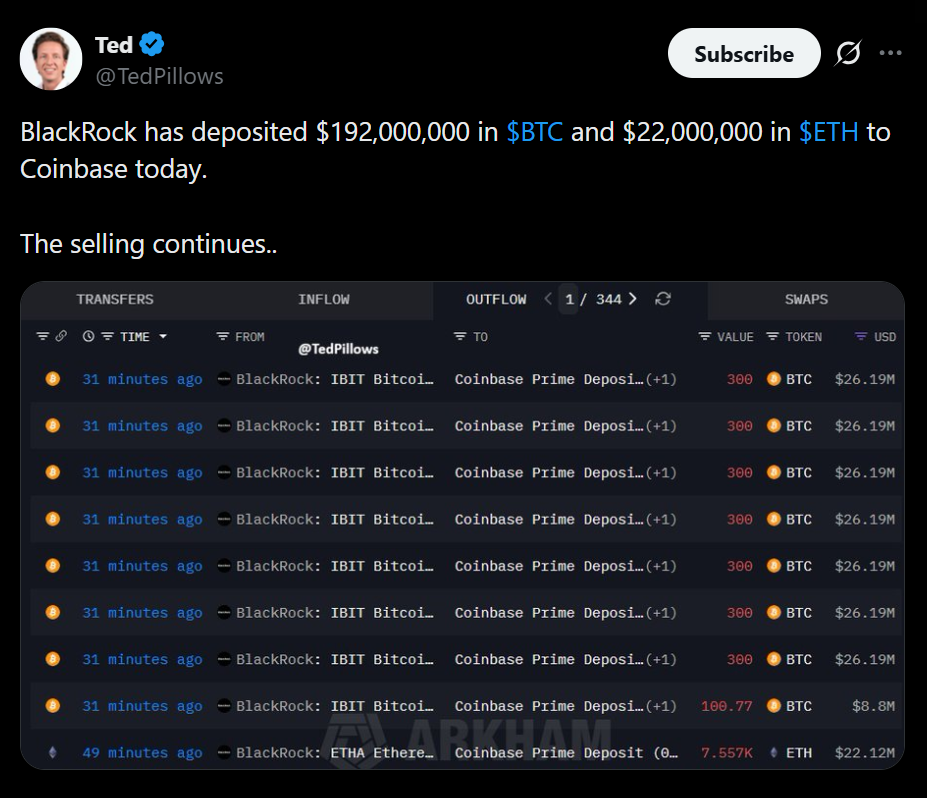

According to data from Arkham Intelligence, BlackRock deposited more than 2,200 Bitcoin, valued at roughly $192 million, alongside around $22 million worth of Ethereum to Coinbase Prime. These transfers were recorded earlier today and come during a period of increased ETF redemptions.

The activity follows a challenging week for BlackRock’s iShares Bitcoin Trust (IBIT), which recorded $435 million in net outflows. While ETF flows have been choppy over recent weeks, outflows have consistently outweighed inflows, suggesting cautious positioning among investors.

Ethereum ETF Also Sees Sustained Withdrawals

Pressure has not been limited to Bitcoin. BlackRock’s Ethereum ETF (ETHA) has also experienced extended investor withdrawals, including roughly $69 million in net outflows last week. The trend reflects broader uncertainty across crypto markets as investors reassess exposure following sharp price swings.

Ethereum briefly pushed above $3,000 during the weekend rally but has since pulled back, mirroring Bitcoin’s reversal from above $90,000.

Market Volatility Remains a Key Factor

Bitcoin surged past the $90,000 level over the weekend before easing back to around $87,700, according to CoinGecko data. Ethereum followed a similar pattern, posting gains before retracing alongside the broader market.

While transfers to Coinbase Prime do not automatically signal imminent selling, they often coincide with ETF share redemptions and rebalancing activity. With volatility elevated, investors appear to be taking a more defensive stance toward crypto exposure.