- Ethereum’s revenue has fallen sharply as Layer-2s capture more value

- Base and other L2s return only a small share of fees back to Ethereum

- BitMine’s heavy ETH accumulation looks increasingly speculative amid weak fundamentals

As Layer-1 networks grow, scalability stops being optional and starts becoming survival. Ethereum leaned into that reality early by pushing activity onto Layer-2s, a move that helped keep fees manageable and throughput high. For years, that strategy supported ETH’s path toward mainstream use, especially during periods of heavy demand.

But that same pillar now looks stressed. According to recent analyst estimates, Ethereum’s revenue has dropped sharply this year, falling from about $2.52 billion earlier on to roughly $604 million. That’s not a small dip. It suggests something structural is shifting beneath the surface, not just a temporary slowdown.

Layer-2 Growth Is Quietly Draining ETH Revenue

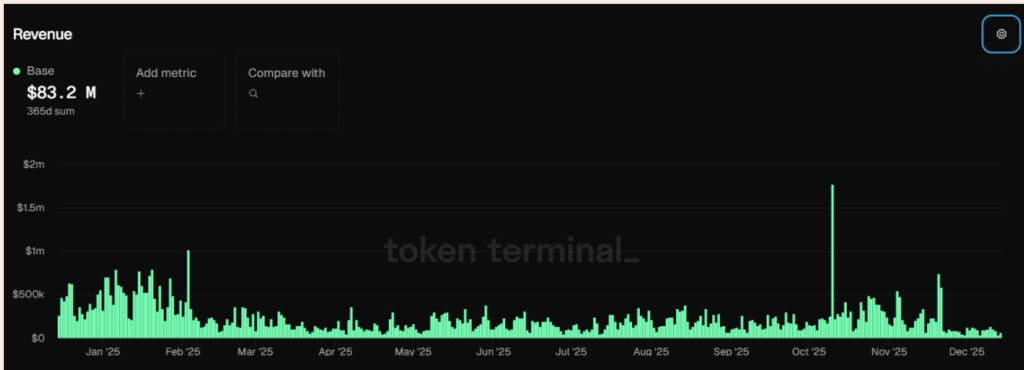

Base offers a clear example of what’s happening. Over the past 365 days, Base generated around $83 million in cumulative revenue. Only about 8% of that, roughly $6.7 million, flowed back to Ethereum as settlement fees. The rest stayed at the Layer-2 level, effectively bypassing ETH’s main revenue engine.

This isn’t unique to Base. Arbitrum, Optimism, and Polygon all show similar patterns, where most value is captured off the main chain. Over time, that leakage weakens Ethereum’s direct fee capture and points to softer on-chain activity. In simple terms, fewer fees burned means less natural pressure supporting ETH’s price.

BitMine’s ETH Bet Starts to Look Risky

Against this backdrop, BitMine’s positioning raises questions. BMNR holds a heavy Ethereum allocation, about 3.66 million ETH, and recently added another 38,596 ETH in just two days. Under different conditions, that kind of accumulation might have sparked momentum. Instead, ETH remained capped below $3,200, barely reacting.

The reaction showed up elsewhere. BMNR closed down 9.17% on the day, extending what’s already been a rough quarter. With losses now around 32%, Q4 is shaping up to be the token’s worst performance since Q3 2022. The message from the market feels pretty clear.

Weak Fundamentals Limit the Upside

Ethereum’s current on-chain setup isn’t helping. With Layer-2s capturing most transaction activity, there simply aren’t enough fees being burned on mainnet to offset issuance. That keeps ETH net inflationary, which naturally dampens upward price pressure, even when accumulation is happening.

In that context, BitMine’s ETH-heavy strategy starts to look less like long-term conviction and more like a speculative bet. If revenue dynamics don’t improve, BMNR’s mNAV could continue to slide, underlining the risks that come with concentrated exposure to Ethereum in its current state.