- BlackRock purchased over $100 million in ETH as ETF inflows picked up in early 2026.

- Ethereum has posted solid gains across short-term time frames but remains below 2025 levels.

- Continued upside depends on market sentiment and broader macro stability.

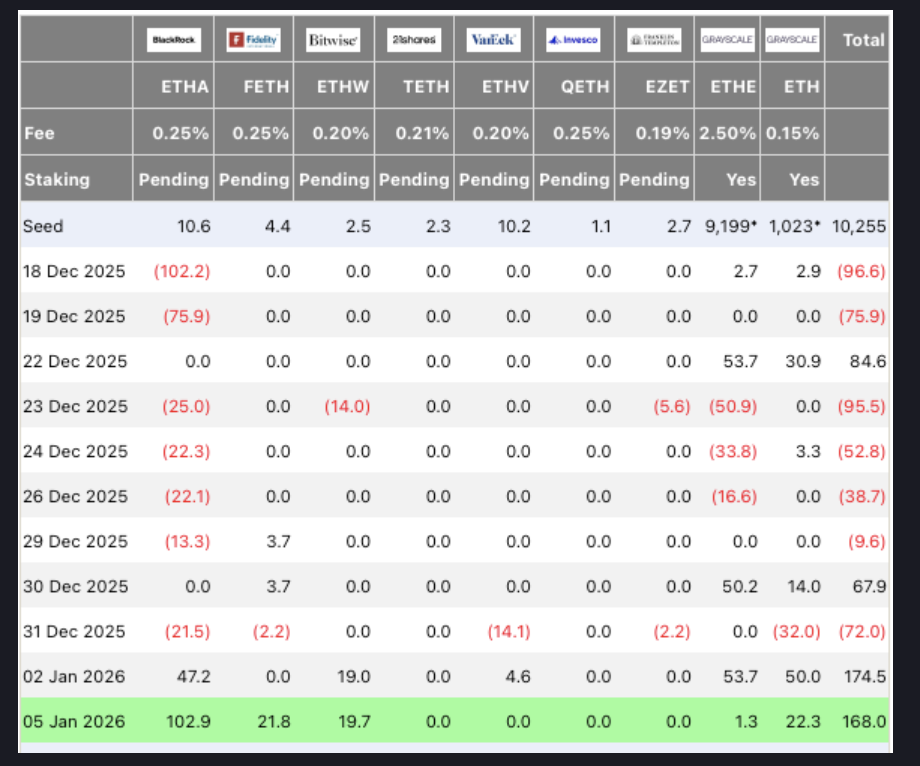

BlackRock stepped up its crypto exposure to start 2026, purchasing $102.9 million worth of Ethereum for its ETH ETF on January 5, according to data from Farside Investors. Just days earlier, the asset manager also acquired $287.4 million in Bitcoin for its BTC ETF, marking its largest single-day Bitcoin buy in nearly three months. The timing has caught the market’s attention, especially as Ethereum begins to show renewed strength after a shaky end to 2025.

Ethereum Price Responds as ETF Demand Builds

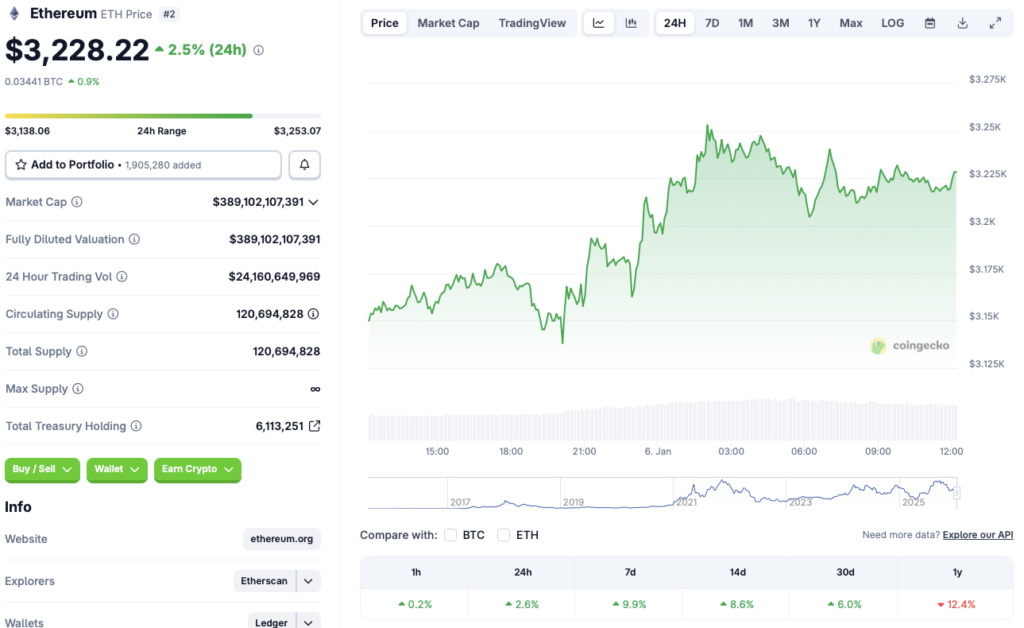

Ethereum’s price action has turned noticeably more positive alongside BlackRock’s buying spree. CoinGecko data shows ETH is up 2.6% in the last 24 hours, nearly 10% over the past week, and 8.6% across the 14-day timeframe. Monthly performance has also flipped green, though ETH still remains down about 12.4% since January 2025. The rebound feels constructive, but it’s not exactly a full recovery yet.

Can ETH Extend the Rally or Does Volatility Return?

Ethereum could continue climbing in the weeks ahead if bullish momentum holds. Several major firms, including Grayscale and Bernstein, expect Bitcoin to reach new all-time highs in 2026, a move that would likely pull ETH higher as well. Still, risks haven’t disappeared. Macroeconomic uncertainty remains elevated, and risk-averse capital continues flowing into gold and silver. If volatility resurfaces, Ethereum may struggle to maintain its gains before a clearer trend emerges.