- $120 million drained from Balancer in a multi-chain exploit, with $99.5M stolen on Ethereum alone.

- Attackers looted assets including stETH, rETH, and Balancer V2 tokens, moving funds into a wallet labeled Balancer Exploiter 2.

- Balancer confirmed the breach and urged users to avoid phishing links and withdraw funds until further notice.

The DeFi world just took another heavy hit. Balancer, one of Ethereum’s oldest and most trusted DeFi protocols, was drained in a massive exploit that saw attackers walk away with nearly $120 million worth of digital assets.

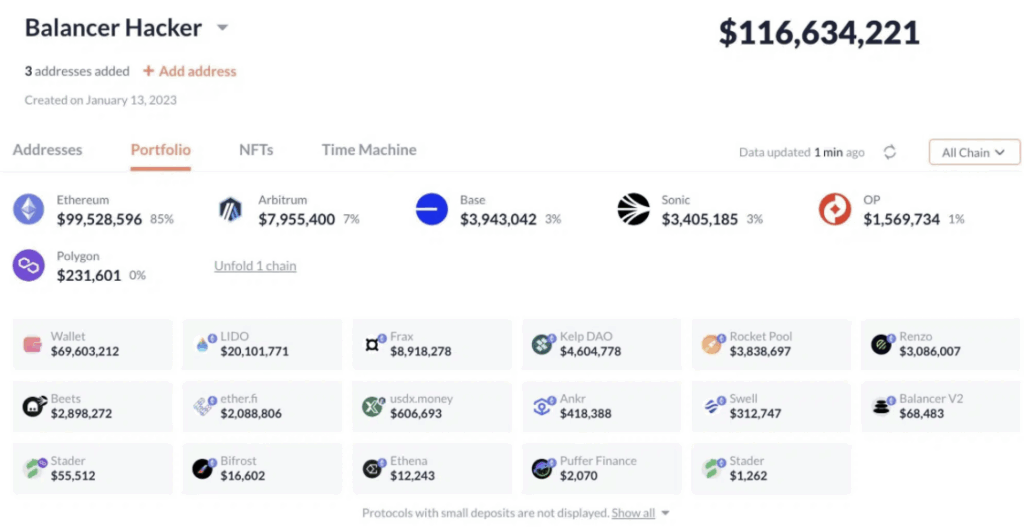

Blockchain security platforms like Lookonchain and PeckShieldAlert were among the first to flag the breach. Lookonchain reported that roughly $116.6 million was stolen from Balancer’s vaults, while PeckShield’s estimates put the total closer to $128.6 million. Either way, it’s one of the biggest crypto heists of 2025 so far.

What the Attackers Took

According to Lookonchain’s analysis, most of the stolen funds — about $99.5 million, or roughly 85% of the total — came directly from Ethereum’s mainnet. The rest was spread across other networks: Arbitrum ($7.9M), Base ($3.9M), Sonic ($3.4M), OP Mainnet ($1.5M), and Polygon ($231K).

The attackers didn’t just steal one type of asset. They looted a mix of liquid tokens and staked derivatives, including Lido’s stETH, Rocket Pool’s rETH, Frax, and Balancer V2 pool tokens.

Etherscan data traced several large transfers — among them 6,851 osETH, 6,587 WETH, and 4,259 wstETH — all funneled into a wallet now labeled as “Balancer Exploiter 2.” As of the latest update, those funds remain untouched in the attacker’s addresses.

Balancer Confirms the Breach

In an official post on X, the Balancer team confirmed that the exploit specifically targeted its V2 pools. Their engineers and security partners are reportedly investigating the breach as a top priority.

“We are aware of an exploit affecting Balancer V2 pools,” the team said, urging users to stay alert and avoid interacting with suspicious links or comments — a warning that comes as scammers try to capitalize on the confusion. Verified updates will follow once the team completes its forensic review.

A Whale Wakes Up — $6M Pulled from Balancer

As the chaos unfolded, one dormant whale wallet suddenly sprang to life after over three years of inactivity. The address withdrew $6.5 million worth of assets from Balancer in two separate transactions — $1.29M in WETH and $5.19M in GNO — likely a preemptive move to secure funds before further fallout.

Analysts warned that the situation may still be developing, advising users to withdraw their assets from Balancer until the protocol confirms that the breach has been fully contained.

Not Balancer’s First Hack

Sadly, this isn’t new territory for Balancer. Back in 2020, the protocol lost $500,000 in a similar attack. More recently, in August 2023, a flash loan exploit drained over $2 million.

Still, this latest incident dwarfs all previous ones. With nearly $120 million gone, it marks one of Balancer’s worst security breaches since its launch in March 2020 — and a sobering reminder that even established DeFi platforms remain vulnerable.