- Davinci Jeremie dismisses Shiba Inu’s $1 target as impossible, noting it would require a $600 trillion market cap—far beyond global financial benchmarks.

- Analysts argue SHIB’s massive supply is the biggest obstacle, with only extreme burns offering a theoretical path, though execution is unrealistic.

- Despite this, Jeremie believes Shiba Inu can still rise in value, but investors should focus on realistic milestones like $0.01 instead of $1 dreams.

Shiba Inu’s community has long clung to the idea of the token one day reaching a $1 price point, but veteran Bitcoin advocate Davinci Jeremie isn’t buying into the hype. In a recent statement, Jeremie bluntly dismissed the target as impossible, arguing that such a move would catapult SHIB’s market capitalization into the $600 trillion range. To put that into perspective, the entire global stock market is valued at roughly $128 trillion, while gold and Bitcoin together don’t come anywhere near that number. His comments poured cold water on a narrative that keeps resurfacing whenever speculative sentiment in the market begins heating up.

The Debate Around Shiba Inu’s Future Price

Despite the harsh dismissal from Jeremie, Shiba Inu supporters continue to hold on to ambitious forecasts. Some argue that while $1 seems unrealistic under current conditions, smaller milestones like $0.01 could open the door for renewed optimism. A community analyst, Lucie, even cited an AI-driven projection that claimed such targets might not be impossible if adoption grows and if the next crypto bull run sparks enough demand. Still, experts warn that these discussions often distract from the practical barriers facing SHIB—mainly its overwhelming token supply. Without massive changes, the market simply cannot sustain a valuation of that magnitude.

Why Jeremie Stays Skeptical

Jeremie’s skepticism isn’t just opinion; it’s rooted in math. At $1 per token, Shiba Inu would be valued at nearly five times the worth of the global stock market and more than 150 times the total crypto market cap, currently estimated at around $3.8 trillion. Even with optimistic projections, that gap is nearly impossible to bridge. Other analysts echo Jeremie’s view, with TradeCityPro and others pointing out that SHIB would surpass Bitcoin and even gold in valuation—something most see as highly unlikely. For them, these comparisons aren’t meant to dismiss the project entirely but to keep investor expectations grounded in financial reality.

Could Supply Burns Be the Key?

One of the few scenarios where Shiba Inu could inch closer to extreme price levels is through aggressive supply burning. Reports suggest that if 99.91% of SHIB’s total supply were destroyed, the token could, in theory, reach $1 with a market cap around $500 billion. But let’s be honest—burning nearly the entire supply isn’t realistic. Token burns do happen, but coordinating an effort of this scale is far beyond what the community or developers are capable of right now. While supply reductions could boost price performance over time, expecting them to carry SHIB all the way to $1 feels more like fantasy than strategy.

A More Realistic Outlook

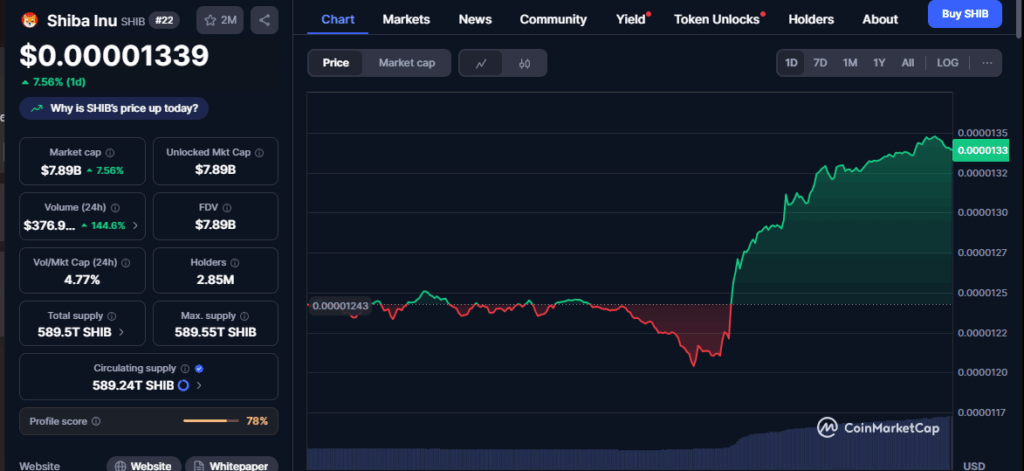

Even with these limitations, Jeremie made it clear that Shiba Inu isn’t doomed. He believes the token could still enjoy strong price appreciation, just not to the levels some in the community keep pushing. At today’s price of around $0.00001240, SHIB would need to skyrocket by over 8 million percent to hit $1. That’s a climb no serious analyst sees happening under current market dynamics. Instead, most believe focusing on steady growth, ecosystem expansion, and smaller achievable milestones will be the more sustainable path forward for SHIB’s future.