- Bitcoin bounced back above $84K after the NY Fed’s John Williams hinted a rate cut may come in December.

- Rate-cut odds spiked to 70%, up from 39% the day before.

- BTC remains down more than 30% from its high but finally saw relief after intense selling.

Bitcoin finally caught a break on Friday after weeks of heavy selling. The world’s largest cryptocurrency bounced from a morning low just under $81,000 and climbed back above $84,000, helped by a sudden shift in Federal Reserve expectations.

The catalyst came from New York Fed President John Williams, who told the Wall Street Journal there is still “room for a further adjustment” to interest rates in the near term — a clear hint that a December rate cut is back on the table.

Coming from one of the Fed’s most influential voices, the comment instantly jolted markets. BTC spiked within minutes, U.S. stock futures flipped green, and traders quickly shifted their rate expectations.

Rate Cut Odds Surge — And Bitcoin Reacts Fast

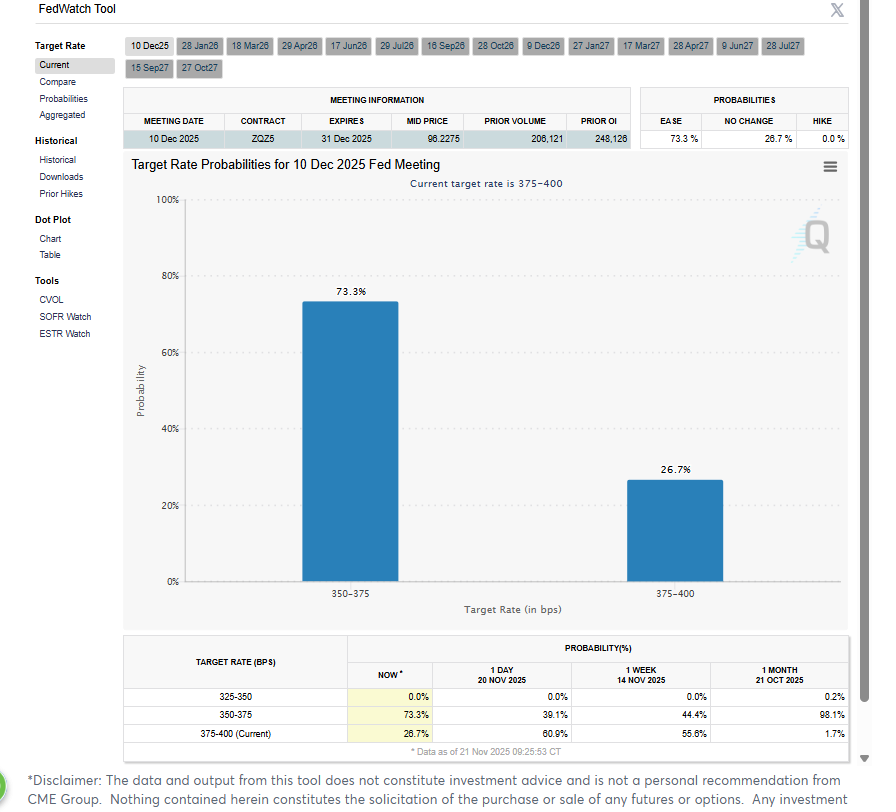

According to the CME FedWatch Tool, the probability of a 25 bps cut in December jumped to 70%, up from just 39% the day before.

That repricing is massive — especially since markets had almost fully priced out any chance of another cut just a few weeks ago.

Williams’ tone stood in sharp contrast to Thursday’s remarks from Cleveland Fed President Beth Hammack, who said markets looked too bubbly and insisted inflation remained the bigger problem.

The difference in messaging created volatility, but Friday’s pivot was enough to give Bitcoin a much-needed bounce.

Why BTC Responded So Violently

For weeks, Bitcoin has been sliding on fears of:

- A hawkish Fed

- Stalling economic data

- ETF outflows

- Liquidity drying up across global markets

A potential rate cut softens that narrative. Lower rates generally weaken the dollar, boost liquidity, and historically favor Bitcoin — especially when sentiment has been as fragile as it’s been this month.

Even after the rebound, BTC is still:

- Down 9.5% in 24 hours

- Down 30% from its October all-time high

- Trading in a deeply emotional, fear-driven market

But this is the first real positive macro catalyst in weeks.