- Bitcoin is extremely oversold, suggesting a short-term bounce toward 95K–100K.

- December catalysts — rate cuts, QT ending, and global stimulus — support upside momentum.

- JRNY Crypto sees a realistic recovery to 110K–120K, not the extreme 200K predictions.

Bitcoin sliding below 90K has thrown the market into full-blown fear, and crypto analyst Tony from JRNY Crypto says sentiment right now is “FTX-level, COVID-crash level, start-of-bear-market level.” But while fear is extreme, he argues the data isn’t matching the dramatic predictions circulating across social media — including the now-viral claims that Bitcoin will hit $200K in 70 days or $220K in 45 days. Tony called those projections “mathematically absurd,” especially given the liquidity backdrop.

Oversold Data Suggests a Short-Term BTC Rebound

Even with sentiment collapsing, Tony says Bitcoin is now in one of its most oversold positions in history — only the sixth time BTC has hit this zone. Every prior instance produced a sharp bounce. He thinks a recovery into 95K–100K within the next couple of weeks is very possible, even if it turns into nothing more than a temporary relief rally.

“If you’re waiting for an exit, a rebound soon is likely,” he said.

December Macro Catalysts Could Shift Momentum

Tony highlighted several major macro triggers lining up:

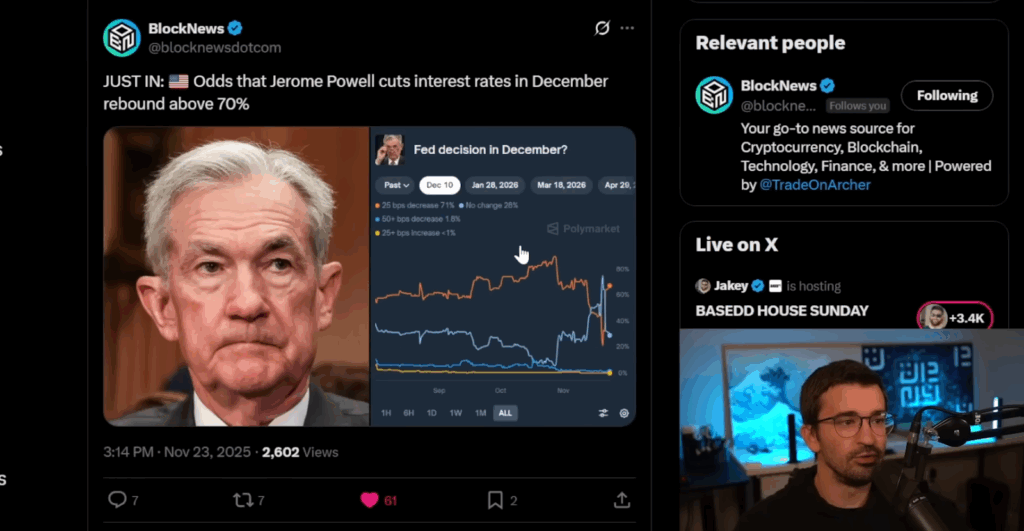

• Rate-cut odds for December, which crashed during the panic, have now rebounded to around 70 percent.

• Quantitative tightening ends on December 1, a significant liquidity tailwind.

• Global stimulus talks are picking up, with the U.S., Japan, and others discussing injections of capital.

He said these factors tilt the short- to mid-term outlook upward, even if the long-term picture still depends on economic stability.

The Market Structure Bill Could Be a Game-Changer

Tony spent time stressing the importance of the upcoming U.S. crypto market structure bill. The proposal could officially classify digital commodities under CFTC oversight. Kevin O’Leary has been vocal about this, saying once the classification is clear, “a trillion dollars will come and index Bitcoin.”

Tony agrees — institutional walls could finally come down, unlocking inflows the industry has been waiting on for years.

Memecoins Ruined Altcoin Season

He noted that the absence of an altcoin season earlier in 2025 wasn’t random. Liquidity was sucked out of the market and into memecoins chasing 1,000x pumps. “People went all-in on hype instead of accumulating serious projects,” he said. If liquidity rotates back into large-cap and utility-based assets, the market structure could shift dramatically.

Kiyosaki’s Warning and the Crash Scenario

Addressing Robert Kiyosaki’s recent “biggest crash in history” warning, Tony acknowledged that if a massive macro crash hits, everything — including Bitcoin — would feel short-term pain. But he said the aftermath is what matters. Once panic clears and governments start printing again, hard assets like BTC, ETH, gold, and silver typically surge.

He also believes governments and institutions quietly accumulated BTC during this downturn.

Conclusion

Tony’s view is straightforward:

Bitcoin fear is extreme, predictions are unrealistic, and the truth lies in the middle. BTC looks oversold, strong catalysts are approaching, and regulation may bring unprecedented liquidity. He doesn’t expect a miraculous run to $200K in the next two months, but he does see a realistic path to 110K–120K if December plays out as expected.

In his words, the short- and mid-term outlook is “good — not magical,” and the real breakout begins when regulation, liquidity, and institutions finally sync with the narrative.