- Bitmine’s total crypto, cash, and “moonshot” holdings now stand at $14.2 billion.

- The company controls over 4.14 million ETH, about 3.43% of total supply, making it the largest ETH treasury in the world.

- Bitmine is accelerating ETH staking and plans to launch its MAVAN validator network in early 2026.

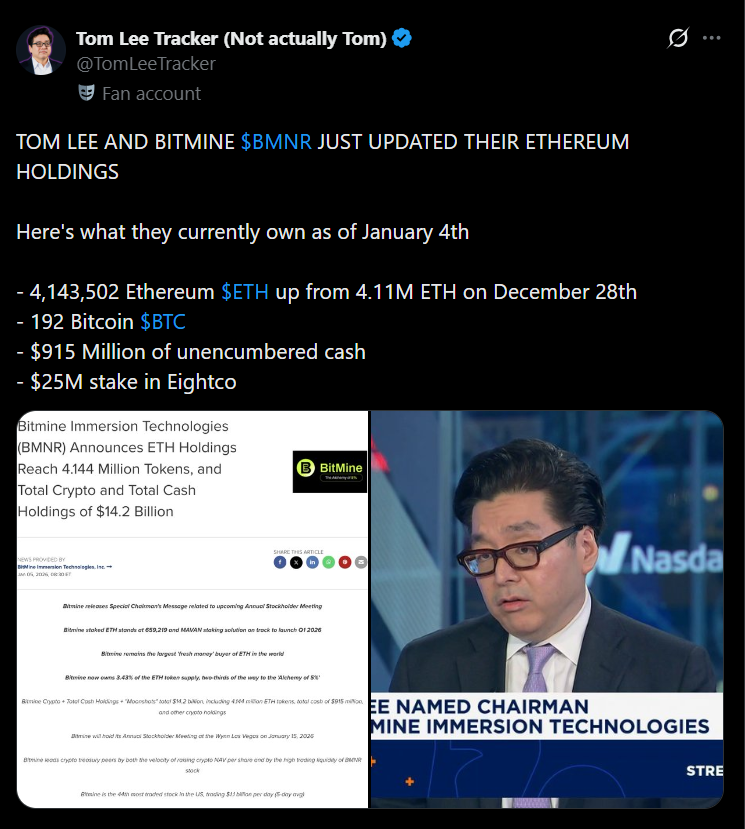

Bitmine Immersion Technologies has disclosed that its combined crypto, cash, and “moonshot” holdings now total roughly $14.2 billion, cementing its position as the world’s largest Ethereum treasury holder and one of the biggest crypto-focused balance sheets globally. The update highlights just how aggressively the company has been accumulating ETH, even as broader market activity slowed into year-end.

Inside Bitmine’s Expanding Ethereum Treasury

As of January 4, Bitmine holds 4,143,502 ETH, valued at around $3,196 per coin, alongside 192 Bitcoin, $915 million in cash, and a $25 million stake in Eightco Holdings as part of its higher-risk “moonshot” allocation. Those Ethereum holdings alone represent roughly 3.43% of total ETH supply, an unusually large concentration for a single corporate treasury.

Chairman Tom Lee noted that Bitmine added nearly 33,000 ETH in just the final week of 2025, a period when most market participants were stepping back. According to the company, that pace makes Bitmine the largest source of “fresh money” ETH buying in the market right now.

Why Bitmine Is So Bullish on Ethereum in 2026

Lee outlined several tailwinds driving Bitmine’s conviction, including growing U.S. government support for crypto, Wall Street’s increasing focus on stablecoins and tokenization, and the rising need for authentication and provenance in an AI-driven economy. He also pointed to strong parallels between the surge in commodities during 2025 and what could follow for crypto prices in 2026, historically.

Ethereum, in particular, sits at the center of that thesis, given its role in tokenization, smart contracts, and institutional-grade infrastructure.

Staking, MAVAN, and the Push for Yield

Bitmine’s strategy goes beyond simple accumulation. The company now has 659,219 ETH staked, valued at about $2.1 billion, after increasing staked balances by more than 250,000 ETH in a single week. While this is still only a fraction of its total holdings, it sets the stage for much larger yield generation.

The firm is working with three staking providers as it prepares to launch its Made in America Validator Network (MAVAN) in early 2026. At full scale, Bitmine estimates staking could generate roughly $374 million in annual revenue, or more than $1 million per day, assuming current staking rates.

Corporate Strategy and What Shareholders Are Voting On

Ahead of its January 15, 2026 annual meeting in Las Vegas, Bitmine is asking shareholders to approve an increase in authorized shares. Lee said the move is designed to support capital market activity, potential share splits if ETH reaches long-term targets, and selective acquisitions. Management emphasized that all of this ties back to a single goal: increasing ETH per share while optimizing yield and strategic investments.

The Bigger Picture

With its crypto holdings now second only to Strategy’s Bitcoin treasury and its stock ranking among the most actively traded in the U.S., Bitmine is positioning itself as a pure-play vehicle for large-scale Ethereum exposure. Whether that strategy delivers outsized returns will depend heavily on how ETH performs in 2026, but the company is clearly betting big that Ethereum’s moment is approaching.