- The Bitwise XRP ETF is trading well below its launch price

- SEC approval failed to translate into sustained crypto upside

- Analysts now flag the ETF as a higher-risk institutional product

Bitwise Asset Management, which oversees roughly $15 billion in assets, became the second institutional firm approved by the US Securities and Exchange Commission to launch an XRP ETF in November 2025. The milestone followed Canary Capital’s debut earlier that month, which saw about $58 million in first-day trading volume and set optimistic expectations for XRP-linked products.

At the time, approval was framed as a potential turning point for XRP, with many expecting institutional inflows to push prices higher. More than two months later, that optimism has cooled. Instead of strengthening in 2026, XRP has trended lower, dragging the Bitwise ETF down with it.

Early Gains Gave Way to Losses

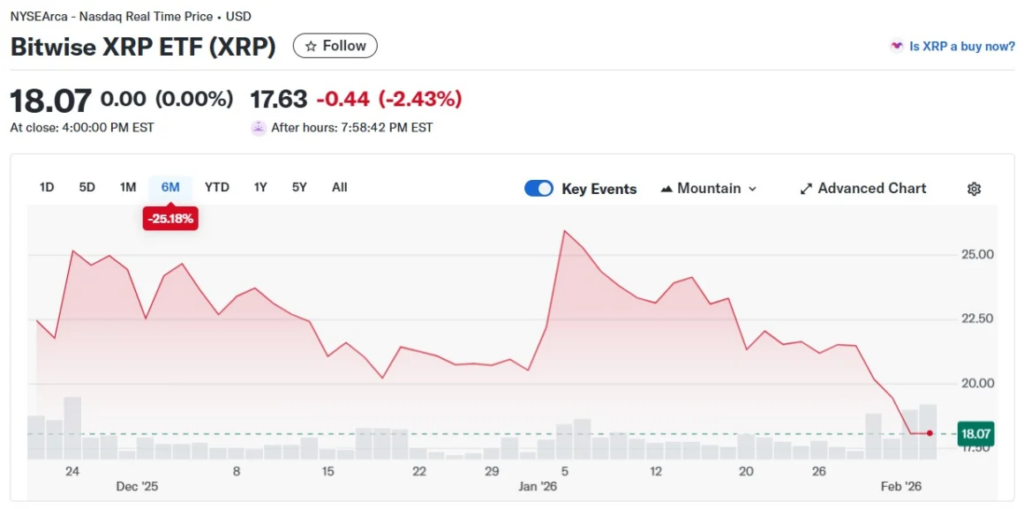

The Bitwise XRP ETF launched at $24.15 and climbed to a high of $26.88 shortly after going live. Momentum didn’t last. As broader crypto sentiment weakened heading into 2026, the ETF began sliding alongside the underlying asset. Market uncertainty, rising trade tensions, and tariff-related concerns added pressure across risk assets.

As of this week, the ETF is trading near $18.07, after briefly touching lows around $17.63. That decline has erased early gains and left investors sitting on losses for the year. The downturn mirrors wider stress in crypto ETFs, especially after Bitcoin fell below the $75,000 level and briefly pushed major funds, including BlackRock-linked products, into the red.

ETF Exposure Isn’t the Same as Holding XRP

Analysts have increasingly described the Bitwise XRP ETF as a higher-risk instrument suited only for investors with strong risk tolerance. Unlike holding XRP directly, ETF exposure introduces additional volatility driven by large capital flows, fund mechanics, and institutional rebalancing.

That structure can amplify downside during periods of weak sentiment. Large inflows and outflows don’t always align with spot market behavior, which can lead to sharper swings than many retail investors expect. For some, that distinction only becomes clear after losses appear.

A Reminder That Approval Isn’t a Price Guarantee

The Bitwise XRP ETF serves as a reminder that regulatory approval alone doesn’t guarantee positive price action. While SEC clearance adds legitimacy, it doesn’t override macro pressure, weak demand, or shifting risk appetite.

For investors, the lesson is fairly blunt. Crypto ETFs can offer access and convenience, but they also come with structural risks that don’t exist when holding the asset directly. As XRP struggles to regain momentum, caution, not hype, is doing most of the talking.