- Crypto liquidations hit $372 million in 24 hours, with Bitcoin dipping to $92,700 before rebounding to $94,400.

- Long positions bore the brunt, accounting for $194 million, with Binance leading liquidations at $31.52 million.

- Ethereum saw $54.93 million in liquidations, highlighting high leverage and ongoing market volatility.

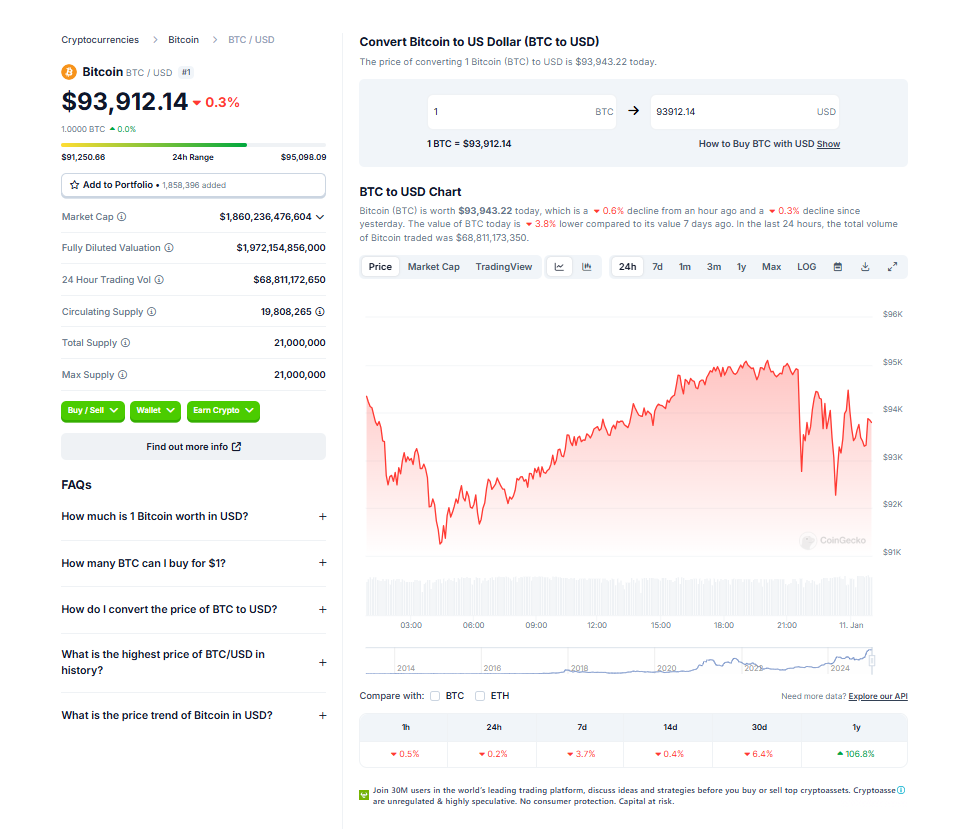

Crypto markets have been anything but stable over the past 24 hours, with liquidations surging to $372 million as Bitcoin dipped briefly to $92,700, according to Coinglass data. The chaos left over 121,000 traders liquidated, a stark reminder of the market’s unpredictability.

Longs Take a Hit: $194 Million Wiped Out

Long positions were hit the hardest, contributing $194 million—around 60% of total liquidations. Shorts weren’t spared entirely, though, accounting for another $120 million as traders struggled to predict Bitcoin’s rollercoaster movements.

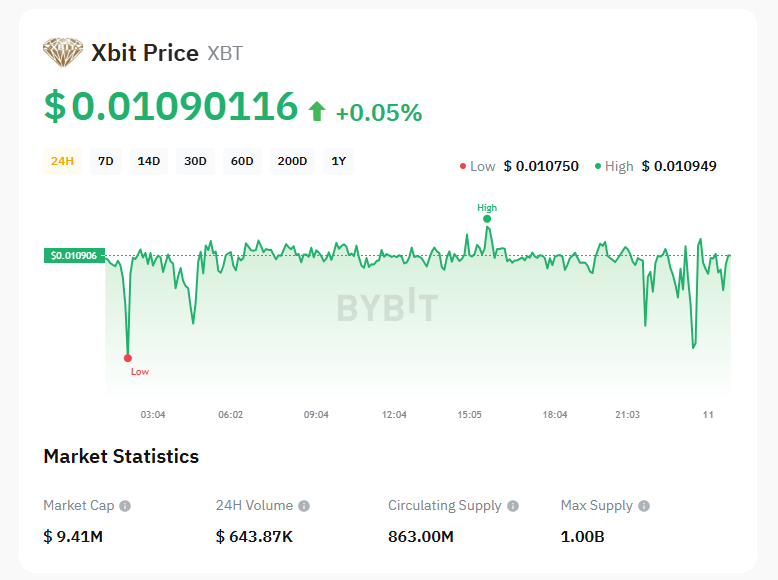

The largest single liquidation happened on BitMEX, involving a $5.5 million XBTUSD position, further emphasizing the heightened volatility gripping the market.

Exchange Breakdown: Binance Leads the Liquidation Wave

Binance saw the most action, clearing $31.52 million in liquidations, with a staggering 81.04% of those tied to long positions. OKX followed with $15.75 million, maintaining a similar liquidation pattern at 79.75% longs. Bybit wasn’t far behind, recording $13.64 million, with 78.5% of liquidations coming from longs as well.

This pattern reflects traders’ optimism turned sour, as Bitcoin’s price danced unpredictably within a tight range.

Bitcoin’s Wild Ride: Flash Crashes and Quick Recoveries

Bitcoin’s price movements in early January have been volatile, to say the least. After peaking at $102,000 on Jan. 6, it retraced on Jan. 7, only to open positively on Jan. 10 with a 4% gain, hitting $95,000. However, a sudden flash crash dragged it down to $92,700, before it quickly rebounded to $94,400 at press time.

This whipsaw action has left traders scrambling to position for Bitcoin’s next directional move, as the cryptocurrency trades in a range following its December all-time highs.

Altcoin Liquidations Add to the Turmoil

It wasn’t just Bitcoin feeling the pressure—altcoin markets saw their share of liquidations too. Ethereum positions accounted for $54.93 million in liquidations, underscoring the leveraged nature of the market. These elevated numbers suggest traders are still heavily exposed, setting the stage for continued volatility in the days to come.

Final Thoughts

The crypto market’s recent activity reflects its inherent volatility, with liquidations highlighting the risks of high leverage. As Bitcoin and altcoins navigate choppy waters, traders should brace for more turbulence ahead. Staying cautious and keeping an eye on key price levels will be critical for those looking to survive this unpredictable ride.