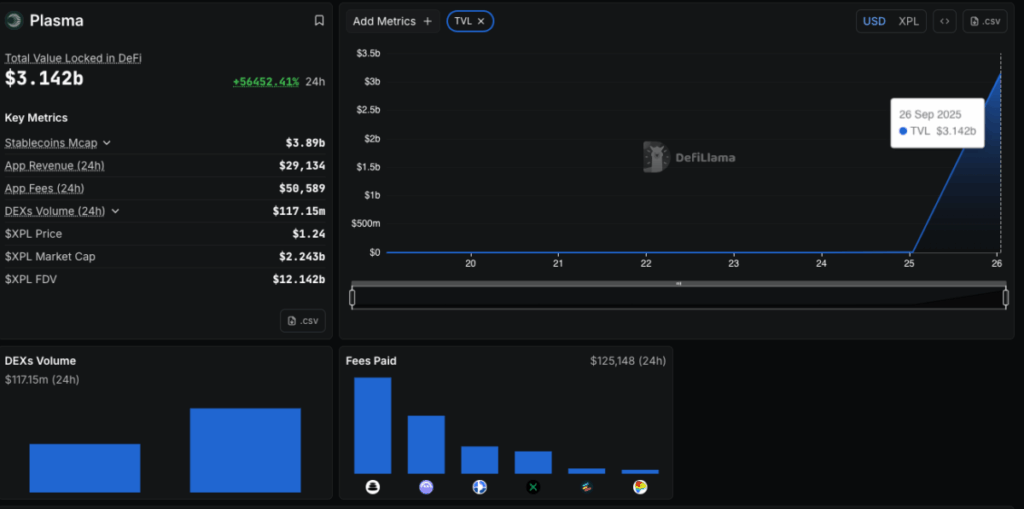

- Plasma’s explosive debut pulled in $3.14B TVL in 24 hours, instantly ranking it the 8th-largest blockchain and pushing XPL up 35% to $1.43.

- Bybit fueled adoption with zero-fee USDT transfers, a 9M XPL rewards campaign, 100% APR staking offers, and a $100K USDT lucky draw.

- Sustainability remains in question, but with Bitfinex backing and early traction, Plasma could cement itself as a major Layer 1 if momentum holds.

Plasma, the new Bitfinex-backed Layer 1 blockchain, wasted no time making noise. Within just 24 hours of going live on Sept. 25, it pulled in over $3.14 billion in total value locked (TVL). That’s enough to immediately rank it as the eighth-largest blockchain by deposits, a feat that stunned the market and sent its native XPL token pumping 35% to $1.43 at peak. On day one alone, Plasma saw more than $117 million in on-chain transactions, generating $125,000 in fees.

Why the Hype Around Plasma?

Plasma positions itself as a fast, low-cost settlement layer designed to supercharge Tether’s USDT transfers, putting it in direct competition with Circle’s Arc chain and Stripe’s Tempo. Backed by Bitfinex, the project had strong launch partners in its corner—Binance listings and Backpack wallet integration added legitimacy right out the gate. But the big adoption wave came from Bybit, which confirmed Plasma-based USDT deposits and withdrawals would carry zero transfer fees, giving traders a strong reason to move liquidity quickly.

XPL Token Rallies With Bybit Push

XPL’s launch was timed perfectly with Bybit’s massive “XPL Tokensplash” campaign, which earmarks 9 million tokens for rewards. New users can earn up to 300 XPL just by participating, while existing traders qualify for bigger prize pools through deposits and staking. Add in staking yields up to 100% APR for early adopters, plus a $100,000 USDT lucky draw for depositors, and it’s clear why FOMO kicked in. With more than $5 billion in daily trading volume and a market cap peaking at $2.5 billion, Plasma’s debut has been one of the most aggressive Layer 1 launches of 2025.

What Comes Next?

Despite the hype, questions remain about whether Plasma can sustain its pace. Incentives and fee waivers are powerful, but maintaining liquidity and long-term activity will require more than short-term campaigns. Still, with institutional-grade backing and strong early traction, Plasma has carved out a spot as one of the most talked-about new chains of the year. If adoption sticks, that early $3.14 billion TVL might just be the beginning.