- Bitcoin remains range-bound between $90,000 and $93,000 after rejection at $94,000

- Bitfinex whales are closing longs, a move that has preceded major rallies in the past

- Key breakout levels sit above $94,000, while $88,000 remains critical downside support

Bitcoin’s latest attempt at a bullish continuation lost steam a few days ago after price was firmly rejected near the $94,000 level. Since then, BTC has slipped into a tight range, moving back and forth between roughly $90,000 and $93,000. It’s the kind of price action that usually signals hesitation, a market stuck at a decision point, not quite ready to commit.

At the time of writing, Bitcoin is trading around $90,739, down a mild 0.12% on the day. On the surface, nothing dramatic is happening. But beneath that calm, futures market behavior, especially from whales, is starting to shift in a way traders don’t usually ignore.

Bitfinex Whales Are Quietly Closing Longs

Activity in the Bitcoin futures market has picked up over the past few sessions. According to CoinGlass data, there are currently more 2x long positions than shorts, which suggests traders are still leaning bullish overall. Sentiment hasn’t collapsed, at least not yet.

That said, a notable change is underway. Large Bitcoin holders on Bitfinex have begun reducing exposure by closing long positions, a move that’s often seen during late-stage consolidations rather than outright selloffs. After nearly a year of steadily declining leverage, whales are now exiting positions at a noticeably faster pace.

Historically, this behavior has mattered. The last time Bitfinex whales aggressively closed longs, Bitcoin went on to rally roughly 50% in just over 40 days, eventually pushing into a new all-time high near $112,000. That move followed a cascade of short liquidations, catching much of the market off guard. If history even partially repeats, BTC could be setting up for another sizable leg higher, potentially erasing losses seen since October 2025.

Liquidity Favors a Short Squeeze, For Now

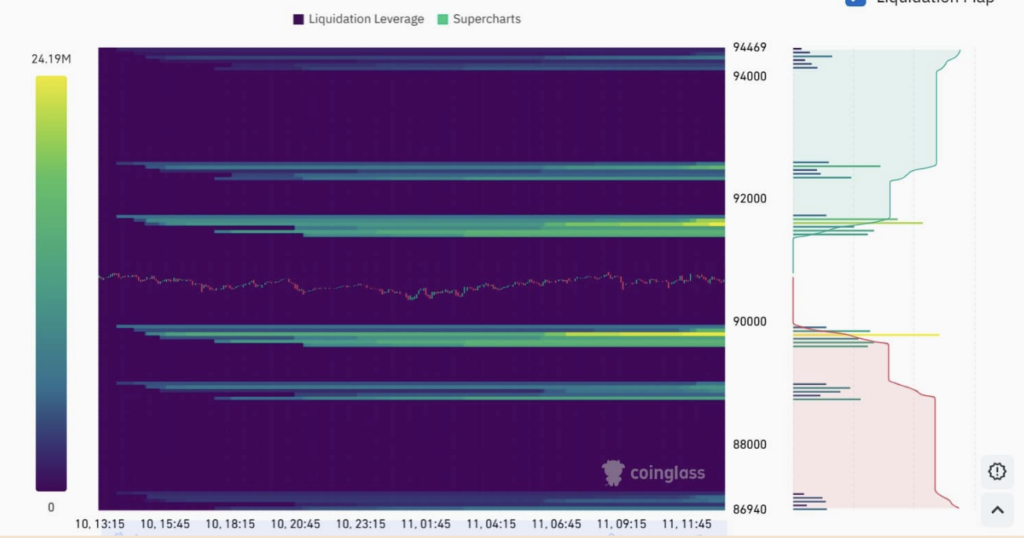

Bitcoin’s current price sits between two major liquidation zones, according to Coinglass heatmap data. On the upside, clusters of short liquidations are stacked between $91,800 and $92,200, with another band near $93,800 to $94,200. A clean break into those areas could force shorts to close rapidly, triggering a classic short squeeze.

On the downside, long liquidation zones are concentrated around $89,000 and $88,000. A drop below either of those levels could quickly increase selling pressure, especially if leverage starts unwinding all at once.

Despite this balance, overall liquidity remains skewed toward shorts. Data from Cryptopulse shows that while there are notable long positions near $88,000, short sellers still hold the upper hand. Bitcoin’s Long/Short Ratio has remained below 1 for five straight days, hovering around 0.9 at press time. When this ratio stays depressed, it usually means traders are leaning bearish and actively betting against price continuation.

Momentum Weakens as the Standoff Continues

From a momentum standpoint, Bitcoin is showing signs of fatigue. The Relative Strength Index has slipped from 65 down to around 52, marking a bearish crossover. That move reflects weakening demand, though it doesn’t yet confirm that sellers are fully in control.

These conditions point to a tug-of-war rather than a breakdown. If the current balance holds, Bitcoin could remain stuck in a sideways grind for longer than many expect, frustrating both bulls and bears.

Still, resolution tends to arrive suddenly. If buyers regain control and push BTC above $94,000, short liquidations could fuel a sharp upside move. On the flip side, failure to defend the $90,000 support could send Bitcoin toward $88,000, where long liquidations may amplify downside pressure.

For now, Bitcoin is calm on the surface, but positioned for volatility underneath. One side will eventually blink.