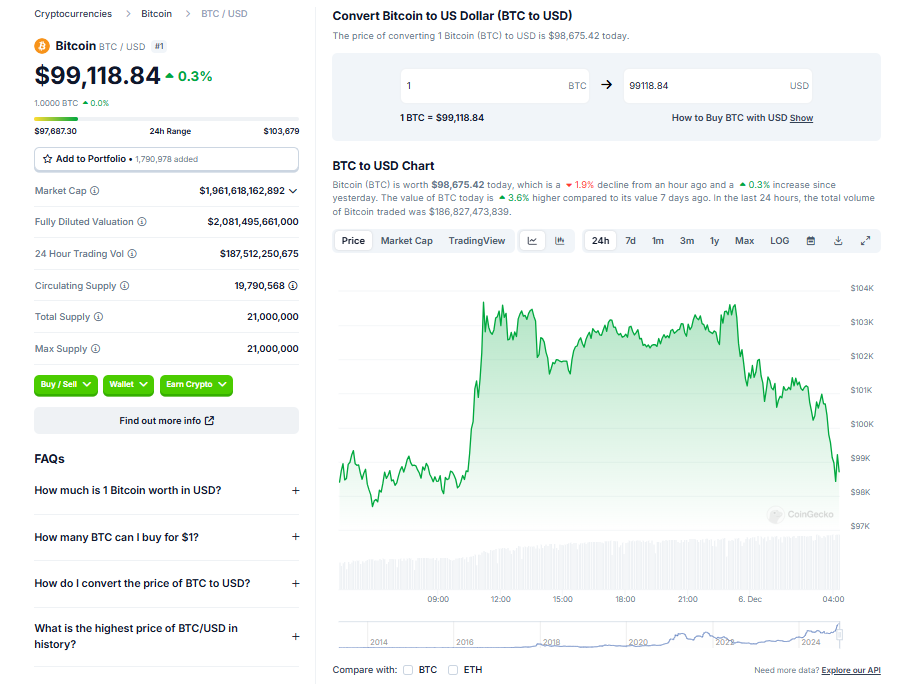

• Bitcoin’s price surpassed $100,000 for the first time ever late Wednesday evening, before pulling back below that milestone on Thursday afternoon

• The rally was aided by President-elect Donald Trump’s announcement of his pick for SEC chair, seen as a crypto-friendly move, and comments from Fed Chair Jerome Powell likening bitcoin to gold

• Bitcoin’s price is now up over 140% in 2024 and 48% since the U.S. presidential election, with hopes for further pro-crypto initiatives from the incoming administration

The world of cryptocurrency witnessed a significant event when Bitcoin, the leading digital currency, surpassed the $100,000 benchmark for the first time. However, it soon fell below this milestone. The rapid progress of Bitcoin to this mark surprised many investors, who had anticipated reaching this level post the U.S. presidential election.

Bitcoin’s Milestone Achievement and Subsequent Fall

Bitcoin, the flagship of the cryptocurrency world, soared past the long-anticipated $100,000 mark for the first time late Wednesday evening. However, by Thursday afternoon, the cryptocurrency had retreated from this milestone. Following some profit-taking by investors, Bitcoin was trading lower by about 0.08% at $98,588.27. Despite the fall, the achievement marks a moment of celebration for long-time Bitcoin investors who have endured the digital currency’s volatile boom-and-bust cycles.

Impact of Political Decisions

The leap and subsequent fall in Bitcoin’s price came in the wake of several political developments. President-elect Donald Trump announced his plans to nominate Paul Atkins as the chair of the Securities and Exchange Commission (SEC). This decision could replace Gary Gensler, whose regulation-by-enforcement approach for the crypto industry has been criticized. Trump’s involvement in the Bitcoin surge was acknowledged in a Truth Social post where he congratulated Bitcoiners and claimed a role in sending Bitcoin to the $100,000 mark.

Bitcoin’s Journey and Industry Reception

Bitcoin’s journey to this milestone has been fraught with dismissiveness and hostility from government and financial institutions, primarily due to its anti-establishment origins. However, in recent years, the value of Bitcoin has been acknowledged by much of the institutional investing world. Major financial services companies including BlackRock, Fidelity, and Invesco launched the first spot Bitcoin ETFs at the beginning of the year. This move, coupled with the increasing demand by institutions, has helped drive the price higher.

Anticipation for Future Developments

There is a widespread expectation for Trump to deliver on several pro-crypto initiatives in the coming year. These include the establishment of a national strategic Bitcoin reserve, no taxes on crypto transactions, and more IPOs in the crypto public equity markets. Mike Novogratz, CEO of Galaxy Digital, said, “With a pro-crypto administration about to take charge in the U.S., it’ll be hard for the rest of the world not to take notice.”

Conclusion

Bitcoin’s journey past the $100,000 mark, although short-lived, signifies a shift in the acceptance and understanding of cryptocurrencies. Its rise of more than 140% in 2024 and 48% post-election, despite its subsequent fall, highlights Bitcoin’s potential in the global financial landscape. As the world watches closely, the future of Bitcoin and the broader cryptocurrency market remains a topic of keen interest and speculation.