- Ethereum gaining traction as Wall Street’s preferred platform for tokenized assets.

- Bitmine has already accumulated 833K ETH, aiming for 5% of total supply.

- Institutional interest rising fast, with rivals racing to build ETH treasuries.

Ethereum is catching fresh attention from Wall Street, not just as another crypto but as the backbone for blockchain finance. Tom Lee, chairman of Bitmine and longtime investor, argued that Ethereum could become the go-to platform for tokenizing real-world assets—everything from bonds to equities and beyond. For institutions aiming to move financial instruments on-chain, ETH offers the rails they need.

Lee made a clear distinction between Bitcoin and Ethereum. While Bitcoin has matured into a store of value, Ethereum was built to host global finance itself. He also noted how artificial intelligence could link digital and physical securities in ways legacy systems simply can’t. In his view, ETH’s upside might even outpace Bitcoin’s legendary gains, with the potential to flip it in overall network value down the line.

Bitmine’s Massive ETH Play

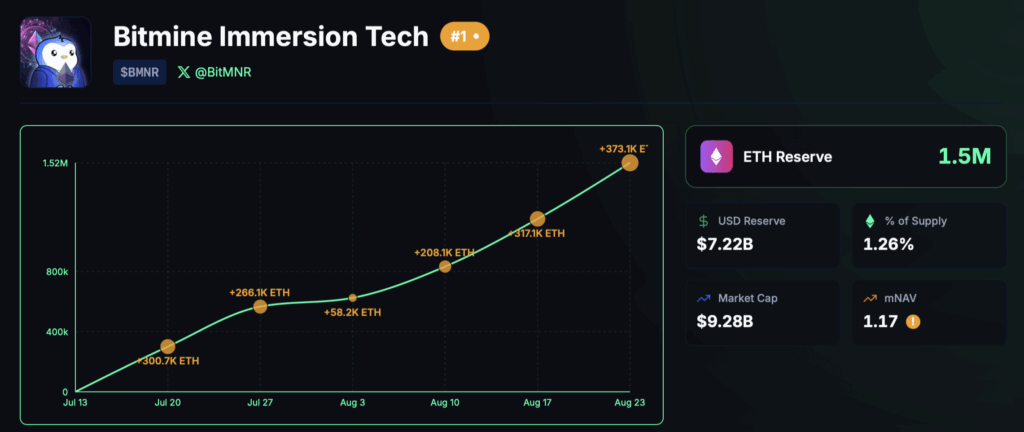

Bitmine has moved aggressively into Ethereum, quickly setting itself up as the world’s largest ETH treasury. Within weeks of launching, the firm acquired 833,000 ETH—nearly 1% of the entire supply. To put that in perspective, MicroStrategy took years to build a 3% share of Bitcoin, while Bitmine has been stacking ETH at more than ten times that speed.

But the plan goes deeper than just buying and holding. By staking their ETH, Bitmine is pulling in yields north of 3%, giving the company recurring income while embedding itself into Ethereum’s infrastructure. Lee said the long-term goal is bold: to reach 5% of total supply, echoing MicroStrategy’s one-million-Bitcoin target. If successful, it would cement Bitmine at the core of Ethereum’s financial ecosystem.

Institutional FOMO Rising

Bitmine’s play hasn’t gone unnoticed. Soon after its announcement, rivals like Sharplink Gaming and Joe Lubin’s SBET began unveiling ETH treasury strategies of their own. The rush shows that institutions aren’t treating ETH as just another altcoin anymore—it’s being seen as the backbone of tokenized finance.

Trading activity backs this up. Bitmine’s shares now see $1.6 billion in daily volume, rivaling companies like Uber, despite its market cap being only $4 billion. That imbalance highlights just how quickly demand for ETH exposure is climbing and how much investor appetite there is for a stake in Ethereum’s future.

A New Phase for ETH

The bigger picture here is simple: Ethereum is no longer just a platform for developers or DeFi experiments. With institutions circling and treasuries forming around ETH, it’s being positioned as a financial base layer for global markets. Whether it flips Bitcoin or not, the narrative is shifting fast—and ETH looks set to play a central role in how Wall Street meets blockchain.