- Bitcoin fell below $92K, triggering nearly $500M in liquidations.

- Long positions made up the majority of losses, pointing to a leverage flush.

- The pullback appears corrective, not structural, with majors holding key levels.

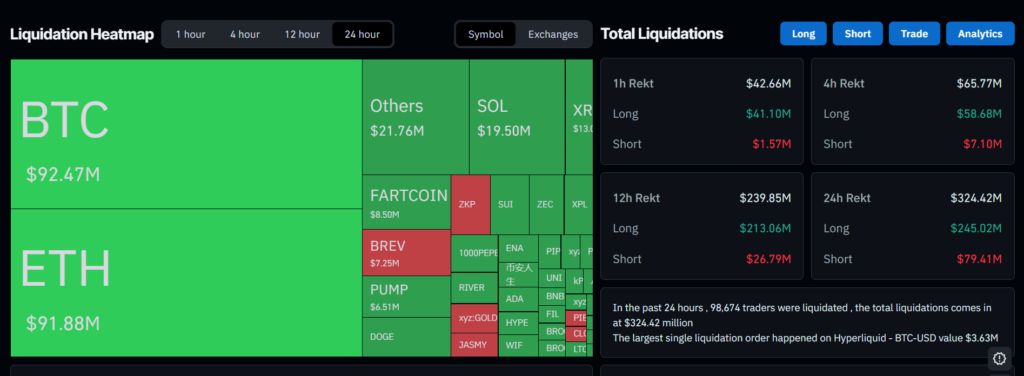

Bitcoin dipped below the $92,000 level early Wednesday, triggering a wave of leveraged liquidations that cleared out overheated positioning. According to CoinGlass data, more than $490 million in crypto positions were wiped out over the past 24 hours, with the bulk of losses coming from long traders caught on the wrong side of the move. The selloff followed a short-lived rally earlier in the week that pushed BTC to a local high near $95,000 before momentum faded.

Leverage Unwind Drove the Move

Long positions accounted for roughly $374 million of the total liquidations, while shorts added another $83 million. That imbalance suggests the move was less about fresh bearish conviction and more about leverage getting flushed as price failed to hold higher levels. Bitcoin and Ethereum led liquidation charts, which is typical during broad risk resets, as large-cap assets tend to carry the most crowded positioning.

Altcoins Followed Bitcoin Lower

As Bitcoin pulled back, major altcoins followed suit. Ethereum slid from a weekly high near $3,300 to around $3,140, while Solana retreated from $143 to $136. XRP saw one of the sharper percentage drops among large-cap tokens, falling from $2.41 to roughly $2.20. Despite the declines, price action remains orderly, with no signs of panic selling or structural breakdown across majors.

Why This Doesn’t Change the Bigger Picture

The broader crypto market is down about 1.5% over the past 24 hours, according to CoinGecko, but the move looks more like a leverage reset than a trend reversal.

Liquidation-driven pullbacks often relieve short-term pressure and create cleaner conditions for continuation, especially when they occur after a failed breakout rather than during sustained weakness. If spot demand holds and selling pressure fades, this flush could end up strengthening the market’s foundation rather than damaging it.