- BitMine bought 54,000 ETH last week, bringing its treasury to nearly 3.6M ETH — close to 3% of all circulating supply.

- The firm boosted cash reserves from $398M to $607M, strengthening future buying power.

- Thomas Lee attributes market weakness to a liquidity drop and believes the cycle peak may extend into 2026.

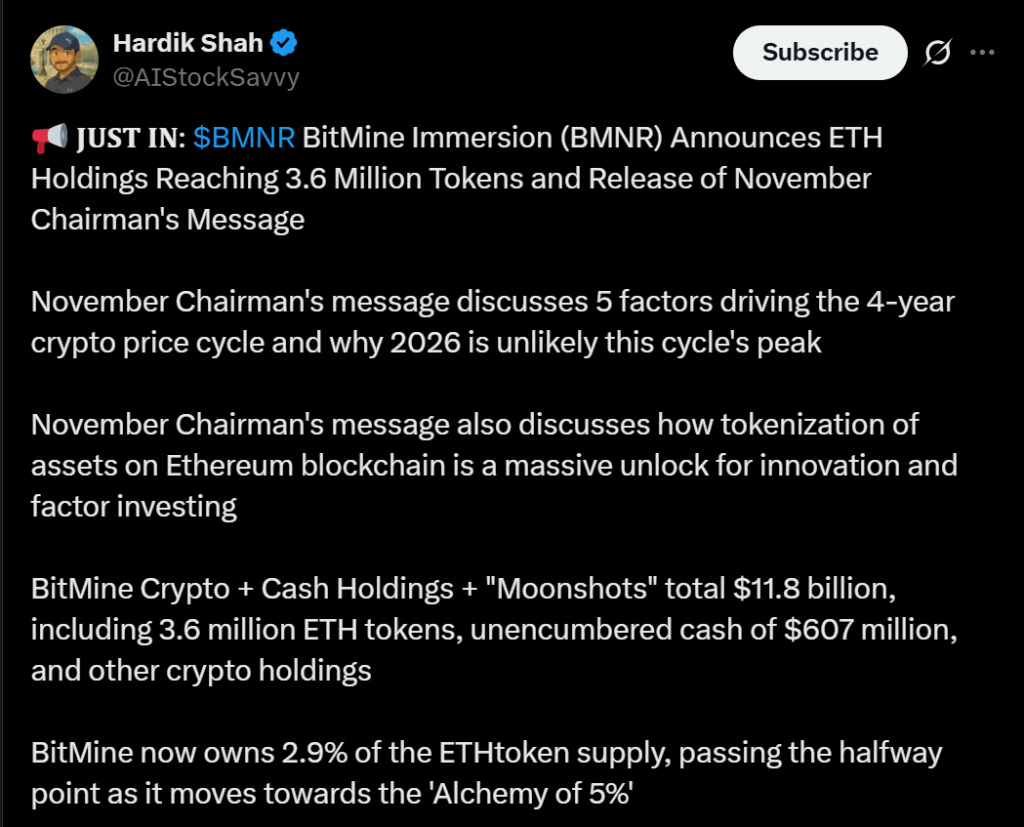

BitMine Immersion Technologies (BMNR), the Ethereum-focused digital asset treasury giant, expanded its holdings again last week with a massive purchase of over 54,000 ETH — worth roughly $173 million at current prices. This aggressive accumulation pushes the firm’s total stash to nearly 3.6 million ETH, placing it just shy of controlling 3% of the entire circulating supply. Alongside its Ethereum position, BMNR also holds a small amount of bitcoin and equity in Eightco (ORBS), a treasury company centered around Worldcoin.

Treasury Growth and Cash Position Strengthen

In addition to its growing ETH reserves, BitMine also increased its cash holdings dramatically — from $398 million to $607 million in a single week. This larger cash position gives the firm more flexibility to continue buying during downturns, staying liquid enough to take advantage of lower prices. Despite these strategic moves, BMNR shares dipped another 2.6% on Monday, marking their weakest performance since August.

Thomas Lee Points to Liquidity Shock Behind Market Decline

BitMine’s chairman and Fundstrat co-founder Thomas Lee attributed the ongoing weakness in crypto to a sharp, sudden drop in liquidity. According to Lee, a market maker likely sustained significant losses during the October 10 crash and has since pulled back liquidity operations. He compared this retreat to a temporary form of “quantitative tightening” for digital assets, reducing market depth and amplifying volatility. For reference, Lee noted that a similar liquidity contraction in 2022 lasted between six and eight weeks.

Why BitMine Still Thinks the Cycle Is Far From Over

Despite the sell-off and underwater sentiment, BitMine does not believe the crypto market has reached its cycle top. In his latest shareholder letter, Lee argued that structural forces could push the cycle peak into 2026 or even later. One of the biggest long-term catalysts, he said, will be tokenization — bringing assets like stocks, real estate, and bonds onto the Ethereum blockchain. He described tokenization as “a major unlock” for global finance and a key driver of Ethereum’s long-term value.