- The U.S. SEC is reportedly investigating BarnBridge DAO according to a post by the platform’s lawyer Douglas Park.

- There is no reason given as to why the Decentralization Platform is under investigation.

- The lead counsel together with the platform’s founders have said they will not give any further information citing the privacy of the matter.

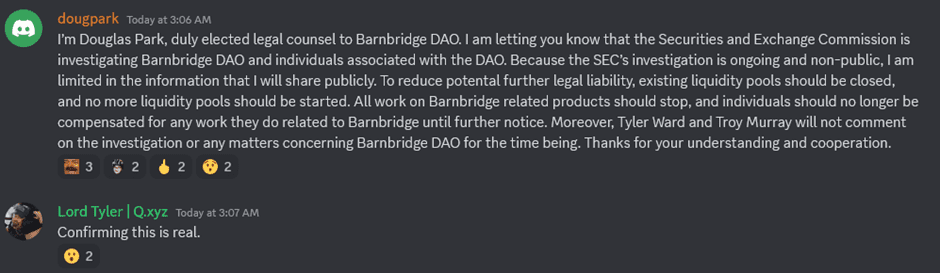

BarnBridge DAO has ceased all operations and closed liquidity pools, as its counsel Douglas Park, notified users that it is under investigation by the U.S. Securities and Exchange Commission.

Douglas Park first mentioned this on the company’s Discord channel stating that in order to reduce potential further legal liability, existing liquidity pools should be closed and no more liquidity pools should be started. The lawyer’s statement was corroborated by Tyler Ward; the co-founder of the platform.

Image Source: Barnbridge Discord channel

The lawyer has not disclosed why the regulator has launched the probe citing what they are referring to as “privacy and non-public”. All the work on BarnBridge-related products will stop and individuals will no longer be compensated.

Founded in 2019 and launched in 2020, BarnBridge allows users to tokenize risks and create tradable tokens linked to market volatility and is an open-source, cross-platform risk management decentralised finance protocol that attempts to tackle inflation risk and interest rate volatility.

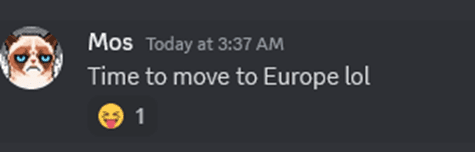

Immediately after the announcements, several users took to the Discord platform with some encouraging BarnBridge while others making mockery and yet others raising a red flag

A user by the name of Mos suggested it was time to move to Europe; maybe to a place where U.S. based regulators will not have jurisdiction.

In the past, Investigations that have been handled by SEC such as Binance and Coinbase have been in the public domain, the reason why BarnBridge’s investigations are not public is still mind-boggling.

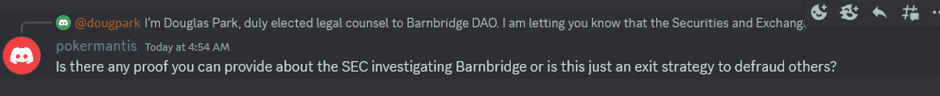

A user by the name pokermantis asked why BarnBridge did not provide any proof about the SEC’s investigations, further wondering whether it was just an exit strategy to defraud others.

Broadening the regulatory push

BarbBridge is a small DAO project, the reason why it is attracting SEC’s attention is not very clear, it could be assumed that the regulator is broadening its legal framework against DeFi and DAOs by sacrificing small players who cannot sustain a long-legal battle in order to create precedents.

Decentralised Autonomous Organizations (DAOs) operate independently of centralised authority and are governed by smart contracts and community consensus. Even though decentralised systems are efficient and innovative, they pose challenges to the regulator because they do not fall under an organized regulatory framework.

The U.S. regulator has been in the news lately for its crackdown on major crypto players. Early in the year, it forced Kraken; a U. S. based crypto trading platform and custodian to discontinue its Crypto program in the U.S. and pay a fine of $30 m USD. In June, Coinbase was charged for the unregistered offer and sale of securities in connection with its staking-as-service program. In the same month, U.S. financial watchdog accused the crypto exchange Binance and its founder Changpeng Zhao of operating a “web of deception,” charging him and the exchange with 13 offences.

Coinbase was charged for the unregistered offer and sale of securities in connection with its staking-as-service program

What does the future hold for BarnBridge?

What does the future hold for the decentralised system? Will they move to Europe as one user suggested? Will they remain put? Will they put up a fight? Only time will tell because the Legal counsel has cited a potential legal liability should they comment on the matter, the investors and the public may have to wait a little longer