- Bitcoin is under short-term pressure, with Q4 shaping up as one of its weaker quarters amid fear, ETF outflows, and short-term holder capitulation.

- Despite the drawdown, declining volatility and rising institutional adoption suggest Bitcoin is transitioning into a more mature, long-term asset.

- Analysts believe this phase may represent a structural reset, setting the stage for potential new highs in the coming years rather than a breakdown.

Bitcoin looks uneasy right now, and there’s no point pretending otherwise. Price action feels heavy, downside risk is still on the table, and short-term confidence is thin. But beneath the surface, something more interesting is happening. The way the market treats Bitcoin is slowly changing, and that shift may end up mattering far more than the next few red candles on the chart.

Bent, But Far From Broken

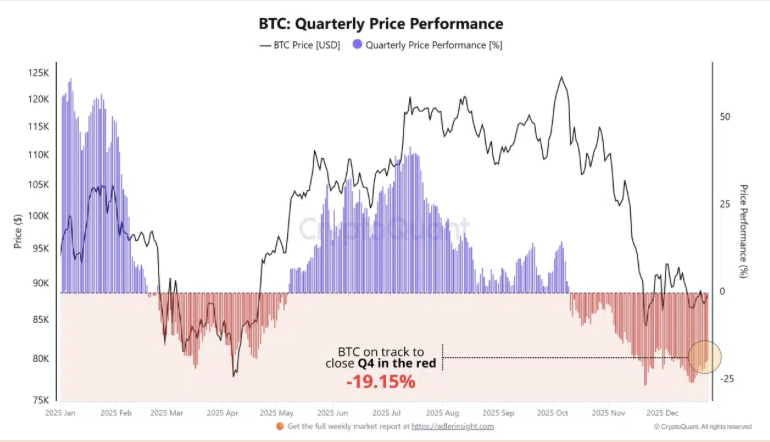

Bitcoin is on pace to close Q4 down roughly 19%, making it one of the weaker quarters we’ve seen in recent years. The on-chain data backs up the pain. Short-term holders are selling at a loss, sentiment has slipped into “extreme fear,” and ETF outflows continue to quietly drain liquidity. It’s the kind of environment where confidence feels fragile and every bounce gets sold.

Indicators like SOPR and MVRV suggest that capitulation isn’t fully done yet. That doesn’t automatically mean a collapse, but it does point to a stretch of grinding price action. Sideways chop, false starts, maybe even another leg lower. Historically, these phases can last a couple of months, long enough to test patience and shake out weak hands.

Still, this doesn’t look like structural failure. It looks more like a market cooling off after excess.

A Different Bitcoin Is Taking Shape

Zoom out a bit, and the longer-term picture starts to change. Bitwise recently suggested that Bitcoin may finally break away from its rigid four-year cycle, with a push toward new highs potentially coming in 2026 rather than following the old script. Their argument is simple but compelling. Halving dynamics, institutional adoption, and steady ETF demand are altering how Bitcoin behaves.

One of the biggest tells is volatility. In 2025 so far, Bitcoin has actually been less volatile than stocks like Nvidia. That’s not something you’d have said a few years ago. It’s starting to act less like a speculative toy and more like a grown-up asset, boring at times, but harder to ignore.

If that trend continues, this current weakness may eventually be remembered not as a breakdown, but as a transition phase. Messy, uncomfortable, and slow, sure, but necessary.

A Sense of Permanence Is Setting In

Long-term value isn’t about daily candles, it’s about position. And Bitcoin’s position today is very different from where it was even five years ago. It now sits comfortably among the top global assets, alongside names like gold, Apple, and Microsoft. That alone says a lot.

Institutions are no longer asking if Bitcoin survives. They’re deciding how much exposure makes sense. That shift brings credibility, liquidity, and staying power. Cycles will still come and go, corrections will still sting, but Bitcoin’s place on the global balance sheet feels increasingly permanent.

A decade from now, the debate likely won’t be about whether Bitcoin makes it. It’ll be about where it ranks.