- Solana (SOL) is nearing a crucial support level at $160, with bearish sentiment intensifying as short positions hit a monthly high and technical indicators flash red.

- Momentum indicators, including the RSI and MACD, signal potential further declines, with a possible drop to the May 6 low of $141.41 if SOL fails to hold above $160.

- Despite the bearish outlook, a recovery to the $184.13 resistance level remains possible if SOL finds support around the $160 mark.

Solana (SOL) is showing early signs of a potential breakdown, with the price slipping to $165.40 as of Monday. It’s inching closer to a key support level that could be the deciding factor for its next big move. Technical indicators are flashing red, and bearish sentiment is ramping up, with short positions hitting their highest point in a month. If SOL fails to hold above its crucial support, the selling pressure could intensify, potentially dragging the token into a significant drop, aiming for the $141 zone.

Solana’s Momentum Indicators Signal Bearish Bias

On May 14, Solana’s price faced a rejection around the $184.13 resistance level, falling nearly 10% by Saturday. A slight rebound occurred the following day as SOL found support near the 200-day EMA, hovering around $162.42. This zone is roughly in line with the $160 daily support level and the ascending trendline drawn from multiple lows since April 7. A breakdown below these levels could spell further trouble for SOL. Currently, the price sits around $165.40, edging closer to a critical support area.

If SOL continues to slide and closes below $160 on the daily chart, it could deepen its losses by 14.6%, revisiting the May 6 low of $141.41.

The Relative Strength Index (RSI) on the daily chart sits at 54, pointing toward its neutral level of 50. If the RSI dips below 50, it could signal increasing bearish momentum, setting the stage for a sharper decline in SOL’s price. Additionally, the MACD indicator is on the verge of a bearish crossover. If that signal confirms, it would further support the case for a potential selloff.

Bearish Sentiment Dominates

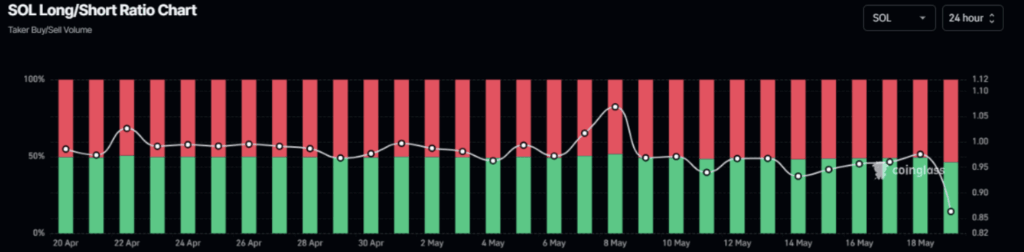

According to Coinglass, the long-to-short ratio for SOL stands at 0.85 — the lowest in over a month. A ratio under one indicates that more traders are betting against Solana, expecting its price to fall further.

However, there’s still a chance for a recovery if SOL manages to find solid support around the $160 mark. If it holds, a rebound could push the price back toward the $184.13 resistance level, setting up a potential reversal.