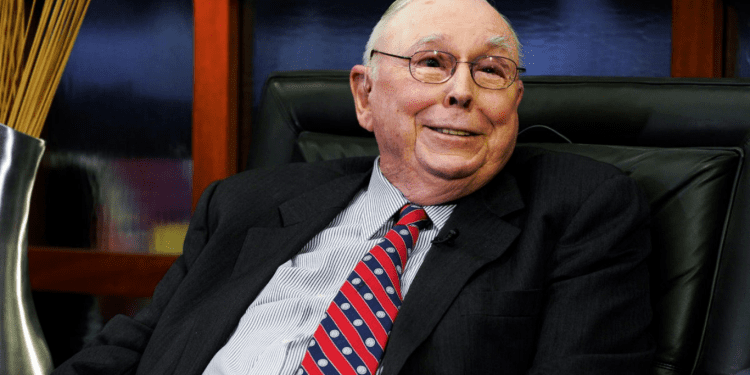

- Charlie Munger, Berkshire Hathaway’s billionaire Vice Chairman, calls for the US to ban Bitcoin and all cryptocurrencies.

- Munger argues that cryptocurrencies fuel criminal activity, are too risky for investment, and goes against the interests of civilization.

- Charlies Munger has a personal net worth of $2.4 billion and has worked closely with Warren Buffett for decades.

Berkshire Hathaway’s Vice Chairman, Charlie Munger, has been one of the most vocal critics of cryptocurrencies, and his recent remarks did not disappoint. In a recent op-ed in the Wall Street Journal, he called for Bitcoin and all crypto to be banned and stated that they were only helpful in illegal activities like extortions, kidnappings, and tax evasion. Munger also praised China for banning cryptocurrencies, saying that they were right to do so.

In the past, Munger has referred to cryptocurrencies as “rat poison” and “contrary to the interests of civilization.” He has argued that digital currencies fuel criminal activity and are too risky for investment. Despite the increasing popularity of cryptocurrencies, Munger’s views have remained the same. He stated that he regards the idea of cryptocurrencies as fundamentally flawed and that he is proud of not investing in them.

Charlie Munger’s Thoughts on US-China Relations

Munger’s views starkly contrast with many tech-savvy investors and financial experts who see cryptocurrencies as the future of money. While leaders in countries like China, Russia, and India have already banned or are considering restrictions on cryptocurrencies, the US is still mulling over a formal adoption and regulation of stablecoins at the federal level.

According to Forbes, Munger has worked closely with Warren Buffett for decades and has a personal net worth of $2.4 billion. Despite his success, Munger remains humble and has a realistic worldview. He praised China and said Americans should not criticize the country, as “they do some things better than we do.” Munger added that it was massively stupid for China and the US to allow existing tensions to arise and that the two countries should like each other.

Charlie Munger’s Views on Inflation

Crypto was only part of what Munger talked about. He also sounded more ominous about inflation, stating that it was a grave subject. He went on to say that you can argue that inflation is the way democracies die. This topic has been on the minds of many economists and financial experts, as rising inflation can lead to a decline in the purchasing power of money and ultimately harm the economy.

Despite the differences in opinion, the fact remains that cryptocurrencies continue growing in popularity and size. The total crypto market has a capitalization of over $1 trillion, with bitcoin accounting for more than $455 billion. The crypto community seems free of older investors not jumping aboard the next wave of modern technology.

Charlie Munger’s views on cryptocurrencies and other topics remain as controversial as ever. Despite the widespread popularity of cryptocurrencies, he remains steadfast in his beliefs and is unapologetic about his stance. His track record of success and long-standing relationship with Warren Buffett gives him a certain level of credibility. Whether or not his views on cryptocurrencies and other topics are correct remains to be seen, but one thing is certain – Munger’s opinions are sure to spark debates and discussions in the financial world.