- Bitcoin’s capped supply, neutrality, and evolving infrastructure make it a solid contender for central bank reserves.

- Governments already hold over 463,000 BTC, and ETF access means more institutions can quietly join in.

- If even one central bank goes in, others may follow—turning Bitcoin from speculative asset to digital reserve money.

For a long time, gold’s been the go-to comfort blanket for central banks. Solid, shiny, and easy to stash in a vault. But things are changing. Fast. The financial world is going digital, and now? An internet-born asset is quietly making a move to join the big leagues: Bitcoin.

Sounds far-fetched? Maybe. But the pieces are starting to fall into place. If things keep heading the way they are, I wouldn’t be shocked if, within the next decade, a few central banks actually hold Bitcoin on their balance sheets—for real, long-term. Like they do with gold and Treasuries. Here’s why that’s not as crazy as it sounds.

Bitcoin Checks the Scarcity Box—Hard

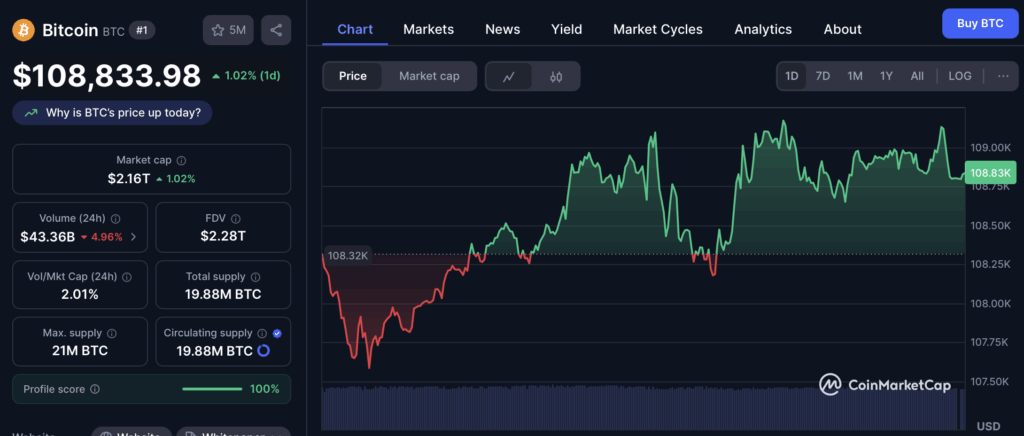

Let’s start with the basics. If something’s gonna be a reserve asset, it better be scarce—and reliably so. Bitcoin’s got that in spades. There will never be more than 21 million coins. Full stop. And as of right now? About 93% of those are already out there in circulation. So yeah, the future dilution risk is basically… none.

And sure, you gotta mine Bitcoin (just like gold), but unlike gold, there’s no “hey we just discovered a new deposit” moment. That supply cap? Rock solid. Plus, every four years the Bitcoin reward gets cut in half—the halving thing—which means its inflation rate is always getting squeezed down. Central bankers are likely nodding slowly at that one.

Oh, and guess who’s been quietly stacking? Governments. Collectively, they’re sitting on around 463,000 BTC—2.3% of all mined coins. Most of that came from seizures, and they’re not rushing to auction them off. Throw in ETFs and companies holding BTC in their treasuries, and that “floating supply” just keeps shrinking.

It’s Not Just About Scarcity—Neutrality Matters

Here’s where Bitcoin really separates from the pack: it doesn’t care who you are. No borders. No politics. No freezing your funds if the wrong person gets elected. For countries managing volatile currencies—or watching their access to global finance get weaponized—that kind of neutrality is gold… but better.

Yeah, gold is neutral too, but moving physical bars across borders? That’s expensive and painfully slow. Bitcoin settles in minutes, costs a fraction, and isn’t stuck in some vault in another country. For policymakers, that’s gonna be hard to ignore much longer.

Infrastructure’s Finally Catching Up

A reserve asset can’t just be rare—it’s gotta be easy to hold and audit too. Until recently, that was a big sticking point for Bitcoin. Not anymore. The SEC just flipped its stance earlier this year, letting Wall Street banks custody digital assets without capital penalties. That’s a huge unlock.

And with ETFs rolling out, central banks that can’t touch crypto exchanges can still get exposure. They can just buy BTC ETFs like they would a gold ETF—simple, familiar, regulated. It opens the door without needing to rethink their entire investment structure.

Even more telling? The Czech National Bank openly said it’s studying a multi-billion-dollar Bitcoin allocation. That’s the first Western central bank to say that out loud. Others, like Switzerland’s, have shrugged it off. But if even one mid-tier central bank makes a move, it might force everyone else to at least pay attention.

This Might Be the Beginning of the Shift

Look, Bitcoin’s still volatile. There’s always the risk of governments coordinating to squeeze it. But… there’s a lot more liquidity now. More sovereign interest. And assuming regulators don’t slam the brakes, this thing’s moving from “outsider money” to legit asset class.

And here’s the kicker for investors: once Bitcoin gets into central bank portfolios, that demand is sticky. Like, decades-long sticky. Central banks don’t flip assets like retail traders do. That means more locked-up supply… and less available BTC on the open market.

So if you’re looking way ahead? That kind of permanent demand could seriously tighten things up. Fewer coins floating around, more people wanting in—and well, you can probably guess what happens next.