• Bitcoin price retreated from the psychologically important $100,000 milestone as investors booked profits from the token’s post-U.S. election gains

• The CoinDesk 20 index measuring broader crypto market performance fell nearly 6%, while Coinbase and MicroStrategy stocks were each lower by about 3%

• Long-term bitcoin holders have been selling in the spot market, but that sell pressure has been absorbed by inflows into bitcoin ETFs and large purchases by MicroStrategy

Bitcoin’s price retreated further from the $100,000 milestone as investors booked profits from the token’s post-US election gains.

What Happened

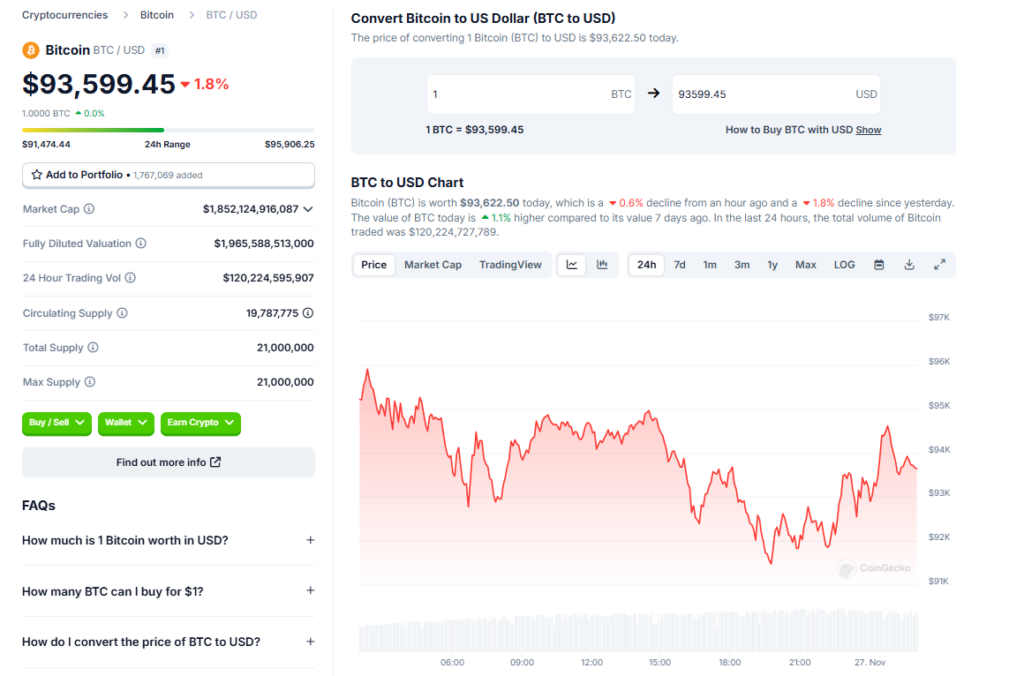

The largest cryptocurrency by market capitalization fell by more than 2% to $92,277.19, according to Coin Metrics. Earlier it fell as low as $91,433.54. The CoinDesk 20, an index measuring broader crypto market performance, fell nearly 6%.

Coinbase and MicroStrategy were each lower by about 3%.

Expert Analysis

Bitcoin has been on a tear since Election Day, with very few pullbacks, but the $100,000 mark remains a formidable psychological barrier, according to Mati Greenspan, founder of Quantum Economics. While breaking through now would be a major bullish signal, a brief pullback may be needed to gather momentum before the next attempt.

With bitcoin regularly hitting new records this month, long-term holders have been selling in the spot market in increasing amounts. That sell pressure has so far been absorbed by inflows in to bitcoin ETFs, which ended a five-day streak Monday and logged $438 million in outflows, and large purchases by MicroStrategy. CryptoQuant typically defines long-term holders as entities that have held bitcoin for 155 days or more.

Looking Ahead

Traders took profits after the bitcoin’s post-election rally, which has been fueled by optimism about President-elect Donald Trump’s pro-crypto policy platform.

Historically when new all-time highs are reached there is typically a period of consolidation before further moves up, according to Brett Reeves of crypto infrastructure firm BitGo. We know that new institutional money is coming into the space and retail activity is picking up both via ETFs and exchanges. With positive macro and regulatory news ahead we could see a quick pick up in price activity.