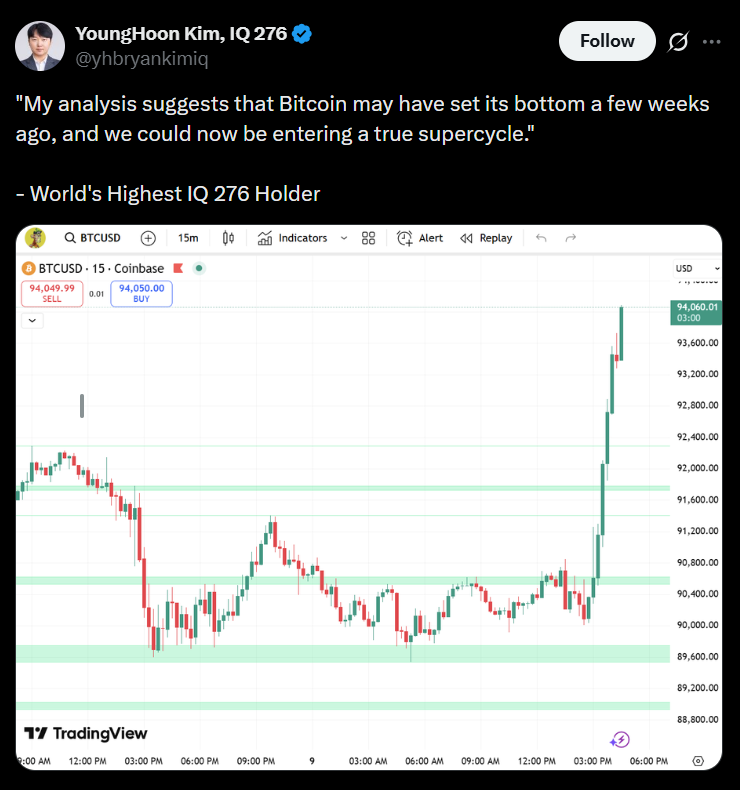

- YoungHoon Kim — who claims a verified IQ of 276 — argues that Bitcoin dropped to its bottom a few weeks ago and that a “true supercycle” may now be beginning.

- Kim’s bullish stance echoes some recent market signals: a rebound off $80-$85K levels, rising miner reserves, and technical setups that hint at recovery.

- Still, many analysts remain cautious. Some point out weak demand, uncertain ETF flows, and macro risks — all factors that could delay or derail further upside.

YoungHoon Kim — who claims an IQ of 276 — has issued one of the boldest calls of the year: Bitcoin has already bottomed, and the next major move will be a surge toward $220,000 within 45 days. Kim recently moved 100% of his assets into Bitcoin, saying BTC will eventually become the world’s ultimate reserve asset. His conviction has captured attention because it aligns with several technical and macro signals now flashing bullish.

Why Kim Says the Bottom Is In

According to Kim, multiple conditions point to a completed bottom: tightening exchange supply, rising institutional accumulation, technical structures resetting, and macro conditions flipping pro-liquidity. After months of aggressive selling pressure, long-term holders are beginning to reassert control of the market. This shift, he argues, historically marks the start of new upward cycles.

Institutional Buying Reawakens

Spot ETF flows have turned positive again, with major issuers absorbing billions in BTC through November and December. Corporate buyers like Strategy have added over 10,600 BTC in just two weeks, while sovereign wealth funds and large investment firms are quietly scaling exposure. This long-term accumulation is draining liquidity from exchanges, reducing sell-side pressure and boosting the likelihood that the market has reached its floor.

Technicals Support the Thesis

BTC has reclaimed key higher-timeframe support levels and printed bullish divergence across several indicators. Analysts tracking historical cycle patterns say Bitcoin often forms powerful reversals shortly after these signals converge. With price now holding strong above critical structure zones, the technical case for a bottom continues to strengthen.