- Bitcoin surged past $94,900 after Trump confirmed a U.S. Crypto Strategic Reserve including five cryptocurrencies.

- Analysts question the feasibility of Trump’s reserve, citing legal hurdles and limited government funding options.

- Altcoins like XRP, Solana, and Cardano soared after being named in Trump’s crypto plan, with Cardano jumping over 48%.

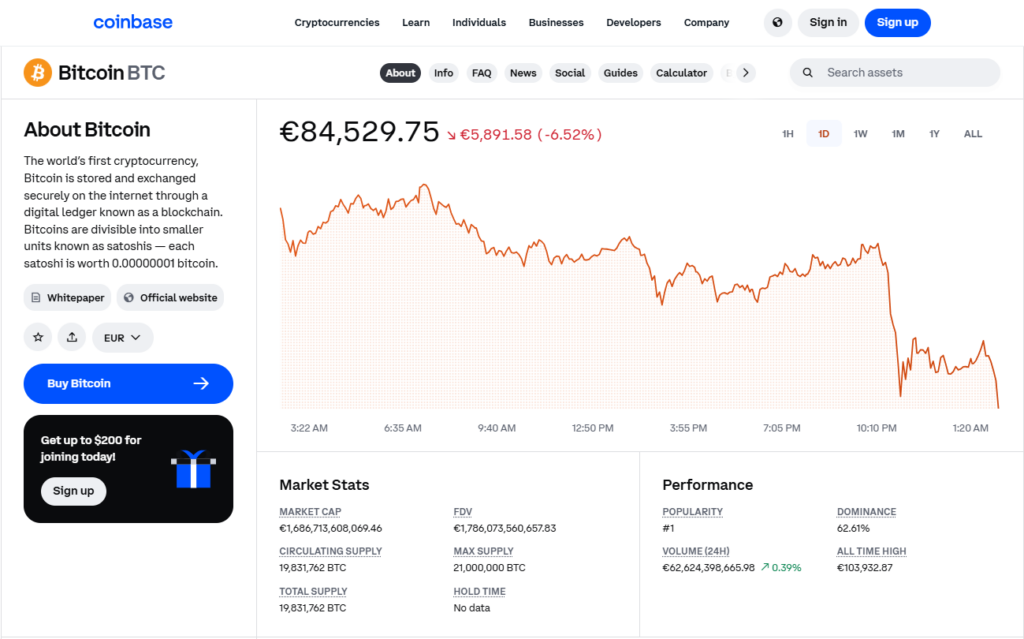

Bitcoin surged on Monday, continuing an overnight rebound after U.S. President Donald Trump listed five cryptocurrencies as part of a planned strategic reserve, giving a much-needed boost to the crypto market.

The world’s biggest cryptocurrency climbed as high as $94,901.96 before retracing some gains, settling at $89,421.0 by 10:02 ET (15:02 GMT). This marks a 15% recovery after Bitcoin briefly plunged below $80,000 on Friday.

Trump Confirms Crypto Reserve, Names Five Coins

On Sunday, Trump reiterated his plan for a U.S. Crypto Strategic Reserve, stating he had directed an executive group to push forward with the initiative. He confirmed that Bitcoin, Ether, XRP, Solana, and Cardano would be included in the reserve.

“A U.S. Crypto Reserve will elevate this critical industry… which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA,” Trump posted on social media, also mentioning Bitcoin and Ether.

While Trump had previously signed an executive order exploring crypto regulation and the formation of a digital asset reserve, the order had left out specific mentions of Bitcoin and provided few details. His latest statement offers clearer insight into the administration’s priorities.

Trump is set to host his first White House crypto conference this Friday, where he’s expected to elaborate on his vision for the industry.

Uncertainty Looms Over Trump’s Crypto Reserve Plan

Despite the excitement in crypto markets, details remain murky regarding how this reserve would function. Analysts have raised concerns about the feasibility of government-backed crypto purchases and the legal complexities surrounding such an initiative.

If Trump attempts to establish the reserve through executive authority, available funds for crypto acquisitions would be limited. Furthermore, any future administration could dismantle the initiative with ease.

For the reserve to function similarly to the Strategic Petroleum Reserve, Trump would need Congressional approval—a challenging task, even with a Republican-majority Congress. Given the party’s ongoing focus on reducing government spending and curbing the fiscal deficit, approving funds for digital asset accumulation might be a hard sell.

“A more viable route might be convincing Congress that Bitcoin is digital gold, making a gold revaluation or reserve reallocation more logical,” noted Bernstein analysts led by Gautam Chhugani. “However, using Fed or Treasury funds to purchase other blockchain assets would be a tougher case to make.”

Bitcoin’s Inclusion Expected, Altcoin Additions Spark Debate

The idea of the U.S. holding Bitcoin as a “digital gold” asset didn’t surprise many analysts, but the inclusion of other cryptocurrencies raised eyebrows.

“Bitcoin as a government reserve asset made sense,” analysts noted. “ETH and SOL are two of the most widely used blockchain networks, supporting industry growth—but their role in a national reserve remains unclear.”

As it stands, the U.S. government already holds around $18.9 billion in cryptocurrency, mostly Bitcoin, a fraction of its $750 billion in gold reserves.

Citi analysts suggested that an official move toward strategic crypto holdings would “enhance the asset class’s legitimacy.” However, they warned that the lack of clear criteria for asset selection could create challenges. Additionally, pre-announcing such investments could disrupt market prices—similar to the UK’s infamous gold sales in the late 1990s.

Altcoins Surge as Trump Mentions Spark Buying Frenzy

Trump’s crypto comments triggered a broader market rally on Monday, especially among altcoins he named.

Ether surged over 4% to $2,288.32, while XRP skyrocketed more than 16%. Solana gained around 12%, while Cardano outperformed, soaring over 48%.

Polygon remained flat, while meme tokens saw mixed action. Dogecoin climbed nearly 8%, while $TRUMP token rebounded roughly 9% from record lows.

Trump’s endorsement lifted sentiment in a market that had been struggling with weak liquidity and worsening risk appetite over the past week. With Bitcoin’s plunge below $90,000, several large holders had already begun cashing out, but Monday’s rebound suggests renewed optimism—at least for now.