- FTX bankruptcy estate is suing Sam Bankman-Fried’s parents to claw back $10 million cash gift and luxury Bahamas property, alleging Joseph Bankman served in improper advisory role.

- Joseph Bankman claims he never officially worked for FTX or had fiduciary duty, making clawbacks legally difficult.

- Bankman parents argue lawsuit lacks evidence they knew of fiduciary breaches, request full dismissal to keep questioned money and property.

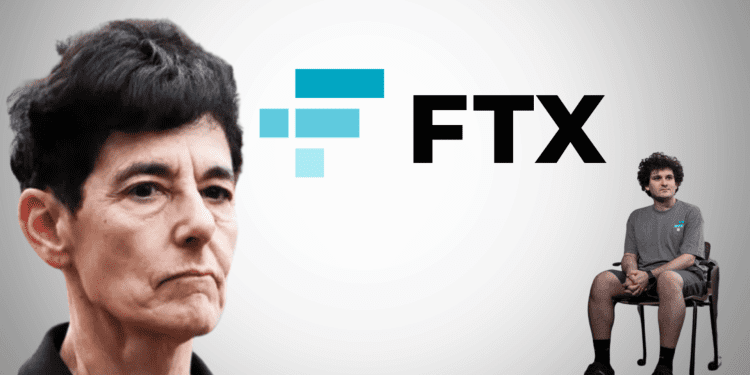

The parents of Sam Bankman-Fried, the disgraced founder of the failed cryptocurrency exchange FTX, are pushing back against a lawsuit seeking to claw back gifts and benefits they received from their son and his companies. Though not officially employed by FTX, Bankman-Fried’s father Joseph served in an advisory role that allegedly went beyond the typical familial interest. Now FTX’s bankruptcy estate wants to recoup a $10 million cash gift to Joseph along with a luxury Bahamas property. But with limited hard evidence of wrongdoing, the case faces major legal hurdles.

Joseph Bankman’s Role at FTX

Officially, Joseph Bankman never received any payments from FTX for his advisory work. As a tenured Stanford law professor, Bankman provided guidance to FTX on a voluntary basis according to records. This could make proving fiduciary duty – required for clawbacks – difficult. Bankman’s lawyers state he “never served as a director, officer or manager” at FTX. While former employees say Bankman was highly involved, hearsay may not suffice in court. Any evidence he was paid by FTX could demonstrate a breach of duty.

The Lawsuit’s Flimsy Basis

In their filing, Bankman and his wife Barbara Fried allege the case lacks evidence they knew of any fiduciary breaches. The gifts they received from their son reflect only a personal connection, which is not actionable. With weak indications Bankman violated obligations to FTX and its investors, the defendants have requested full dismissal of the clawback claims. This would allow them to keep all questioned money and property.

The Road Ahead

SBF’s parents face an uphill battle in defending against allegations of playing an outsized role at FTX. But proving fiduciary breaches as required for clawbacks may prove challenging absent more tangible evidence. As the saga continues, FTX’s bankruptcy estate will likely scour for any smoking gun indicating Bankman improperly benefited from his advisory position. For now, the future of FTX’s lawsuit remains uncertain.