- Bitcoin dips below $116k despite ETF inflows and positive sentiment.

- Analysts highlight $115k as the make-or-break level for near-term direction.

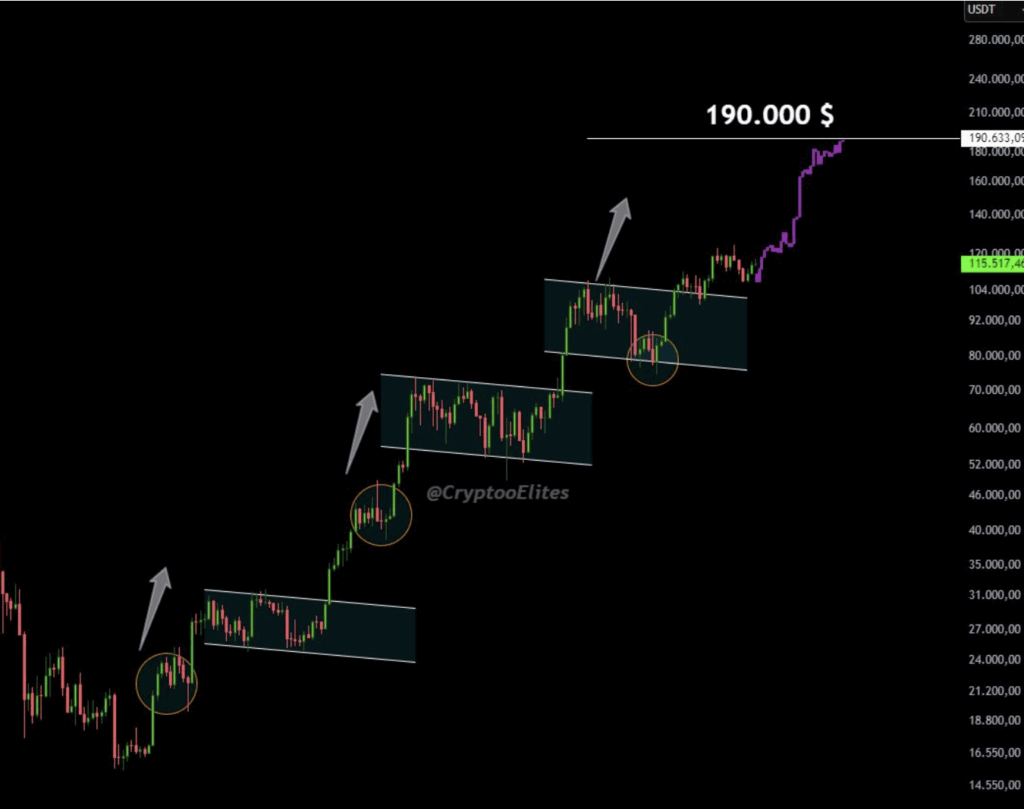

- Predictions range from a rally toward $190k to a slide back under $100k.

Bitcoin (BTC) slipped under $116K after a choppy trading session, losing short-term momentum even as analysts project long-term upside. One bold forecast suggests Bitcoin could eventually rally to $190,000, though key support levels must hold to keep that outlook alive.

Bitcoin Support Levels: Why $115K Is Crucial

BTC has been ranging between $116,495 and $115,141 in the past 24 hours, with futures open interest down 0.6%. Analysts warn that losing the $115K zone could trigger a sharp selloff, sending BTC toward $93K. On the flip side, holding this level could fuel a rebound toward $137K in the near term.

Analyst Prediction: Can Bitcoin Reach $190K?

CryptoELITES sparked debate with a Bitcoin price prediction targeting $190K, citing historical cycles as a guide. While past patterns don’t guarantee future gains, the analysis has caught traders’ attention. Ali Martinez echoed the importance of defending $115,440, saying a successful bounce could send BTC surging.

Macro Events Shaping Bitcoin’s Short-Term Outlook

The Fed’s recent rate cut failed to keep BTC bullish for long, but upcoming catalysts could be more impactful. Investors are watching Jerome Powell’s September 23 speech and U.S. PCE inflation data, expected at 2.7%. A hotter reading may weigh on Bitcoin, while softer inflation could boost risk appetite.

Bitcoin Price Forecast: Volatility Still in Control

Despite bearish pressure, Bitcoin continues to draw strong institutional inflows, with U.S. spot ETFs adding $886M last week. If BTC holds $115K, a run toward $137K—and eventually higher—remains possible. But a break lower could test $90K, showing that volatility still rules Bitcoin’s path forward.