- Bitcoin is hovering in a range with very little historical price memory

- The $70K–$80K zone lacks strong ownership and structural support

- Thin supply makes the range unstable, not reassuring

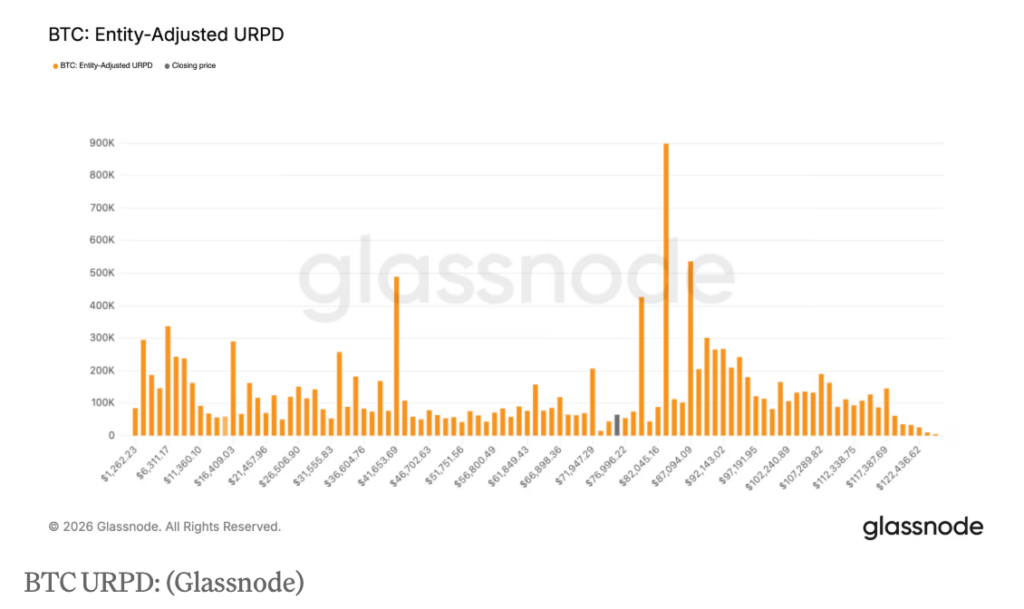

Bitcoin spending several consecutive days between $70,000 and $79,999 might look calm at first glance, but structurally, it’s anything but. This is one of the thinnest zones on Bitcoin’s long-term chart. Historically, BTC has spent only about 35 total days trading in this range, which means there’s very little price memory built here.

Price memory comes from time and repetition, not headlines. When Bitcoin trades in a zone long enough, positions stack up and friction forms. That friction creates support. This range doesn’t really have that yet, which makes the current pause feel more fragile than stable.

Thin Supply Cuts Both Ways

Data suggests there’s a real lack of established ownership between $70,000 and $80,000. Outside of one notable purchase by Strategy back in November 2024, there’s little evidence of large players building sustained exposure in this band. Trading activity here has been light, and that absence matters.

When Bitcoin enters areas with thin structure like this, outcomes tend to be mechanical rather than emotional. Price either chops sideways long enough for ownership to develop, or it drifts lower into a zone with heavier historical positioning. That’s not inherently bearish. It’s how markets search for balance.

History Favors Speed, Not Stability

This isn’t the first time Bitcoin has moved through this range without much resistance. In March 2024, BTC barely paused near prior highs before rolling over. Later, following the November 2024 election, price cut through this same zone on its way toward six figures with almost no friction at all.

That move wasn’t strength, it was emptiness. Thin zones allow for fast moves in both directions, and they rarely behave like long-term bases without significant time spent building structure.

Time Alone Doesn’t Create Support

Five days can feel like a long stretch after weeks of volatility, but structurally, it’s barely a moment. This range hasn’t earned the right to be called support yet. Until real ownership forms, Bitcoin isn’t consolidating so much as waiting.

Whether it chooses to build here or move on will depend less on sentiment and more on where liquidity and conviction finally show up. For now, patience isn’t the usual resolution in zones like this.