- In Q3 2025, institutional demand pushed Ethereum to a 66.76% gain, led by BitMine, which increased its holdings from 163k to 2.6M ETH — a 1,495% jump in three months.

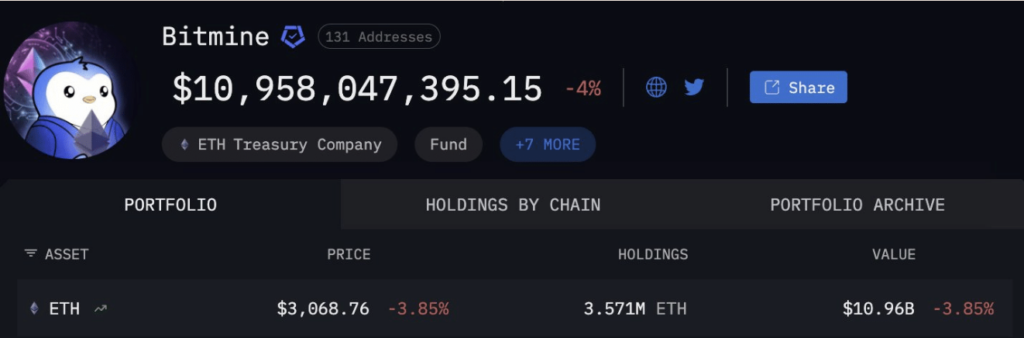

- BitMine continued accumulating in Q4, adding another 900k ETH to reach a 3.7M ETH treasury, even as its $11B ETH stake is now down 3.85% with ETH trading near $3,068.

- This growing divergence between aggressive institutional accumulation and weak market response raises doubts about another Q3-style rally and puts Ethereum’s $3,000 support level at risk if DAT-driven sentiment continues to soften.

Institutional demand for Ethereum in Q3 2025 didn’t just rise — it went vertical. ETH posted a 66.76% gain over the quarter, its strongest Q3 rally so far.

At the center of this surge sat one name that kept popping up on-chain: BitMine (BMNR).

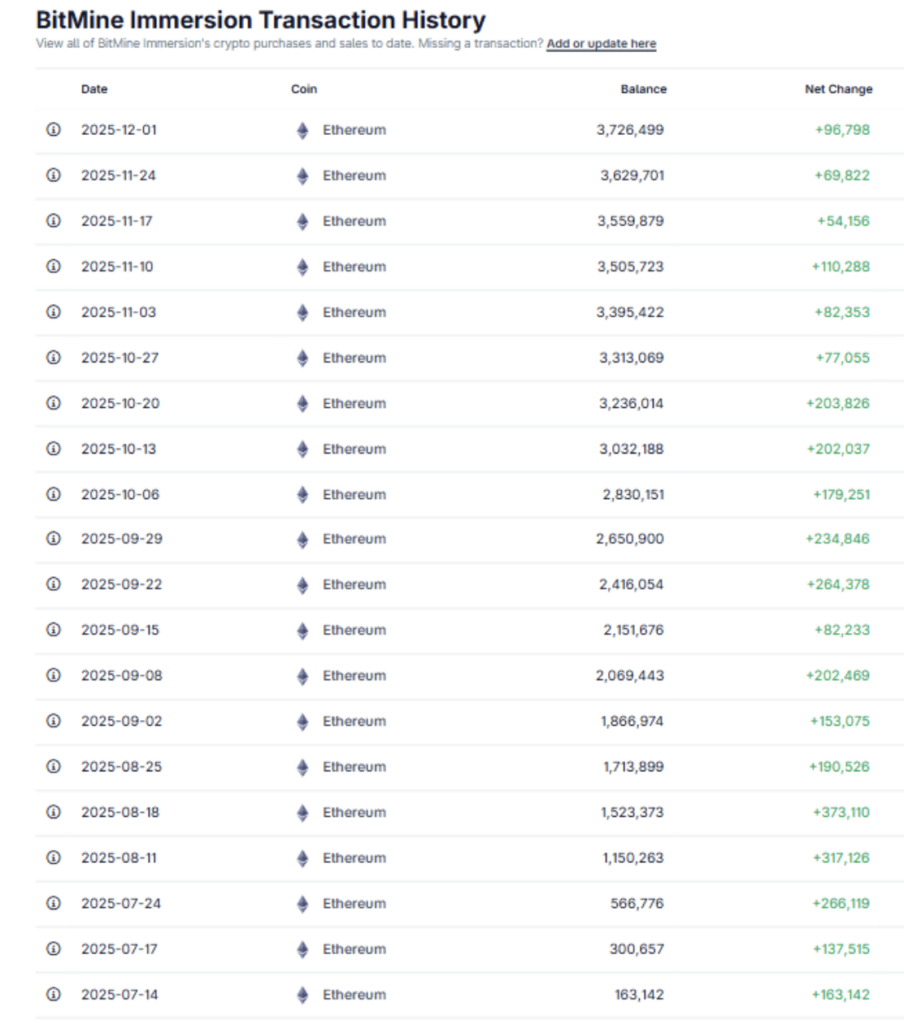

Transaction history tracked on CoinGecko shows 11 separate ETH accumulation moves from BitMine in Q3 alone. Not tiny buys either — together, they added up to a massive stack.

BitMine’s Aggressive ETH Accumulation Shocked the Market

At the start of July, BitMine held around 163,000 ETH. By the end of September, that number had jumped to 2.6 million ETH.

That’s an extra 2.44 million ETH in just three months. Or put another way, roughly a 1,495% increase in their Ethereum holdings.

Naturally, the market noticed. On the daily chart, BMNR stock climbed 45% in Q3, making it the most bullish quarter in the company’s history. High valuations reflected strong confidence in BitMine’s “ETH-heavy” treasury strategy.

For many traders, it was one more reason to stay bullish on Ethereum itself.

Q4: BitMine Keeps Buying While ETH Starts Slipping

The interesting part? BitMine’s conviction hasn’t faded at all — but the market’s reaction kind of has.

In Q4 alone, BMNR has already executed nine more ETH transactions, bringing its treasury to roughly 3.7 million ETH. That’s another 900,000 ETH in about three months, a 33% jump in holdings.

During the last bull market, this kind of aggressive accumulation helped ETH rocket to $4,900. This time, it’s different.

Despite the buying, Ethereum is down about 26% on the quarter, underperforming even Bitcoin, which is down around 21% over the same period.

A chart shared on X highlights the shift clearly. BitMine now sits on an $11 billion ETH stake, yet their ETH-heavy portfolio is down 3.85% at current prices near $3,068.

Big money is still buying. The market, though, feels hesitant.

DAT Sentiment Divergence Puts Ethereum’s Rally at Risk

This brings us to the key question:

Is enthusiasm for DATs (data availability tokens / related narratives) starting to fade?

The divergence is clear:

- BitMine keeps stacking ETH aggressively

- Ethereum’s price keeps sliding

- The broader market isn’t rewarding the behavior the way it did last cycle

If that trend continues, ETH may lose one of its most powerful catalysts — large-scale, high-conviction institutional buyers anchoring the narrative.

Without that driver, a repeat of Q3’s +66% rally becomes much less likely. And if sentiment around ETH and DATs weakens further, even the $3,000 level could come under pressure.

The fundamentals haven’t changed overnight… but the way the market is reacting to them clearly has.