- Bitcoin continues to face strong resistance near the $90,000 level.

- BTC is consolidating around $87,000–$88,000 amid macro uncertainty.

- A potential rebound toward $90,000 could emerge in early 2026.

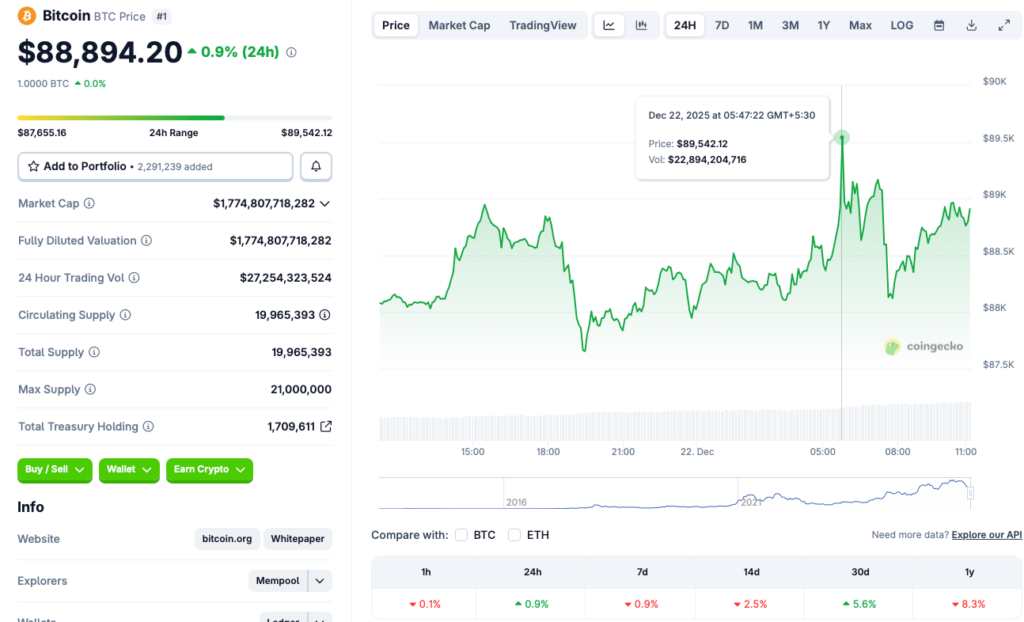

Bitcoin is once again running into stiff resistance near the $90,000 level, a zone that has repeatedly capped upside attempts in recent weeks. Earlier today, Dec. 22, 2025, BTC climbed to around $89,542 before slipping back toward the $88,000 range. According to CoinGecko data, Bitcoin is up 0.9% over the last 24 hours and 5.6% over the past month, but it remains down 0.9% on the week, 2.5% over 14 days, and more than 8% since December 2024.

Consolidation Signals Caution, Not Capitulation

Despite the pullback, Bitcoin appears to be stabilizing between $87,000 and $88,000, suggesting consolidation rather than panic selling. This sideways movement comes after months of pressure following BTC’s all-time high of $126,000 in October. Historically bullish, October delivered the opposite result in 2025, with Bitcoin entering a sustained downtrend that has yet to fully reverse.

Rate Cuts Failed to Spark Momentum

The bearish shift began shortly after the Federal Reserve delivered an interest rate cut in October, typically a supportive signal for risk assets. Markets, however, reacted negatively as investors questioned whether further easing would follow. Even December’s additional rate cut failed to revive momentum across crypto, highlighting how macro uncertainty continues to outweigh monetary tailwinds.

Capital Rotates Into Safe Havens

Investor behavior suggests a defensive stance. Capital has been flowing into traditional safe havens such as gold and silver, both of which recently reached new all-time highs. That rotation signals reduced appetite for volatile assets like cryptocurrencies, helping explain Bitcoin’s muted response to otherwise bullish policy developments.

A Window for a 2026 Breakout

While near-term momentum remains weak, the outlook is not entirely bleak. If macro conditions stabilize and risk appetite returns, Bitcoin could see renewed inflows in early 2026. A decisive push above $90,000 would likely require a broader shift in sentiment, but consolidation at current levels may be laying the groundwork for that next move.