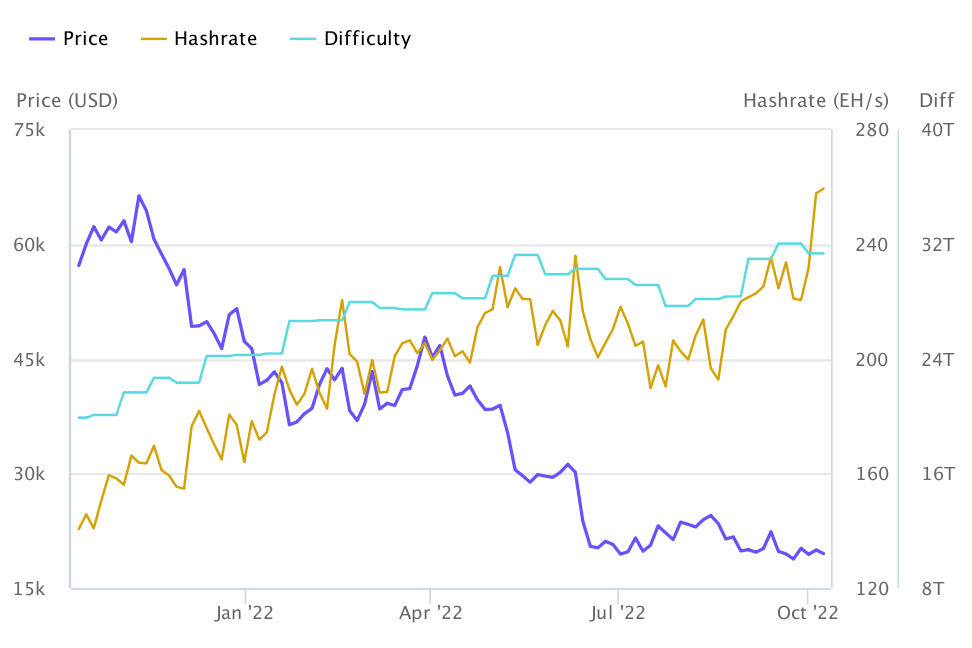

Bitcoin hash rate has hit a new all-time high (ATH), bringing a new wave of implications that industry players must deal with. Data by Braiins, a Bitcoin mining company, shows that the Bitcoin hash rate hit a new high of 259 exahash per second (EH/s) on October 8, while the BTC token price rallied south over 71% from its November 10 peak.

According to market analysts, the network’s soaring hash rate and difficulty uptick continue to weigh down on investors’ profit margins. The hash rate indicates the overall security of the Bitcoin network.

The data accessible from the Braiin Insights website also revealed as

mining difficulty increased, miner profitability rallied in the opposite direction to hit the lowest record ever. According to the analysis, miners are at the point of acute income distress as the BTC price teeters within a low range of $19,515 while the estimated network-wide production cost hits $12,140.

Hash rate is a critical security metric that BTC miners watch and refers to the number of hashes produced per second. The more hashing (computer power) the network churns out, the greater the overall security of Bitcoin, making the web more resistant to attacks.

It is imperative to note that a 51% attack, for example, is when a single individual or group of attackers purchases or rents enough mining equipment to control over 50% of a blockchain’s hash rate. Therefore, a fall in hash rate means a reduction in the cost to perform a 51% attack, making the network more vulnerable.

Following the Bitcoin block reward announcement, many miners continue to go online to solve valid blocks for rewards. The reward is currently at 6.25 BTC, equivalent to approximately $122,000 at press time. Note that every 10 minutes, a new block is solved and added to the Bitcoin blockchain.

The Crypto Winter Leaves Miners In The Cold

A Bitcoin maximalist going by the Twitter name BTCGandalf from Braiins Insights opines that the current macroeconomic environment is not so good for Bitcoin miners. He says:

“Bitcoin continues to trade in this tight band between $19,000–$20,000, and this recent increase in hash rate will result in a sharp upward adjustment in mining difficulty meaning that miner margins will be further squeezed.”

However, marketing professionals observe that the hash rate hitting another all-time high shows miners are bullish about Bitcoin’s prospects.

The situation has also attracted the interest of mining engineers and crypto enthusiasts, who also opined about the hash rate hitting ATHs while the BTC price remains low. Rob W, a worker from the Bitcoin mining company Upstream Data posted a GIF on Twitter with the caption, “I’m proud of all my mining friends, and things are going great.”

Other market analysts like Zack Voell attributed the rising hash rate to “S19 XP coming online” and shared Rob W’s sentiments. “S19 XP” is the most recent model from Bitmain, a global leader in Bitcoin mining hardware supplies.

Based on the surging hash rate, the difficult adjustment is expected to increase on October 10, determining the rate at which blocks are solved. According to statistics, the fluctuation changes roughly every two weeks.

As it stands, the difficulty adjustment has adopted a steady march upward in 2022, which means that it is increasingly becoming harder to solve blocks. The first time the difficulty adjustment fell was in March 2022.

While Bitcoin price drops below $20,000, the number of miners continues to see value in backing the flagship crypto. as James Check, a Glassnode analyst, says:

“… the fact that the hash rate continues to record new all-time highs indicates that Bitcoin is still alive.”