- Binance added roughly $100 million worth of BTC to its SAFU reserve

- The exchange is shifting its entire $1B SAFU fund from stablecoins to Bitcoin

- The move reinforces Bitcoin’s role as a long-term crypto reserve asset

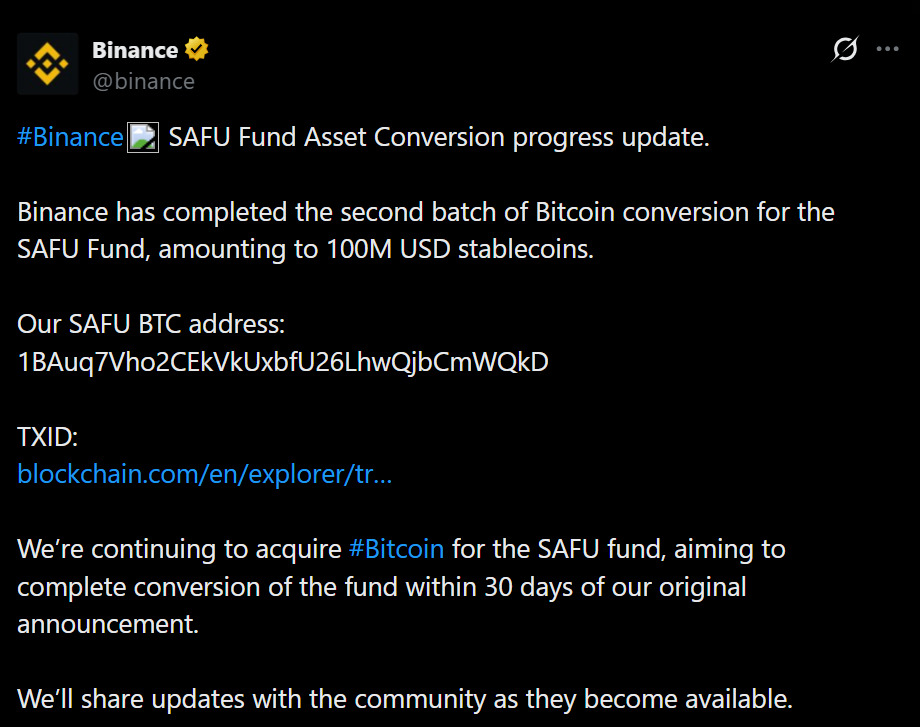

Binance has completed the second phase of its Bitcoin conversion for the Secure Asset Fund for Users, adding another $100 million worth of BTC to the reserve. The exchange confirmed the transaction publicly through its official X account, sharing both the wallet address and transaction ID to allow on-chain verification. That transparency signals this isn’t a symbolic move, it’s an operational one.

This latest conversion follows Binance’s announcement in late January 2026 that it would transition the full $1 billion SAFU fund from stablecoins into Bitcoin within a 30-day window. The plan marked a notable shift in how major crypto platforms think about reserve assets during volatile market conditions.

The First Batch Set the Tone

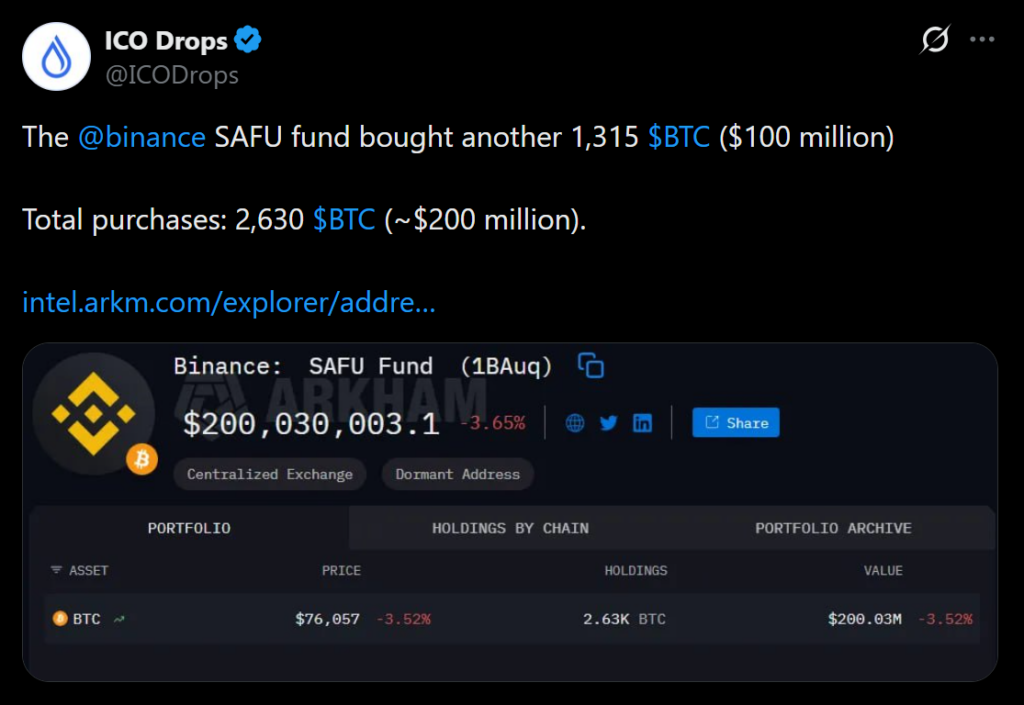

The initial conversion took place on February 2, when Binance transferred approximately 1,315 BTC, valued at around $100 million at the time. That first batch made it clear the exchange was serious about executing the strategy quickly rather than spacing it out indefinitely. The second tranche now reinforces that commitment.

By breaking the conversion into batches, Binance reduces execution risk while still signaling urgency. It also allows the market to observe how a large-scale reserve shift into Bitcoin unfolds in real time, without sudden shocks.

SAFU’s Role Goes Beyond Headlines

SAFU was created in 2018 as an emergency insurance fund, financed by a portion of Binance’s trading fees. Its purpose has always been straightforward: protect users in extreme scenarios. Over time, the fund has evolved into a visible pillar of Binance’s risk management framework.

Importantly, SAFU includes a rebalancing mechanism designed to maintain a minimum value of $800 million, even as Bitcoin prices fluctuate. That structure adds a layer of stability, ensuring the fund remains functional rather than purely directional.

A Broader Signal for Crypto Reserves

Moving SAFU into Bitcoin isn’t just about asset preference, it’s a statement about confidence. Binance is effectively choosing BTC volatility over stablecoin exposure, betting that long-term scarcity and liquidity outweigh short-term price swings. That’s a notable stance for one of the largest players in crypto.

As more institutions rethink reserve strategies, moves like this may shape how Bitcoin is viewed, not just as a speculative asset, but as balance-sheet infrastructure. Whether others follow remains to be seen, but the signal is already loud.