- Bitcoin is showing early bullish signals as institutional flows, sentiment, and derivatives positioning begin to align

- The Coinbase Premium Gap rebound suggests U.S.-based buyers may be returning after year-end selling

- Despite improving indicators, macro uncertainty keeps traders cautious rather than aggressively bullish

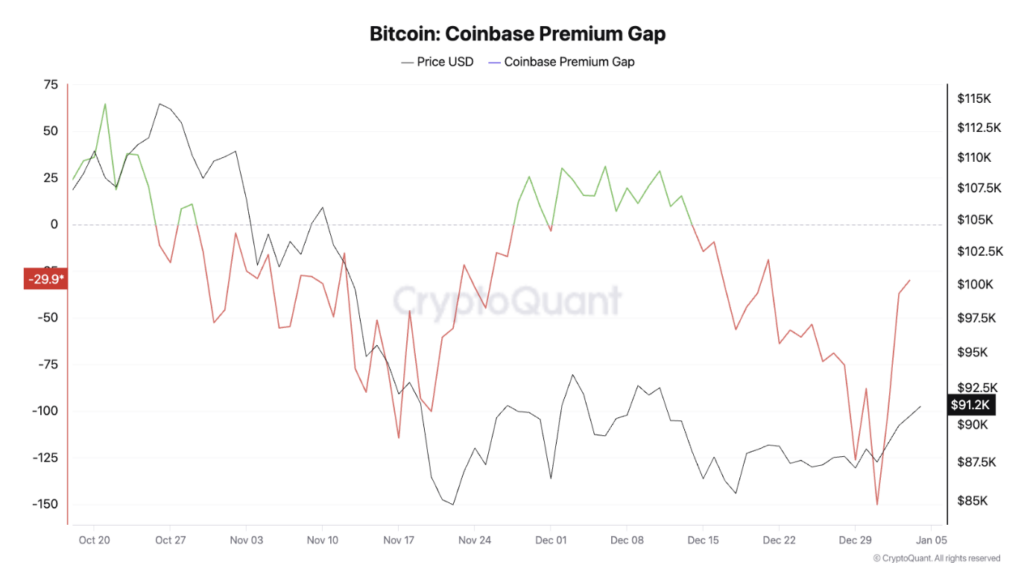

Bitcoin bulls are stepping into the new year with a bit more confidence than they had just weeks ago. Several on-chain indicators are starting to line up in a way that usually grabs attention. The Coinbase Premium Gap is rebounding as institutional flows appear to return, market sentiment is lifting out of fear, and derivatives traders are still leaning long despite a recent cooldown in leverage.

At the time of writing, Bitcoin is trading around $91,700, comfortably above the late-December lows near $87,000. That recovery has helped stabilize sentiment, though analysts remain careful. The macro backdrop is still messy, and nobody seems eager to declare a full-blown bull run just yet.

Institutional Interest Begins to Reappear

One of the more encouraging signs is the recovery in the Coinbase Premium Gap. After plunging to roughly -150 in late December, the metric has steadily climbed back toward the zero line. This matters because Coinbase is widely viewed as the main on-ramp for regulated U.S. capital, especially institutional money.

A narrowing or positive premium typically suggests that American buyers are stepping back in after periods of selling or inactivity. While the metric hasn’t fully flipped positive yet, the direction alone hints that dollar-denominated demand may be rebuilding beneath the surface.

Sentiment Slowly Escapes Extreme Fear

Investor psychology is also shifting, albeit gradually. The Crypto Fear & Greed Index has climbed from around 29 last week to roughly 40 today, moving out of the extreme fear zone that often coincides with market capitulation. It’s not euphoric by any stretch, but it is a clear improvement.

Different platforms show slightly different readings, some closer to the mid-20s, others near 40, but the trend is pointing upward across the board. That consistency matters more than the exact number, especially after a volatile end to the year.

Traders Still Lean Bullish, Carefully

Derivatives data adds another layer to the picture. The Bitcoin long/short ratio has eased off recent highs, but it remains above the critical 1.0 level. In simple terms, more traders are still betting on upside than downside.

What stands out is the way leverage has cooled. Instead of a sharp flush, positioning has unwound gradually, which tends to reduce the risk of sudden liquidation cascades. That kind of reset often creates a healthier base, even if price doesn’t immediately explode higher.

Why Caution Still Makes Sense

Despite these positive signals, the market isn’t out of the woods. The Fear & Greed Index may be improving, but it’s still sitting in fear territory, reflecting lingering uncertainty around Federal Reserve policy. December’s FOMC minutes reminded traders that rate cuts aren’t guaranteed, and expectations continue to shift.

There’s also the question of whether the recent bounce is partly technical. Year-end tax-loss selling may have exaggerated December’s downside, meaning some of the current strength could be repositioning rather than fresh conviction. Many analysts argue that a decisive, sustained move into positive Coinbase Premium territory would be needed to confirm a true trend change.

A Cautious but Constructive Setup

Taken together, the alignment of recovering institutional demand, improving sentiment, and resilient long positioning paints a cautiously optimistic picture for Bitcoin as 2026 begins. Still, fear hasn’t disappeared, and macro risks remain unresolved.

For now, traders appear to be accumulating carefully rather than chasing price. Given the volatility of recent months, that restraint might actually be the most bullish sign of all.