- Bitcoin’s MVRV ratio has dropped to 1.2, approaching the undervalued zone

- Historically, MVRV below 1 signals the average holder is underwater

- A bottom is possible, but macro stress could still push BTC lower

According to CryptoQuant data, Bitcoin is nearing what many analysts consider undervalued territory. BTC’s MVRV (Market Value to Realized Value) ratio is currently sitting around 1.2. In simple terms, MVRV compares Bitcoin’s current market value to the average price at which coins last moved onchain. When it drops below 1, it typically means the average holder is holding at a loss, and historically that has lined up with deep bear-market zones.

We aren’t there yet, but we’re close enough that the market is starting to ask the obvious question again: is this the bottom, or just another stop on the way down?

Price Action Still Looks Fragile

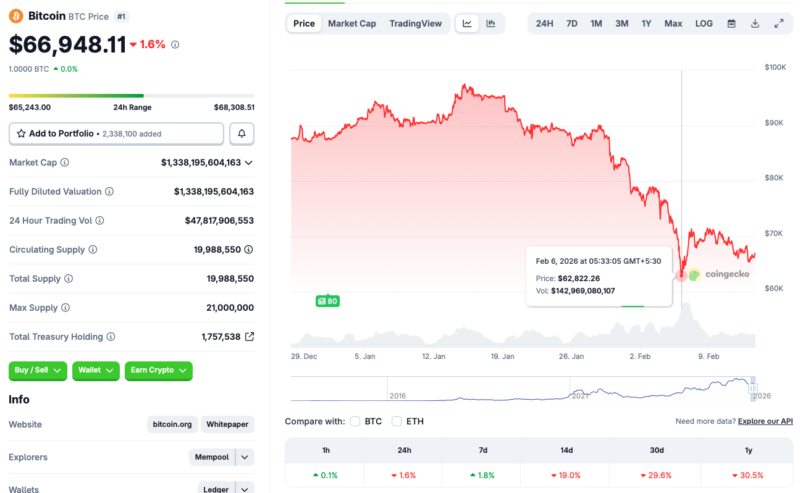

Bitcoin recently dipped to the $62,000 level earlier this month before bouncing back and reclaiming $71,000. But that recovery didn’t hold. BTC faced a rejection and slipped again, showing the market is still struggling to regain momentum. According to CoinGecko, Bitcoin is down roughly 19% over the last 14 days and nearly 30% over the past month, even though it has managed a small gain over the last week.

That’s the messy part about bottoms. They rarely feel clean. They feel like exhaustion mixed with uncertainty, and right now that’s exactly what the chart looks like.

Undervaluation Doesn’t Mean “Up Only”

A lot of traders misunderstand MVRV. It’s not a magic buy signal, it’s more like a temperature check. When MVRV approaches 1, it suggests capitulation may be closer than it was before. But it doesn’t guarantee the market reverses immediately. Bitcoin can sit in undervalued zones for a while, especially if macro conditions stay hostile.

And macro is still the elephant in the room. Liquidity is tight, risk appetite is weak, and even traditional markets have been shaky. If broader markets slip again, BTC can absolutely overshoot to the downside, even if onchain metrics look “cheap.”

The Bear Case Still Exists

Some forecasts remain openly bearish. There are growing calls for Bitcoin to revisit the $50,000 range, and Stifel has floated an even harsher scenario, suggesting BTC could fall as low as $38,000. That may sound extreme, but the market has already shown it’s willing to punish risk assets fast when liquidity disappears.

The key point is this: approaching undervaluation is not the same thing as being immune to another flush.

The Bull Case: A Bottom Could Be Forming

On the other side, CoinCodex analysts still expect Bitcoin to rally from here. Their model projects BTC reaching $88,047 by May 11, 2026, which would represent roughly a 31% upside move from current levels. That kind of rebound would fit the classic pattern where Bitcoin bottoms when sentiment is ugly, positioning is washed out, and most investors stop believing in upside.

That’s why MVRV is getting attention right now. It’s not about calling a perfect bottom, it’s about recognizing when risk-reward starts shifting.

Conclusion

Bitcoin nearing undervalued MVRV levels is a real signal, but it’s not a guarantee that the market has already bottomed. It suggests the selloff is getting mature, and that the average holder is closer to pain levels that historically lead to long-term accumulation. Still, macro uncertainty and liquidity stress can push BTC lower before any real recovery begins.

In other words, a bottom may be forming, but the market still hasn’t proven it yet.